- Understanding the basics of corn and wheat can give insight into individual commodity value.

- Examining the price drivers that influence both can help with proactive business decisions.

- If two commodities appear to have similar uses, can one go up while the other goes down?

Corn vs. Wheat

Growing up as a farming-obsessed youngster, it never made much sense to me when the older farming generations referred to wheat as ‘corn’.

It’s true to say they’re both grains, grown in similar climatic and hence geographical areas, to a greater or lesser degree. They’re primarily used to feed humans and livestock in different measures throughout the world. There are definitely major similarities.

Examining the full breadth of their common ground and distinct differences allows us to see where the value and prices sit together.

Area, Production & Uses

Wheat

Wheat is the largest grain worldwide in terms of area, grown on an estimated 223m hectares in 2021/22.

Global production should total 789m tonnes in 2021/22.

The primary use for wheat is milling for livestock rations and human food. It’s also used for some industrial production on a relatively small scale (ethanol, starch and more).

Corn/Maize

Global corn area should total 199m hectares in 2021/22.

Despite a lower area sown, with higher yields than wheat, the global corn harvest in 2021/22 should total 1.19m tonnes.

Corn’s uses are more varied than one might at think. It’s primarily a grain used for human and livestock consumption. However, it also has a multitude of industrial uses. The largest of these is ethanol production but looking deeper into end products containing corn is a major topic in itself.

Corn products are found in toothpastes, explosives, detergents, dyes, soaps and many more.

Price Drivers: The Common Ground

Prices will often trend in the same direction, up or down, when major grain fundamentals come into play.

Being grown in the same countries generates comparable weather and harvest estimate issues, which in turn have a like-minded price impact.

Where rations for feeding livestock are concerned, it comes as no surprise that the general grains macro supply and demand factors impact the price of both.

Our previous article exemplified where price differences can be impacted on a regional scale, by simple short term and localised supply and demand factors.

Price Drivers: The Not So Common Ground

Higher quality or specialist wheat for human consumption, such as bread or cake flour, pasta or other specialist wheats, will follow their own market prices driven by demand that cannot be supplied by corn.

Where industrial processes become a factor, a new set of price influences appear, mainly impacting corn.

Ethanol as a biofuel for vehicles and transport mixed with oil-based fuels, like petrol, at the forecourt pump brings the oil price drivers into the equation. Ethanol and hence corn prices will be affected by the overall economic situation and demand for oil, in a way that’s not comparable for wheat.

It should be noted that where an industrial use for corn is concerned, there are still livestock feed by-products, such as distiller’s grain, gluten feed and gluten meal. The price of these products will relate to the macro-economics of grains as a whole, including wheat.

Interestingly, a sell-off in the equities and oil markets, where macro-economic factors are at play, can at times lead to money transferring into the grains markets lending support. At this point, we have conflicting price drivers for corn, in a way we don’t necessarily see in wheat.

The Ultimate Price Impact

Figure 1 shows the prices of oil (blue), wheat (green) and corn (yellow).

Looking at the general run of prices over the last five years, Figure 1 shows an interesting picture to demonstrate the common and not so common ground between wheat and corn prices.

We can see that, from 2015 to 2019, the prices of both wheat and corn showed similar ups and downs. These demonstrate the link as values are driven by the usual macro-economic grain price drivers at work.

The coronavirus pandemic showed that an oil crash following huge macro-economic global turmoil had a more meaningful impact on corn than wheat. This was in the main driven by the destruction of ethanol demand, as was the case with the oil markets.

In contrast, the wheat price remained broadly stable as the world demand for food was robust.

More recently, towards the end of 2020 and into 2021, Figure 1 shows that although all three markets have rallied, the corn prices have rallied significantly more than wheat values.

A combination of factors has driven the rise.

Ethanol demand, as with oil, has returned as large-scale lockdowns ease around the world, stimulating the movement of people and goods.

Global corn stocks are diminishing with an increased demand from certain livestock sectors. The most notable being China, as the restocking of its devastated pig herd continues following the African Swine Fever outbreaks.

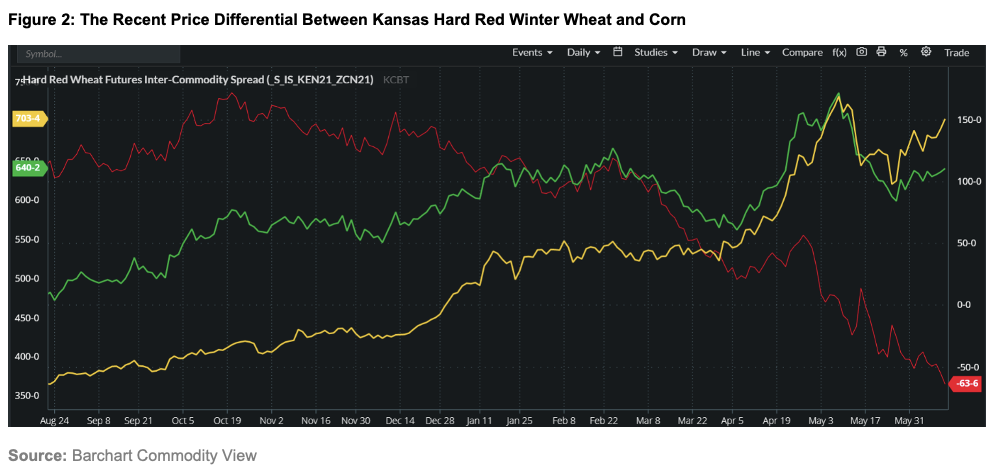

Conversely, wheat has large global supplies, which have not prevented the rally over recent months, but have kept it in check relative to corn.Figure 2 shows the recent price differential/spread (red line) between Kansas Hard Red Winter Wheat (green) and corn (yellow). We’re currently seeing a historic discount with wheat worth less than corn, which is an extremely uncommon occurrence.

Conclusions

Wheat and corn are the world’s major grain crops. They are therefore, inevitably, interlinked with regards their values and market swings.

The last couple of years have been wonderful examples of how anomalies in price spreads are established when exceptional factors are at play.

Oil price and hence ethanol price collapses have impacted the corn price to a far greater level than wheat prices.

Create an almost perfect storm, with oil/ethanol demand rising and some additional support from the Chinese livestock industry, and the price arbitrage between corn and wheat is driven to the other extreme.

‘Grains are grains’, however, look into the variety of uses and the price drivers for all may not be equal when, in this case, wider industrial economics become influencers!

Other Opinions You Might Be Interested In…