As far as we know, Baltimore Sugar Refinery is operational once again.

Its running capacity is yet to be confirmed, however, so the USDA will need to take this into account.

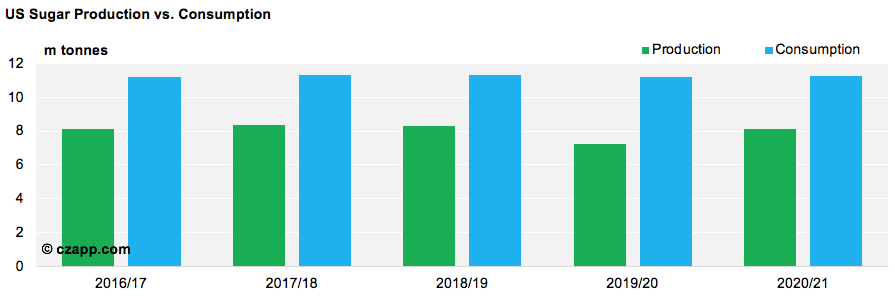

According to the latest WASDE Release, the US has more sugar than it needs to satisfy demand this year, meaning reduced throughput at Baltimore would not necessarily be a problem.

Baltimore Sugar Refinery processes around 600k tonnes of raw sugar each season, 300k tonnes of which have already been processed for 2020/21. Other refineries that are still operational will likely process anything Baltimore is no longer able to. This could increase regional deficits in the North-East and up logistical costs for buyers.

If the USDA decides that the refiners can no longer handle demand due to the fire, options are somewhat limited.

They could increase the proportion of Mexican sugar that enters as whites. As it stands, the quota is split so 70% enters as raws and the remaining 30% enters as whites. However, this isn’t that helpful as the majority of sugar produced in Mexico is Estandar quality, rather than the traditional 45 ICUMSA refined the US market is accustomed to.

So, the USDA may also turn to a global refined sugar quota, as we saw in 2020. This measure is only triggered in emergencies and is not something the USDA is keen to do regularly as it can lead to high bonded stocks and oversupply in the long term.

The final option would be to do nothing and wait for domestic prices to make duty-paid refined sugar imports viable.

Depending on the size of the supply shortfall, the best course of action may be to wait for spot demand to raise domestic prices and allow for world market imports. Currently, the duty is for refined sugar is 16.21c/lb.

Other Opinions You Might Be Interested In…

Explainers You Might Be Interested In…

- Czapp Explains: US Sugar Production and Consumption

- Czapp Explains: US Sugar Pricing and Quotas

- Czapp Explains: The Mexican Sugar Industry