Forecast

Our 2020/21 (Sep/Oct) average price forecast for Chicago Corn remains unchanged in a range of 4.7 to 5 USD/bu.

However, this could narrow and sit between 4.9 and 5.1 USD/bu if we lower our Brazilian production estimate following the prolonged period of dry weather.

The average price since the start of the crop (Sep/Aug) is 4.9 USD/bu.

Market Commentary

Corn’s rally continued for another week and made heavy gains in all geographies. These were at their strongest in Chicago, where Corn logged a 7.75 USD/bu high. Wheat and Soybean also rallied last week on the back of weather worries in Brazil and the US.

For Brazil, rains may not arrival until the end of the month, so this week’s May WASDE and Conab’s report downgrade Brazilian production from 108 to 103m tonnes.

However, we also think May’s WASDE Release will show a large jump in corn acreage, which should partially offset Brazil’s smaller safrinha crop.

China’s buying appetite remains strong, despite rallying prices. The US recently sold 1.36m tonnes of new crop corn to China, bringing its cumulative corn sales there to 23m tonnes.

Corn planting in the US reached 46% last week, down 2% year-on-year, but up 10% from the five-year average. In Europe and the Black Sea, the picture looks promising with French corn planting 89% complete, up 13% year-on-year. Ukrainian Corn is now 46% complete as well.

For wheat, the US’ crop ranked 48% good-to-excellent, down 7% year-on-year. The situation was more positive for France, with the crop achieving a rate of 79% good-to-excellent, up 22% year-on-year.

Conclusions

Since March, we’ve said that prices would have to do the work to increase acreage and/or destroy demand. We think both things are now happening.

On the supply side, we’re anticipating higher Corn and Soybean acreage estimates for the US in this week’s WASDE.

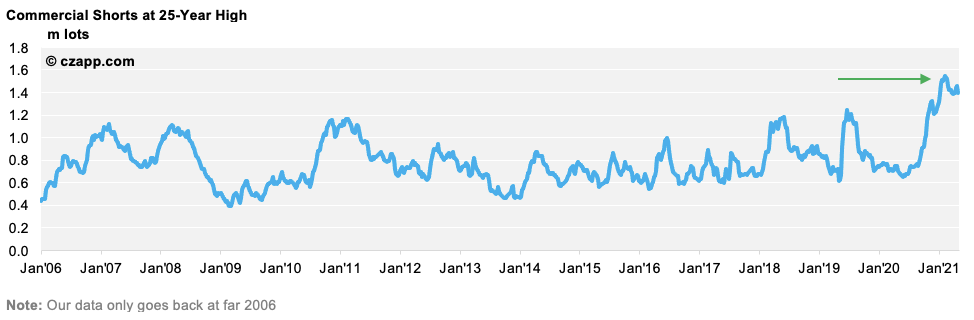

The Commitments of Traders also shows Commercial Shorts (producer hedges) at their highest level in 25 years.

Of course, not all Commercial Shorts in Chicago are US farmers, but the bulk of them are. So, this should be an indication that acreage will be much higher than the 91.1m acres published in the prospective planting report.

This doesn’t necessarily mean the USDA will increase acreage in this week’s WASDE, but it’ll happen sooner or later, and we think production will be some 300m bu (8m tonnes) higher than previously thought.

We’re also prepared for a sizable (5m tonne) downgrade to Brazil’s safrinha crop estimate and both things can offset one another.

On the demand side, we’re starting to see the US cancel Corn and Wheat exports. Tenders to buy Wheat in some countries are also being cancelled. Yes, feed and food needs are there, but purchases are being limited to what’s strictly required until more incentivizing prices arrive.

In any case, the high price environment is here to stay. Higher US acreage should be a cap for the market, but the downgrade to Brazil’s safrinha crop should limit the downside.

Other Opinions You Might Be Interested In…