- European PET prices could face a major downward correction.

- Increased PET imports are on the way.

- Ineos and JBF production facilities have lifted force majeure and will be making PET at full capacity in June.

EU Production Constrained by Raw Material Supply

- Within Europe, PTA production and imports have both been constrained, limiting PET production at European sites.

- Two major PTA suppliers have been on force majeure and running at reduced rates since March.

- Meanwhile, PTA imports remain hampered by the ongoing container shortage.

- PET operating rates are running at between 60 and 70%.

- Going into May, several PET producers further reduced output, challenged by limited PTA availability in the aftermath of the Suez blockage.

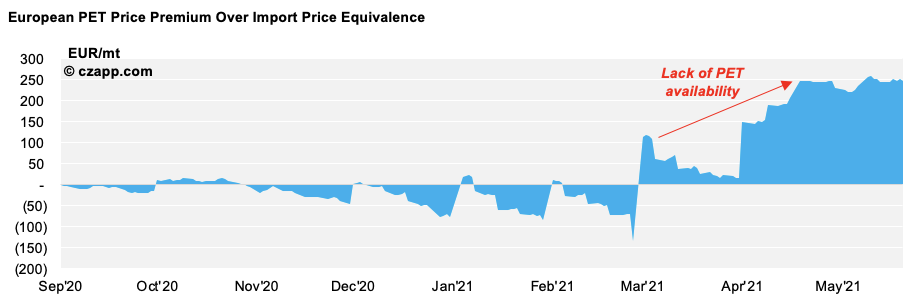

- With EU PET production hamstrung, domestic prices have sky-rocketed over the last few months.

- Reduced supply is supporting record premiums over import parity, despite weak demand for PET-packaged beverages, such as bottled water and soft drinks.

- In May, EU prices held a premium of around 245-260 EUR/mt over Asian imports on a delivered-duty-paid basis, and raw material spreads averaged over 515 EUR/mt, the highest seen in over a decade.

- Buyers now hope domestic PTA and PET production normalises over the coming months, increasing supply and calming the exorbitant prices.

- Industry players even talk of a price war, with resumed production and greater imports precipitating a major correction in European PET prices.

- Inflated premiums of around 250 EUR/mt could be wiped off domestic prices, pulling the market closer to import parity.

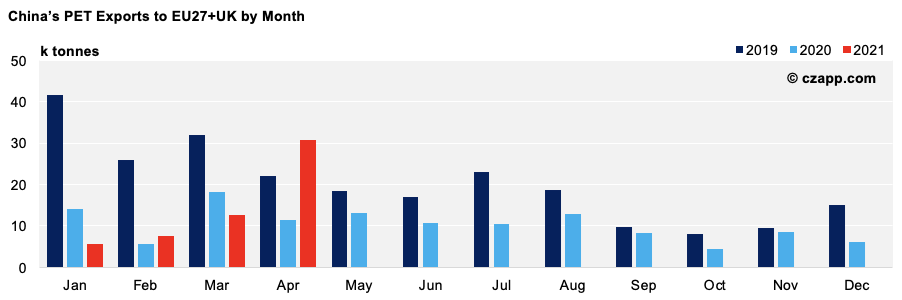

- Asian exports from major supply origins, such as China, to the EU27+UK were subdued in the first 3 months of 2021 before increasing in April.

- Relief coming from imports though should be relatively modest over the next couple of months, with volumes steadily fed in the market initially, rather than a dramatic wave of imports, such as those faced in H1’19.

- In addition, any shipments made in April and May still face challenges in being delivered in time for the peak summer season.

- Pre-COVID, the average container cycle time for Asia to Europe was approximately 65 days.

- This is now over 100 days due to a combination of increased demand, supply chain disruptions, and port congestion.

- Overland transport within Europe is also facing difficulties due to a lack of drivers and increased road haulage volumes.

Market Outlook

- With additional imports set to play a more pronounced role later this season, all eyes are on INEOS to increase PTA production.

- INEOS and JBF have reportedly both lifted force majeure and should be back at full capacity by June.

- The restart at INEOS should catalyse a recovery in PET production across Europe, lifting operating rates and boosting supply.

- European PET prices for June have already started to soften in anticipation, representing a turning point for the market.

- July price targets from some buyers are already set at the sub-1200 EUR/mt level, representing a decline of over 100 EUR/mt from current levels.

Other Opinions You Might Be Interested In…