- The fundamental picture remains unchanged from two weeks ago.

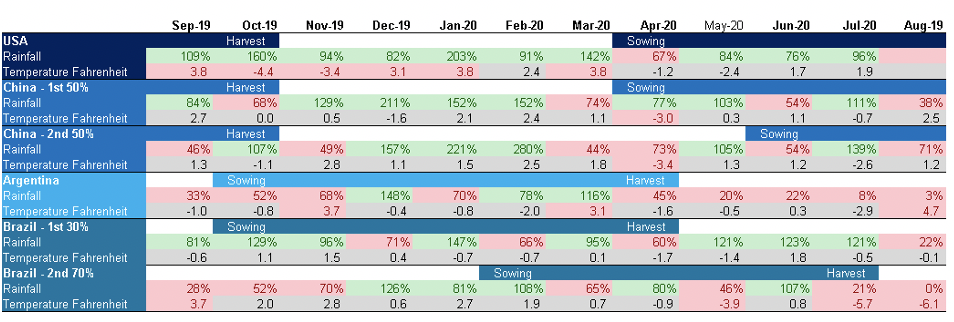

- Worries surrounding the potential impact of La Niña on South America’s corn and soybean crops continue to grow.

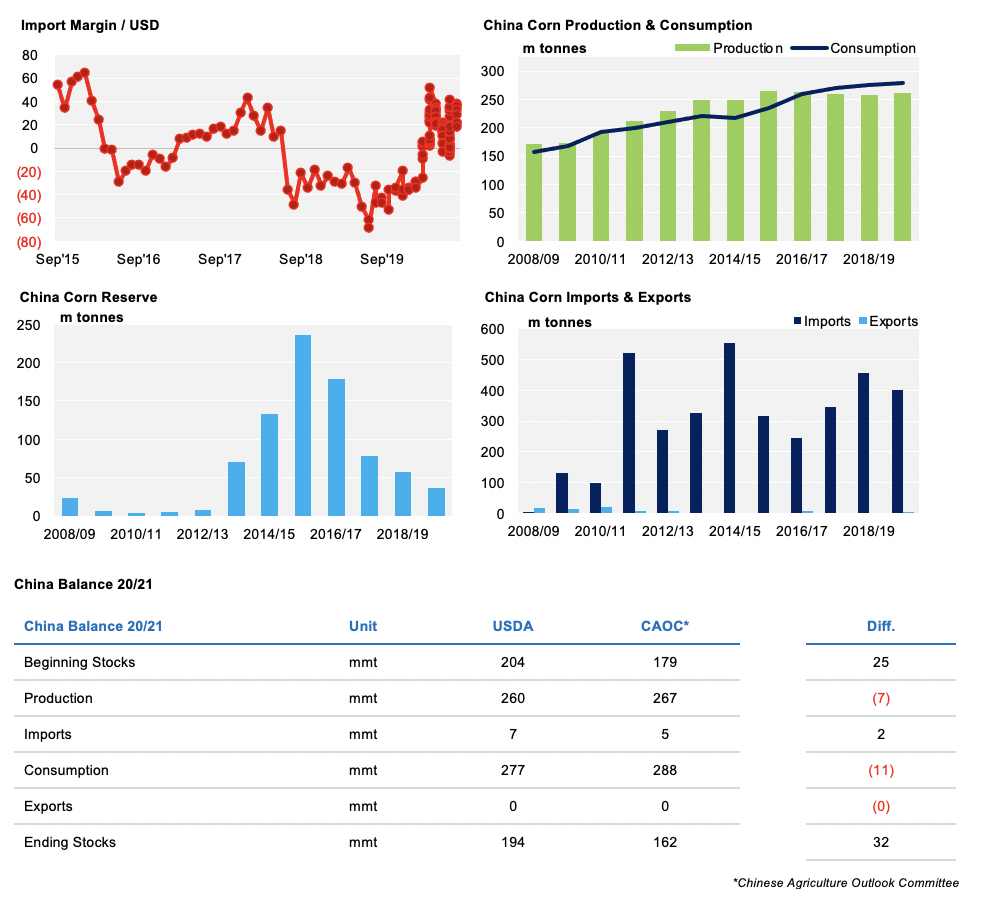

- Meanwhile, China’s corn buying remains strong as it looks to feed its recovering pig herd and also fulfill the Phase One Trade Agreement.

Price Action

Forecast

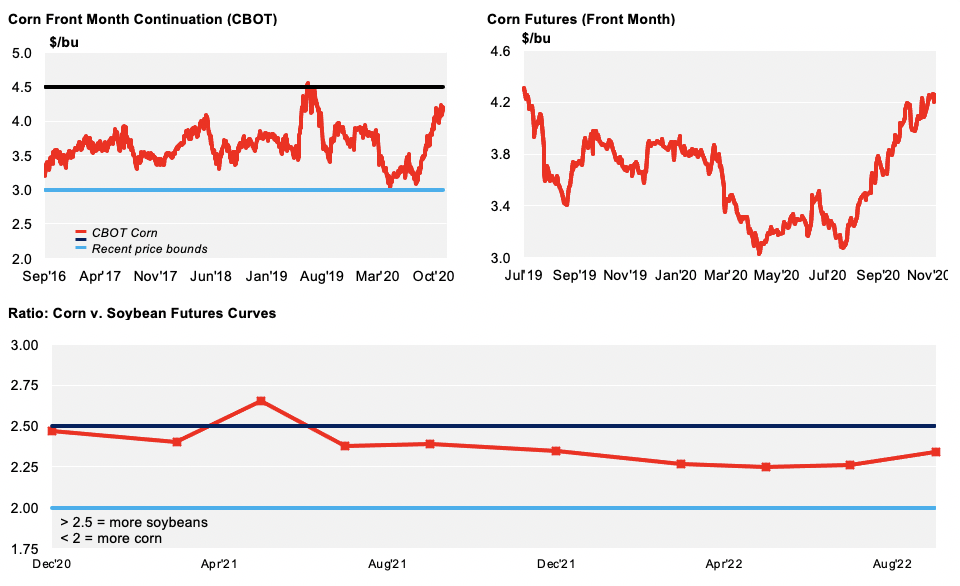

Our 2020/21 average price forecast (Sep/Oct) remains unchanged, in a range of 3.4 to 3.6 USD/bu for Chicago corn. The average price since the start of the crop (Aug/Sep) has been running at 3.9 USD/bu.

Market Commentary

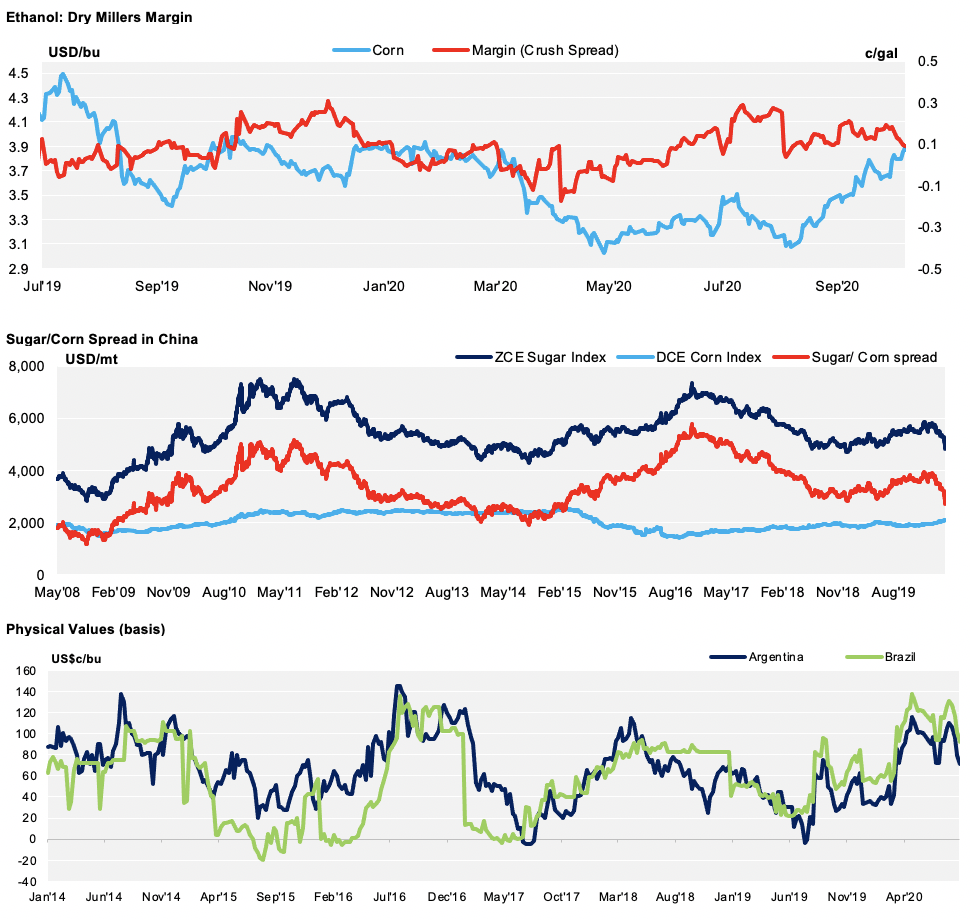

Last week was a neutral one for grains in the US and EU. Things got off to a strong start, but there was a correction as rumours of China washing out soybean cargos emerged. Brazilian corn fell 1.2%, in line the with the 1% valuation of the BRL. Corn and wheat made small gains of around 0.5% in Chicago and Europe.

Chinese Customs revealed that its October soybean imports were its highest in history, with corn imports at their second highest point. The US’ export stats also showed significant volume destined for China. The week started strong and sold off Wednesday on the back of profit-taking ahead of Thanksgiving. This was triggered by forecasted rains in Brazil and Argentina, as well as the aforementioned Chinese washout rumours. The selloff in beans pressed down both corn and wheat in Chicago.

Soybean planting in Brazil is 81% complete, in line with the five-year average. Its first corn crop is 91% complete, up 9% year-on-year. As it stands, there are no concerns surrounding a delayed planting of Brazil second, and larger, corn crop. However, if any of the soybean crop needs to be replanted, some delays may arise. Some are currently suggesting that around 1% of the soybean crop will need to be replanted…

Corn planting in Argentina made almost no progress for the third week in a row (up just 0.5%). It’s now 31.9% of the way complete, compared to 46.2% this time last year.

The Ukrainian corn harvest is 89% of the way complete and yields are showing just 5.3 mt/ha on average, compared to 7.2 mt/ha last year. This is the impact of the soil’s lower humidity which has been caused by a dry summer and autumn. The Ukrainian Agriculture Ministry is now anticipating a 33m tonne corn crop, compared to the USDA’s 28.5m tonne forecast.

France the US have now finished harvesting their corn crops.

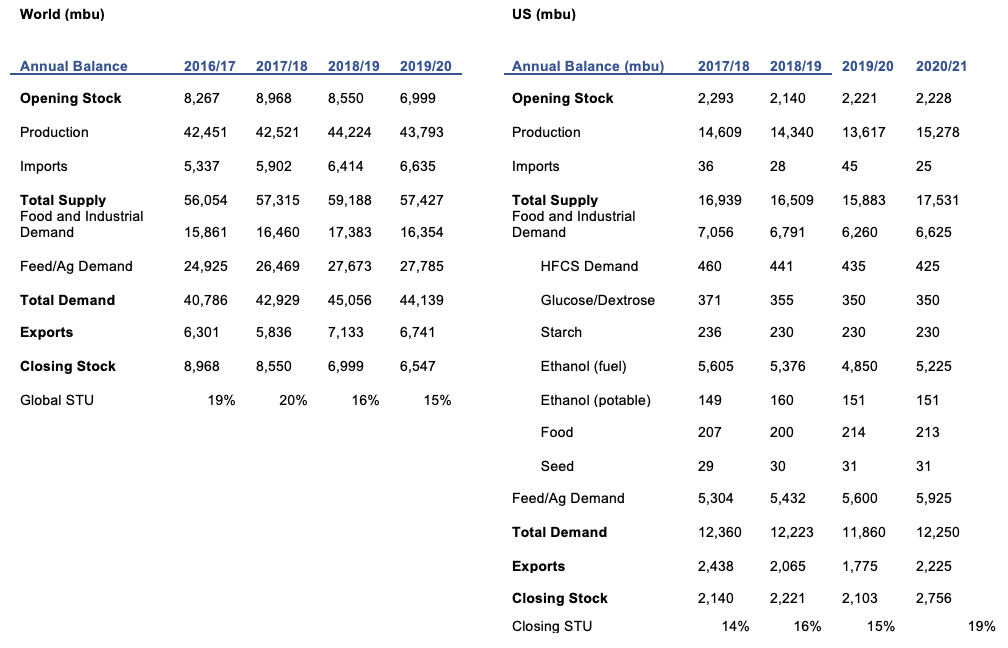

The IGC lowered global corn production by 10m tonnes, in line with the latest WASDE Release. With this, global production could now total 1.146b tonnes in 2020/21. This remains 2% higher than last year’s production number. These reductions were made in the US, Ukraine and the EU; they also increased Chinese imports. Closing stocks are now forecast to total 275m tonnes, down 7.7% year-on-year.

Wheat got off to a positive start last week, thanks to good tender activity. However, the market plummeted on Wednesday, largely on the back of profit taking following the selloff in soybeans.

The November MARS bulletin in Europe showed good soil moisture and temperatures benefiting wheat. This also helped the pace of planting for winter crops.

US Wheat planting is complete, and the condition is 43% good to excellent, compared to 46% last week and 52% last year. Conditions worsened last week as the key wheat producing regions saw very little rainfall.

French wheat planting is now 99% complete, well ahead of last year (78%). The crop condition is 96% good-to-excellent, owing to the milder weather conditions.

The IGC increased global wheat production by 1m tonnes, meaning it now sits at 765m tonnes for 2020/21. This is 2% above last year’s production number. Closing stocks are now forecast at 292m tonnes, up 1m tonnes year-on-year.

The fundamental picture remains unchanged, with the key focal points being the Chinese buying program and the potential impact of La Niña on South America’s corn and soybean crops.

On the weather front, there are rains forecasted this week in parts of Brazil and Argentina, but no rains are expected in other key growing areas. Some 1% of Soybeans in Brazil seem to need replanting and Argentina’s corn planting is highly delayed. The intensity of La Niña remains one to watch as the months ahead are key for corn and soybean development in Argentina and Brazil.

Chinese buying remains strong as it looks to feed its recovering pig herd and also fulfill the Phase One Trade Agreement. It may also be an attempt to make up for the losses suffered during the typhoon, although its Government says there’s no such damage. Either way, we think their strong buying appetite will continue to grow.

There is no reason to see lower prices.

Supply

WASDE Projections

Weather in Main Corn Growing Regions

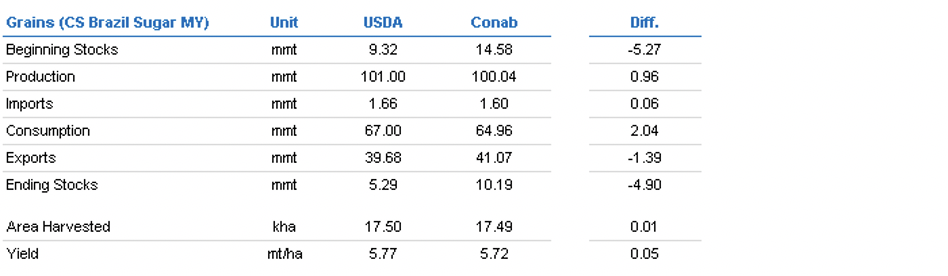

Brazil Balance

China

Demand

EU