Note: All the data seen throughout this discussion is housed in Czapp’s Interactive Data Section.

- We think the world will have 3m tonnes more sugar than it needs next year.

- However, this will only materialise if we see good crops from the four main producers: Brazil, India, Thailand and the EU.

- Here, we focus on each of these regions and reveal whether or not their production is performing as hoped.

Brazil: Low Rainfall Hits Cane Production

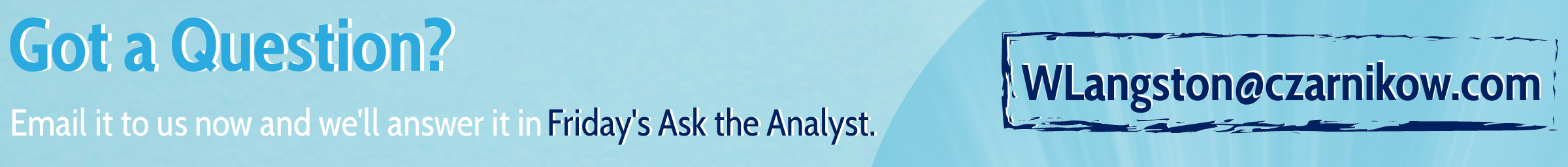

- Brazil is the most important player in the sugar market; the key question each year centres around whether its mills will prioritise sugar or ethanol production.

- As it stands, sugar is the favoured option as it pays the mills almost 4 cents more than ethanol (on a No.11 basis).

- Furthermore, since ethanol is sold on a spot basis mills can not lock in prices and become exposed to the risk of a downturn in the ethanol market.

- Therefore, the mills’ decision to favour sugar becomes easy to understand as they can secure great returns for the next two seasons.

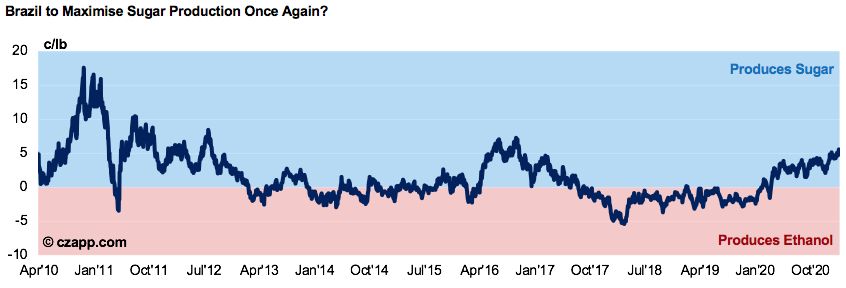

- The Brazilian Real’s (BRL) weakness over the last 12 months means sugar returns have been steadily rising, even before the market really took off in the latter half of last year.

- Much of this has been forward hedged by the mills meaning, even if the market comes off significantly, the BRL, as it currently sits (~5.4), will continue to give sugar an advantage.

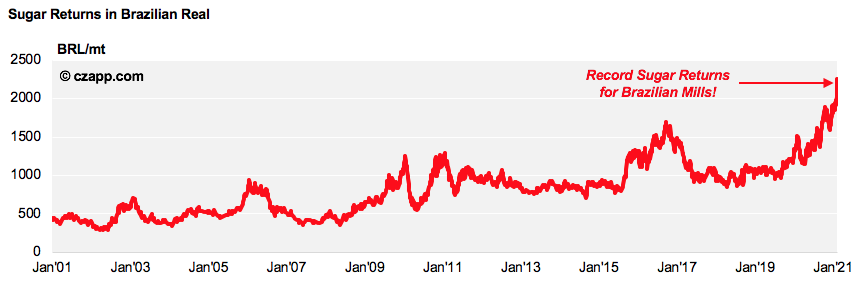

- Having said this, we think Brazil will produce 36m tonnes of sugar in 2021/22, down 2.4m tonnes year-on-year.

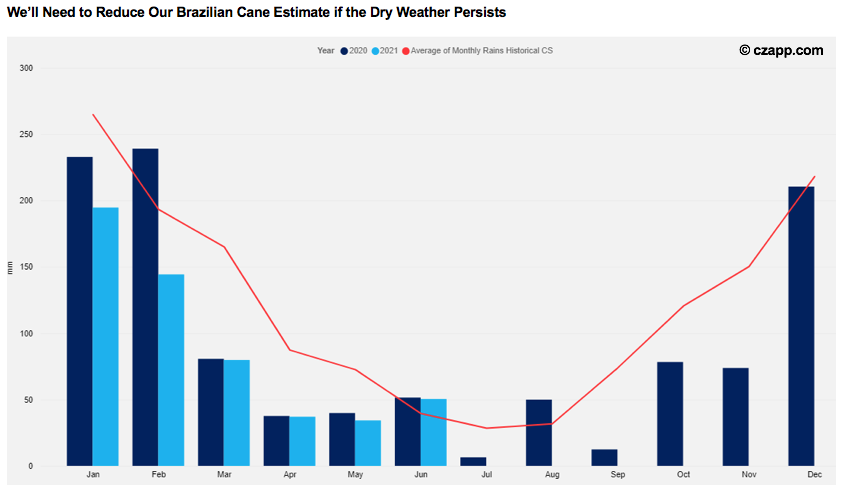

- This is because its cane is in poor condition following a prolonged period of below average rainfall.

- The chart below shows just how dry it’s been in CS Brazil through January and February; this means agricultural yields will likely be lower this season.

- March rains could bring some relief, but some areas might not be able to recover from the prior conditions.

Thailand: Rebound on the Cards?

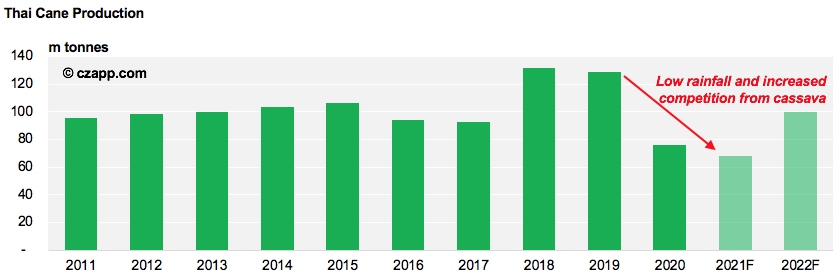

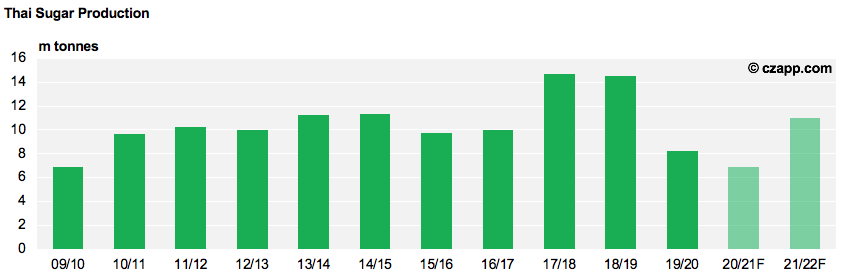

- We think the Thailand will produce 100m tonnes of cane in 2021, up 32m tonnes year-on-year.

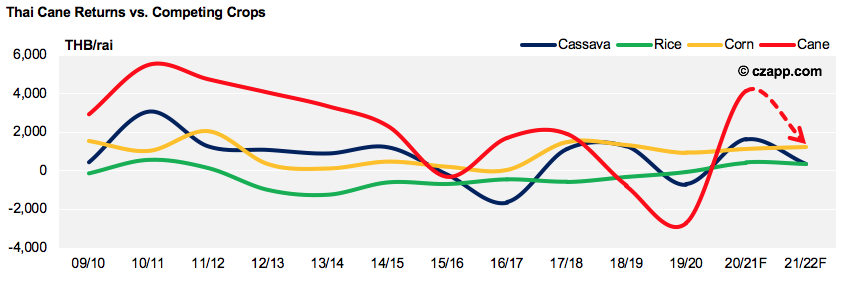

- Thailand’s issue in recent years has been its low cane availability; this has been hit by years of drought and the fact many of its farmers turned to plant competing crops, notably cassava, in search of greater returns.

- However, today’s world market prices incentivise sugar production once again, and we’ve seen the competing crops’ returns weaken once more.

India: More of the Same?

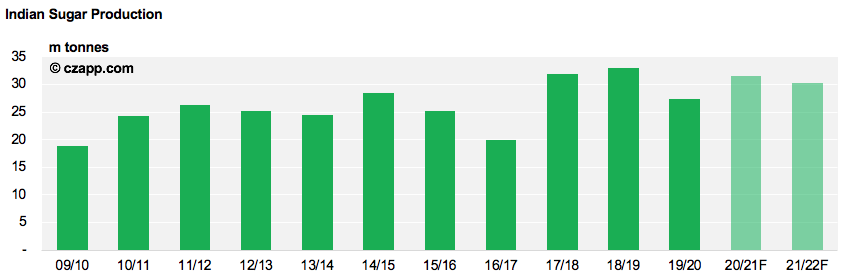

- We think India will produce over 30m tonnes of sugar once again next season.

- This is because, fundamentally, nothing has changed that would encourage farmers to move away from cane.

- Therefore, with domestic consumption set to total 25m tonnes, India will be left with a 5m tonne surplus.

- World market prices have made exports easily possible this season and we think the Government to continue to make these possible one way or another, if required.

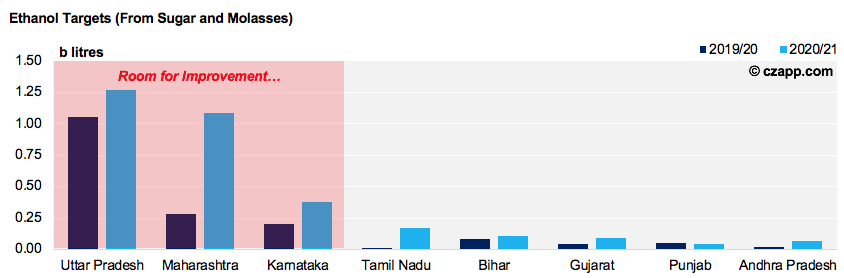

- India’s increased ethanol production and targets could reduce its overall sugar production, however, meaning its surplus could be eased that way too.

- However, India’s ethanol production capacity and its storage facilities are still too small to significantly alter its sugar landscape.

- At the moment, the monsoon appears to be the only factor that could cause a serious drop in the Indian crop.

- The monsoon takes place between July and September and replenishes the reservoirs with key water for the crop development.

The EU: A Slight Production Increase

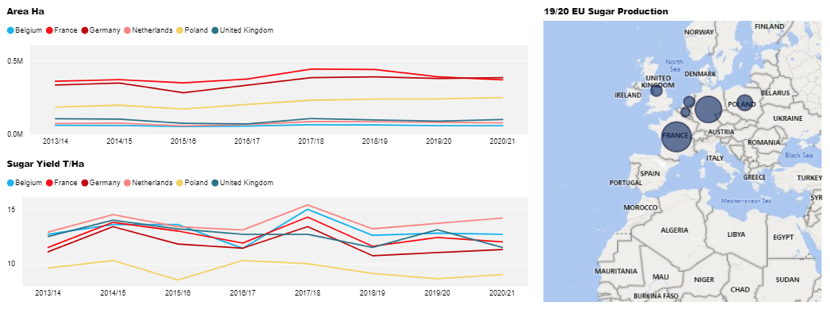

- We think the EU will produce 16.8m tonnes of sugar this season, up 8% tonnes year-on-year.

- This comes as its beet condition is set to improve now farmers are learning to operate without the help of neonicotinoids.

- The EU’s acreage has remained steady for several years, but yields have been much more questionable.

- The key beet crops to keep an eye on will be that of the Germany and Poland as they remain under the neonicotinoids ban.

To Summarise…

- We think the market will retain a small surplus in 2022.

- However, this will only materialise if we see good crops in the four key producing regions: Brazil, India, Thailand and the EU.

- As it stands, there are significant questions surrounding all of these crops.

- However, this uncertainty will likely persist for a while as COVID-19 continues to impact logistics and market sentiment.

Other Opinions You Might Be Interested In…