- The UK has a new duty system now that it’s left the EU.

- With this, it can import 260k tonnes of duty-free raws from any origin, including Brazil.

- We could therefore see the UK change the countries it buys sugar from this season.

What Changed for Sugar When the UK Left the EU?

- When the UK left the EU, it took on a new duty system; the UK Global Tariff (UKGT).

- This replaced the EU’s Common External Tariff (EUCET) and applies to trade with non-EU countries; all trade between the UK and EU remains duty-free.

- Under the EUCET, complex rules are applied to sugar imports, which vary according to the origin, quality and end-use.

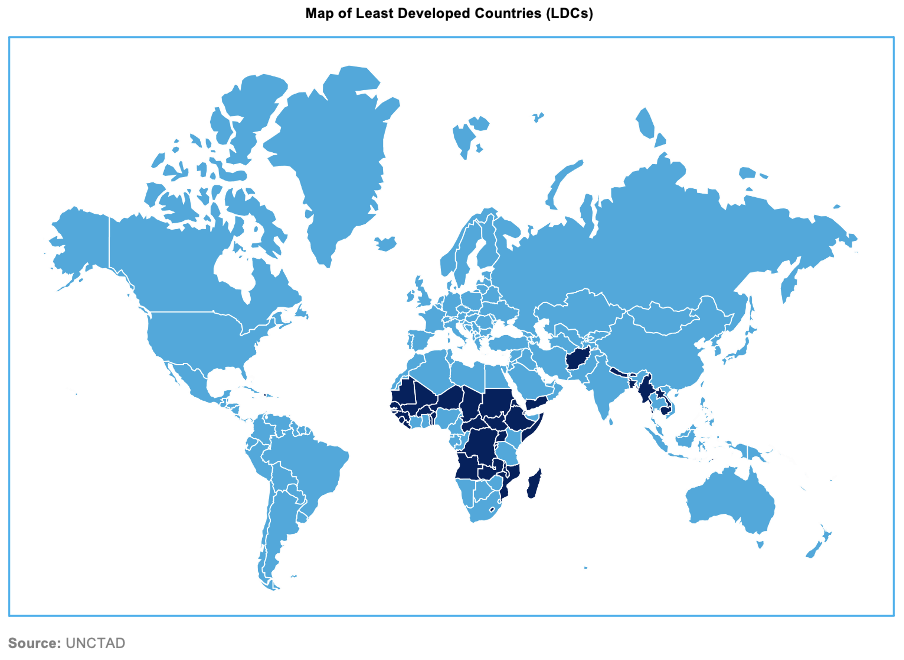

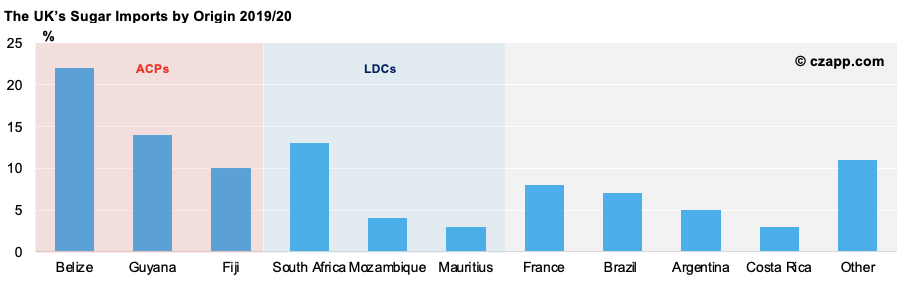

- One of its perks is that it allows the EU to import an unrestricted amount of duty-free raws from LDCs (Least Developed Countries) and ACPs (African, Caribbean, and Pacific Countries).

- The UK has been afforded the same luxury under its new system.

- However, it also allows a set volume of duty-free raws to enter via an Autonomous Trade Quota (ATQ), which is set at 260k tonnes for 2021.

- Any sugar imported under the ATQ will come from non-LDC and non-ACP countries, meaning the UK can import more duty-free raws now than it could before Brexit.

- Any raws imported outside of the set ATQ volume will be taxed at £28.00/100kg.

How Does This Impact the UK’s Sugar Industry?

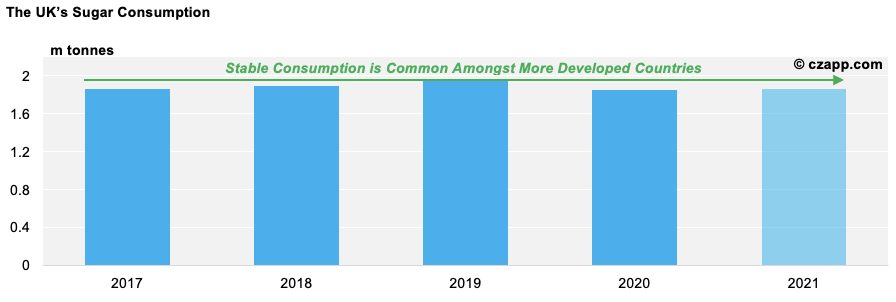

- The UK currently consumes approximately 1.8m tonnes of sugar each year.

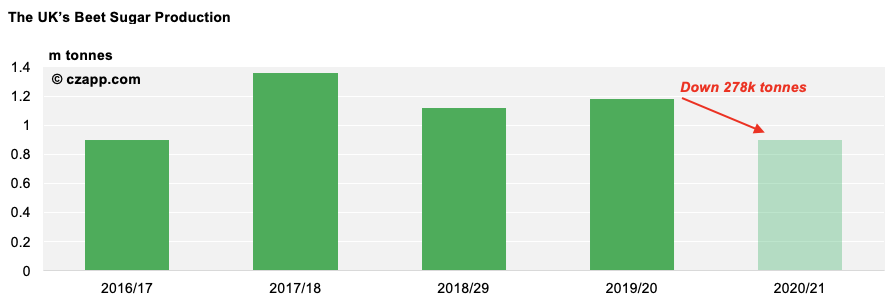

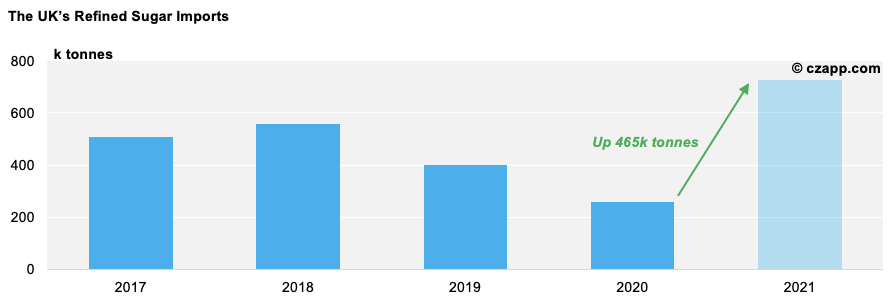

- With beet sugar production set to total 902k tonnes this year, it will need to import just under 900k tonnes of sugar to satisfy domestic demand.

- It usually imports around 600k tonnes of refined sugar from the EU each year; this flow will be able to continue duty-free under the terms of the UKGT.

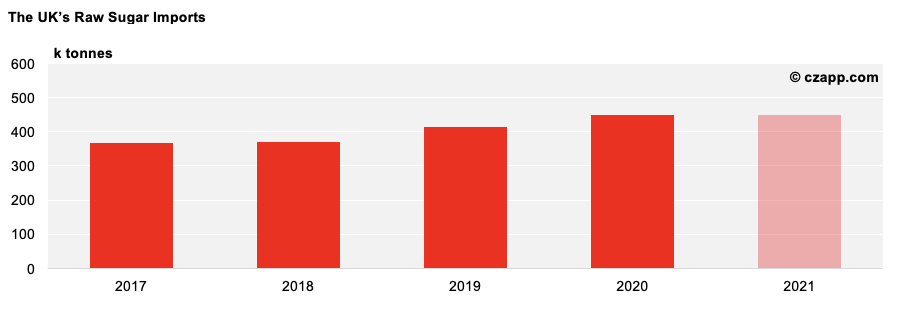

- It also imports raw sugar from the world market, which is then refined in-country.

- In 2020, it imported 450k tonnes of raw sugar from LDCs and ACPs, notably Belize (156k tonnes), Guyana (99k tonnes) and South Africa (92k tonnes).

Where Could the UK Now Import From?

- Whilst in the EU, the UK favoured sugar from LDCs and ACPs as the duty-free access made these imports the most cost effective.

- This means, with the duty-free access from the ATQ, the UK’s refinery will favour low-cost raws producers.

- It’s therefore likely that some of the ACP and LDC volume is replaced by Brazilian supply.

- However, there’s still demand for around 250k tonnes outside of the ATQ, so strong buying from ACP and LDC countries should still continue.

How Does This Impact the UK and EU’s Trade Relationship?

- The UK and the EU are now two separate markets with distinct regulatory and legal spaces.

- Whilst this will not impact trade of domestically grown beet sugar, it will impact any sugar that is refined from raws produced outside of the EU and UK.

- This is because the EU wants to retain a ‘level playing field’.

- To combat this, the EU now has the right to tax any UK sugar entering the EU under the ATQ.

- In theory, this could include UK-made food and beverage products being exported to the EU if they contain sugar derived from ATQ imports.

Other Opinions You Might Be Interested In…

- Brexit Leads to Regulatory Changes in the Food Industry

- Ask the Analyst: Brexit, Sugar Consumption, Health