Forecast

- Our 2020/21 (Sep/Oct) average price forecast for Chicago Corn remains unchanged in a range of 4.7 to 5 USD/bu.

- We may increase this soon, as April rainfall in Brazil could be 70% below the long-term average meaning safrinha yields will be lower.

- The average price since the beginning of the crop (Sep/Aug) is running at 4.74 USD/bu.

Market Commentary

Last week was a crazy one for grains, with Brazil showing only mild gains (0.8%). Chicago had gains above 10% and 8% for corn and wheat respectively. Europe showed similar weekly gains in wheat, but just 5% in corn. Strong Chinese demand, together with weather worries in Brazil and the US are behind the bullish grains story.

Weather worries in the US and Brazil were the drivers of last week’s price rally. Cold and dry temperatures in the US have threatened the planting pace, whilst dryness in Brazil has hit safrinha crop yields. The consensus is for a downward revision of Brazil’s second and biggest safrinha corn crop. This is probably why the Government extended its import tax waiver on corn imports from origins outside Mercosur until the end of 2021.

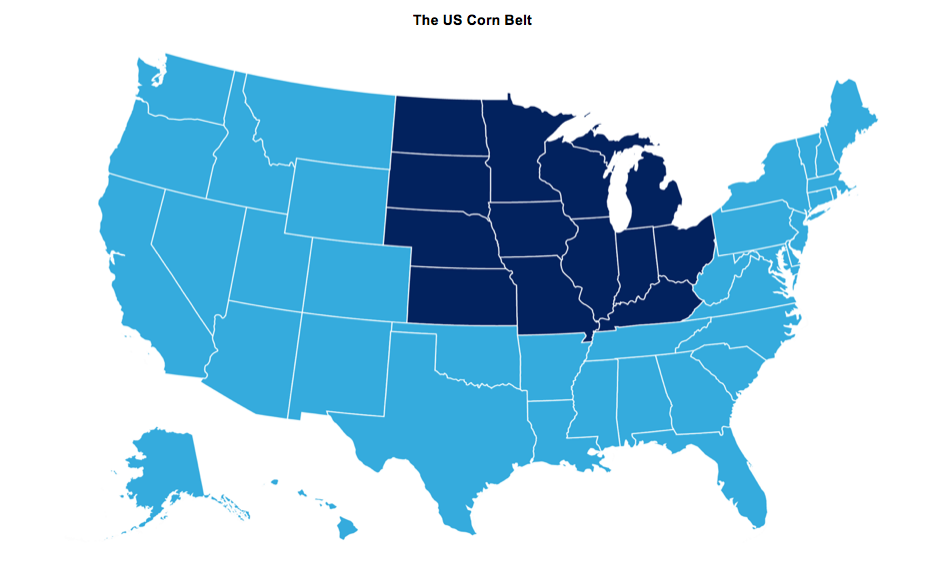

US Corn planting reached 8% last week, up 2% year-on-year, but aligned with the five-year average. The concerns surrounding slower planting may materialize in this week’s crop progress report, following freezing temperatures across the US Corn belt last week.

Also, the condition report showed that the 10 largest producing states have started planting with the lowest level of soil moisture since the USDA started first published this data in 2015.

US Corn inspections were impressive again, at 1.5m tonnes. China took the largest volume. By the end of the week, China had already bought new crop cargos for loading in Q4.

The USDA’s office in Beijing increased its Chinese import number to 28m tonnes, reinforcing our view that the May WASDE will see US corn exports increase (tightening ending stocks).

In the Black Sea, Ukrainian corn planting started last week and is 7% complete, up 3% year-on-year. However, the geopolitical tension might be another threat to global grains tightness. Russia is finally evacuating the huge number of troops they were holding at the Ukraine border, but it seems they intend to block vessel traffic in some areas, which could limit Ukrainian exports. Any disruption to exports could cause grain prices to rise.

Wheat prices rallied last week, following corn and soybeans. US wheat condition was unchanged at 53% good-to-excellent, down 4% year-on-year. French wheat ranked 85% good-to-excellent, up 27% year-on-year.

Fundamentally, the situation remains very supportive. On the one hand, we have increased protein demand from China as it aims to reestablish its pig herd. It also wants to increase its corn-based ethanol production in the second half of this year. Elsewhere, we’re still seeing supply problems following weather issues in the US and Brazil.

This high price environment should persist during the coming months. The May WASDE will be highly important, however, as the USDA reveals its new crop forecasts. If it uses the acres from the prospective planting report, closing stocks for the new crop will become seriously tight. They could use a yield higher than the trend to soften the supply tightness, however, but this would be difficult to believe, looking at low soil moisture levels.

We could see some profit taking and correction this week, but a lower Brazilian corn crop and tighter US new crop supply creates the perfect environment for higher prices.

Other Opinions You Might Be Interested In…