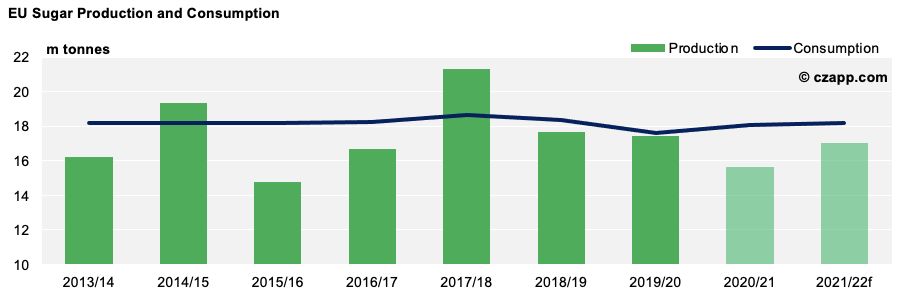

We think sugar production in the EU-27 and the UK will rebound to 17m tonnes next season, following the pest-ridden 2020/21 campaign.

The cooler weather over the winter and spring means aphid populations are significantly lower this year. Therefore, Beet Yellows Virus (BYV), a disease carried by aphids, shouldn’t pose any real threat.

Also, beet farmers in some countries, such as France, have been given authorisation to use neonicotinoids, a seed treatment that protects against these pests. This too should help agricultural yields rebound.

However, beet area in France and the UK may decrease slightly as beet returns are poor at present, leaving little incentive to plant it. The picture is slightly more positive in Germany, where farmers are looking to increase their area by around 3% this season.

However, production should still fall at least 1m tonnes short of consumption, meaning imports will be required. The EU-27 and the UK will most likely remain net importers of sugar.

This season’s significant production shortfall only adds their need to import in 2021/22.

The EU sugar market is regulated by a variety of import quotas and tariffs.

This means volume it imports is quite sensitive to EU prices. More specifically, the price difference between the EU and the World Market (the EU premium) will determine how much sugar is imported.

The EU premium must therefore adjust and reach level that ensures there’s incentive for sufficient imports to be secured.

We cover these dynamics in more detail in our EU Explainer.

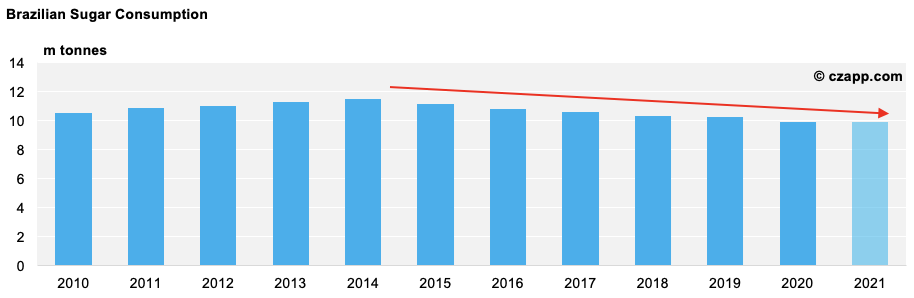

We think Brazilian sugar consumption saw a 2.5% reduction in 2020.

This is because, as with many countries during the pandemic, Brazil saw an increase in at-home eating and drinking.

With this, products such as cake mix, condensed milk, sprinkles, cooking chocolate (and more) saw an increase in sales. Sales of industrial products containing sugar also reported more than a 50% increase, according to the Brazilian Association of the Food Industry (ABIA).

Meanwhile, soft drinks sales saw a drop of almost 16%, according to a study conducted by Kantar. This makes sense because soft drinks are more commonly consumed outside of the home in restaurants and bars, or at concerts or the cinema (for example). The hospitality industry was hit hard by the COVID-induced lockdown restrictions.

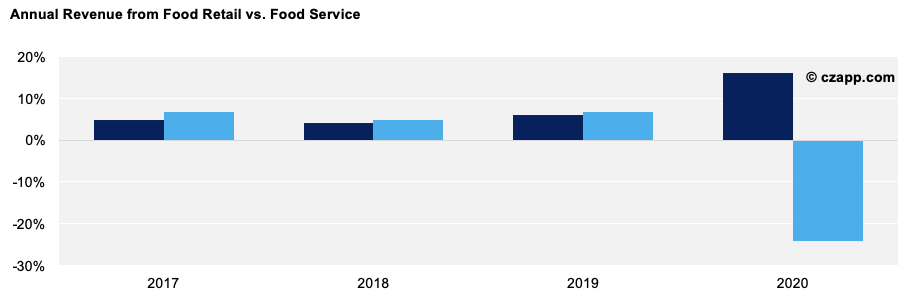

It’s interesting to compare the growth of the food retail versus food service during the pandemic too. Lockdown restrictions meant people had to resort to cooking at home. This meant more shopping in supermarkets. Food retail revenue saw a 16% increase in 2020, while food services dropped by almost 25%.

Explainers You Might Be Interested In…