- 2021 is turning increasingly sour for Chinese exporters.

- Surging freight rates and port shutdowns are hampering demand.

- Producer margins have slumped as inventories build and new capacity comes on-stream.

Boom Times Are Over

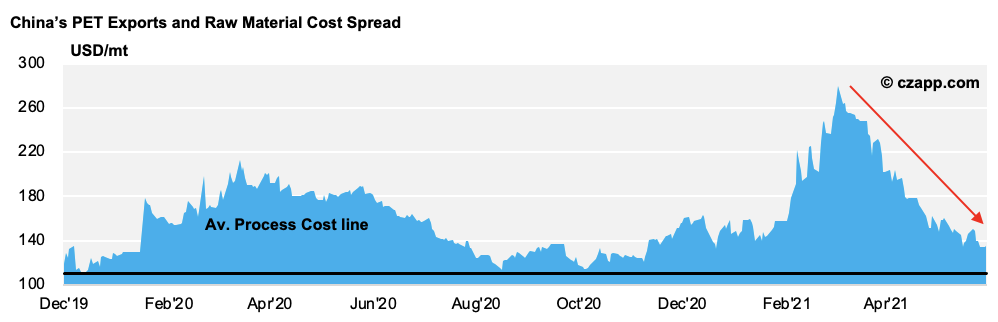

- China’s PET export margins have slumped due to increased freight volatility, new COVID lockdowns across Asia, and increased domestic supply.

- Following Chinese New Year, the spread between PET exports and raw material costs ballooned to around 280 USD/mt, well above the long-term average of 150 USD/mt.

- Having peaked at the end of March, PET export spreads have fallen with the talk of negative margins back on the cards once again.

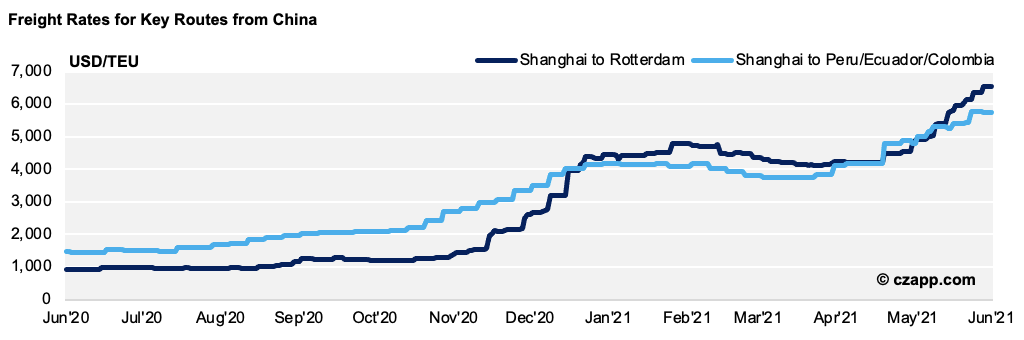

- Container shortages, port congestion, and the lack of shipping availability have sent freight rates surging over the past year.

- PET exports from China are now facing a new crisis moment.

- Following a local COVID outbreak, Shenzhen’s Yantian port, the world’s largest single container terminal, was temporarily closed at the end of May.

- As shipping lines sought to divert elsewhere, major congestion and confusion spilled over into other regional ports.

- This logistical nightmare could result in further price rises and shipping delays, with the fallout perhaps eclipsing that of the earlier Suez blockage.

- By mid-June, freight rates from Shanghai to North-West Europe were over 6500 USD/TEU, a rise of over 700% year-on-year.

- Elsewhere, rates to South America have increased by around 360% over the last year to approximately 9,300 USD/TEU.

PET Exports Fall for Third Month Running

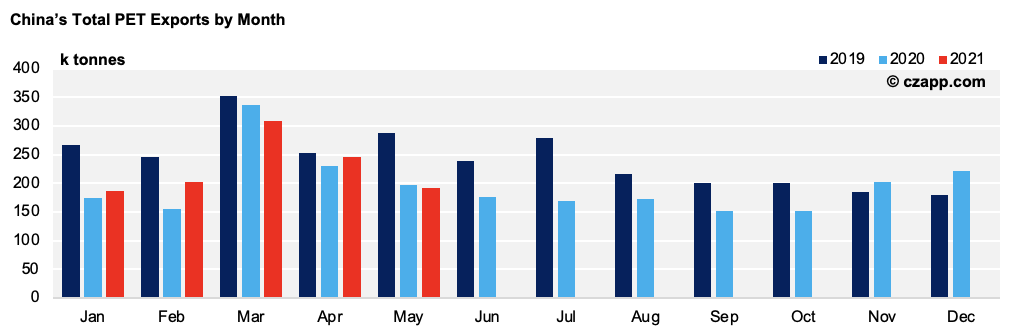

- Even before the recent disruption, many customers faced unknown delays due to a lack of shipping containers.

- Orders were sent piecemeal, spread across multiple vessels with differing schedules, simply where space could be found.

- Although Chinese PET exports remain competitively priced, with buyers now facing further delays, a greater risk aversion among buyers could precipitate.

- Chinese export volumes fell for the third consecutive month in May, dipping below 200 kt.

- June and July volumes could come under pressure, following a similar pattern to 2020.

- In addition to these major logistical challenges, demand in key markets has been hit be fresh COVID restrictions across India and Southeast Asia.

- With Chinese exports caught in a pincer movement, between a logistics nightmare and turgid demand, producer inventories are on the rise.

- Since the start of May, stock levels have increased from a healthy 15-day average to around 20 days, although still below the 30+ days seen in late 2020.

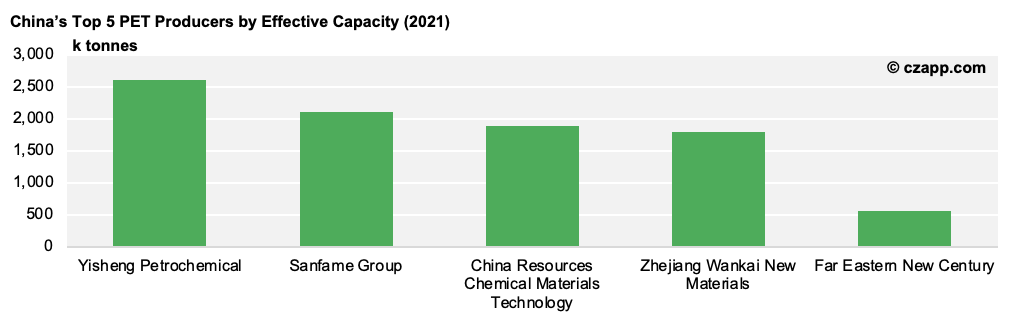

- To compound the already difficult sales environment, China Resources’ new 500 kt/year plant, which began production in May, and the restart of Wankai’s 400 kt/year unit is already being felt in the market.

- With the new additions, production could potentially exceed 1m tonnes in July, a new all-time-high far outstripping demand.

Producer Profitability Squeezed in Q3

- At present, there seems little upside to export margins and expectations are for spreads to weaken through Q3.

- Although Chinese exports should see support from a resurgent Indian market, renewed European production may see buyers back away from imports there.

- Some are already talking of negative export margins.

- However, with inventories still having room to build, and a buoyant domestic market approaching peak season, producers may be resistant to further heavy discounting.

Other Opinions You Might Be Interested In…

- European PET Market Set for Major Price Correction

- India’s PET Industry Set for Post-Lockdown Recovery

Explainers You Might Be Interested In…