It seems we have gone full circle, as Brazil continues to be ravaged by COVID-19 and lockdown measures are imposed once again.

The question on all our minds now is: how will fuel demand be impacted?

Of course, a demand drop is expected, but based on information regarding mobility and isolation, it seems the retraction will not be as steep as it was one year ago.

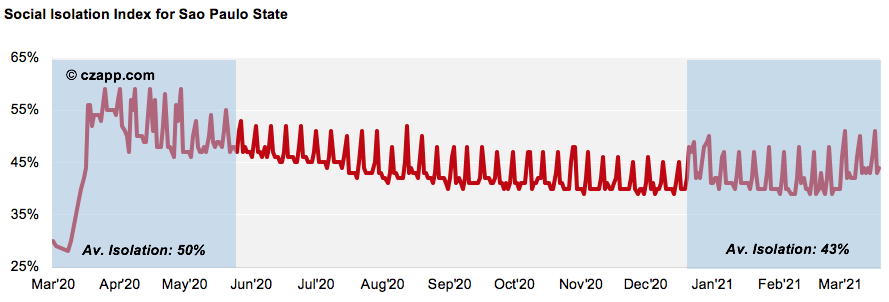

Last year, when the first lockdown was imposed in mid-March, the isolation index in Sao Paulo averaged 50% until May.

As it stands, the data shows isolation at around 43%, which is not far from what was registered in late 2020.

However, given the country’s dire situation, more restrictive measures may be imposed, further restricting mobility and making the anticipated drop more severe in the coming weeks.

There’s another factor that has hindered ethanol demand, which is the competitiveness at the pump.

Over the last fortnight, the average parity (gasoline and ethanol ratio) in Sao Paulo was close to 75%, meaning consumers turned to favour gasoline. The pandemic and the parity above 70% ended up curbing the increase in hydrous prices.

For more information on this topic and our ethanol price outlook, click here.

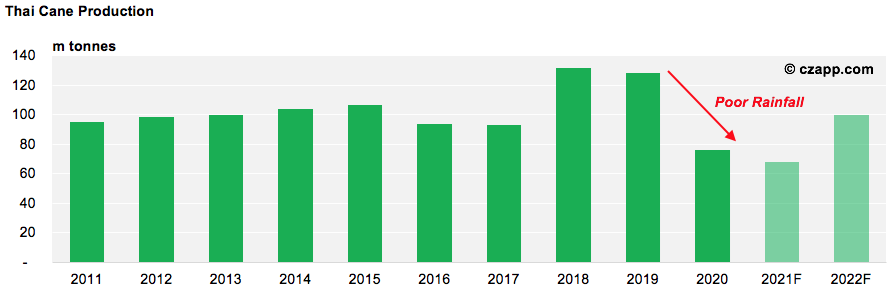

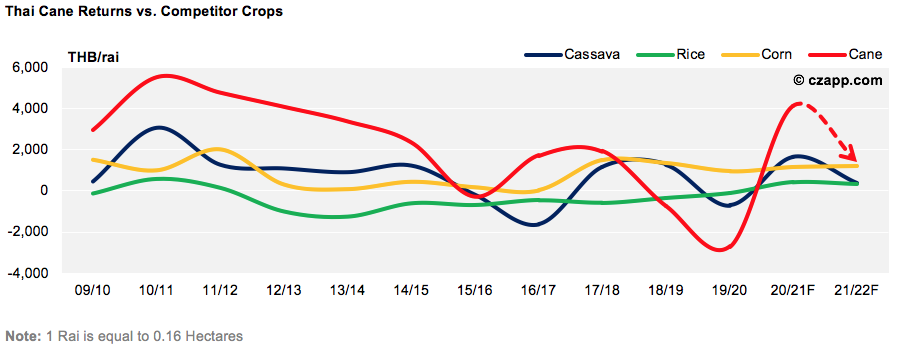

We think Thailand will crush 100m tonnes of cane in 2021/22, up 20% year-on-year.

This is because Thai mills are currently paying farmers record amounts for their cane this season, which should mean farmers plant more cane in the future, and not competing crops like cassava.

The Thai Meteorological Department also thinks Thailand will receive 20% more rain than usual between February and April, which bodes well for cane development.

All things considered, we think Thailand’s cane area will increase to 9.7m Rai in 2021/22, up 1.4m Rai year-on-year.

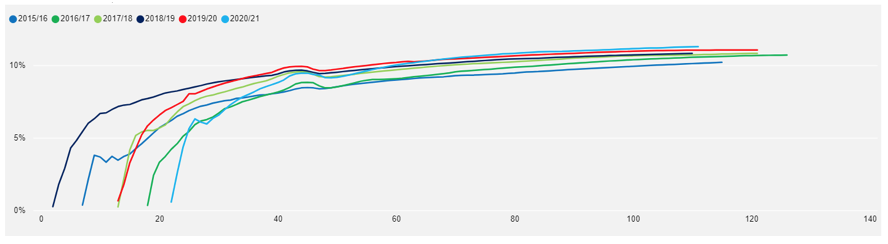

In terms of sucrose yields, these vary each year, mostly according to the weather; dry and cool conditions prior to harvest enable the cane to build up its sucrose yields.

This year’s sucrose yields, at 11.33%, sit above the five-year average because the weather between late November and mid-December (pre-harvest) was very dry and cool, especially in the Northeast.

With this, the Northeast has been able to produce 120.5 kg/mt (sugar per tonne of cane), or 12.05% (as of the 21st March 2021).

You Can Track Thailand’s Sucrose Yields Using This Interactive Data Tool.

Other Opinions You Might Be Interested In…

- Ethanol: The Sugar Sector and Interventionism in Petrobras

- Brazil Ethanol Market: So Far Without Interventions