Price Action

Forecast

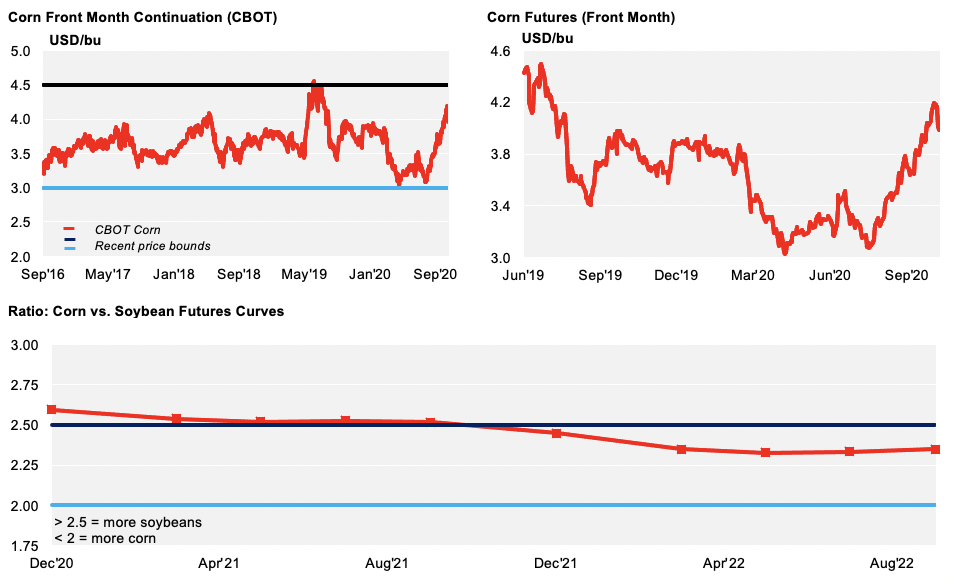

Our 2020/21 forecast (Sep/Oct) remains unchanged in a range of 3.4 to 3.8 USD/bu. The average price since the beginning of the crop (Sep/Aug) is running at 3.81 USD/bu

Market Commentary

There was a healthy correction last week after the rally that started in the middle of August. This was helped by a macro sell-off, rains arriving in key regions and profit taking. The only exception was a 4% rally in Brazilian corn, caused by strong local fundamentals. All other geographies saw heavy losses in corn, soybeans and wheat.

Some profit taking was due in grains. The main trigger was last week’s weak macro environment. Another was the rainfall that arrived in areas which had previously suffered from excessively dry soil (South America, the Black Sea area and the US Plains).

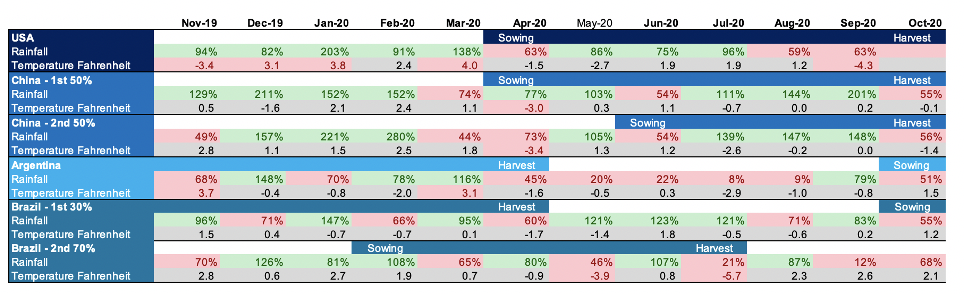

All three areas are in planting season. Brazil is planting soybeans and corn. The Black Sea and US are planting wheat. Rains were very much needed and dry weather was one of the supportive factors, meaning there is less weather-related bullishness now. We still have the uncertainty of La Niña ahead of us, which causes dry weather in South America, Europe and southern US. All these areas are in critical stages of crop development for wheat and corn. So, despite ample rains having arrived, some risk premium associated with La Niña should be justified as different climate institutes say there is a 90% chance that it will happen.

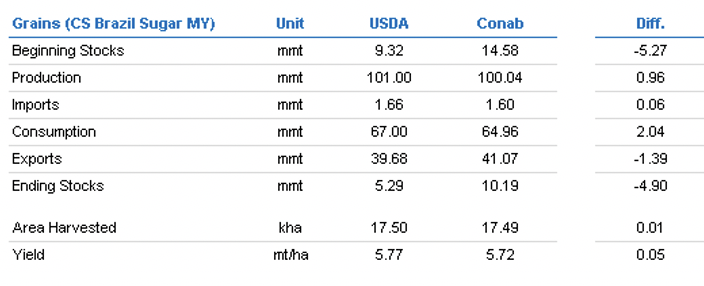

The first positive impact from rainfall in Brazil is that it allowed farmers to speed up in soybean planting, which made 15-point progress in the space of a week. This is now 23% complete compared to just 8% in the previous week. Despite progress still below last year’s 35%, concerns of a delayed planting having a negative impact to safrinha corn are now much lower. The first corn crop in Brazil remains a tad behind last year with 46% planted, compared to 51% last year.

However, Brazil supply and demand picture for corn remains very tight which, coupled with a further devaluation of the Real, made corn rally again last week by 4%. The fundamentals suggest that strong prices will remain until there is availability from the new crop.

US Corn Harvesting is now 72% complete compared to the five-year average (56%). Similarly large progress has been observed with soybeans.

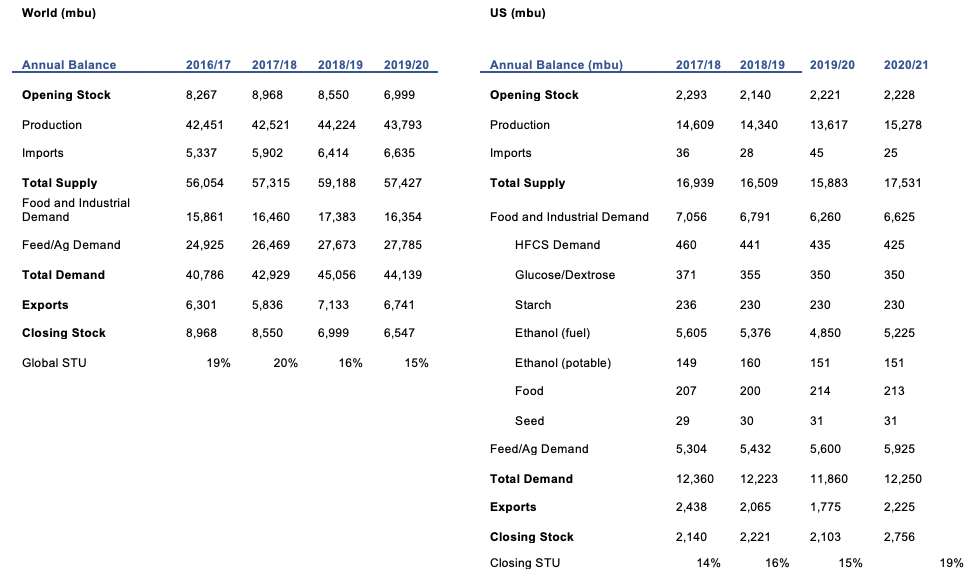

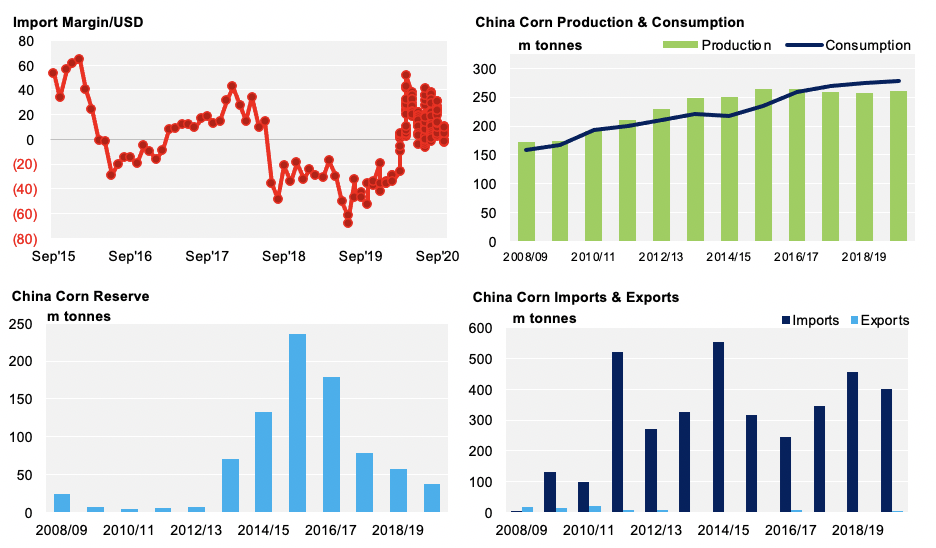

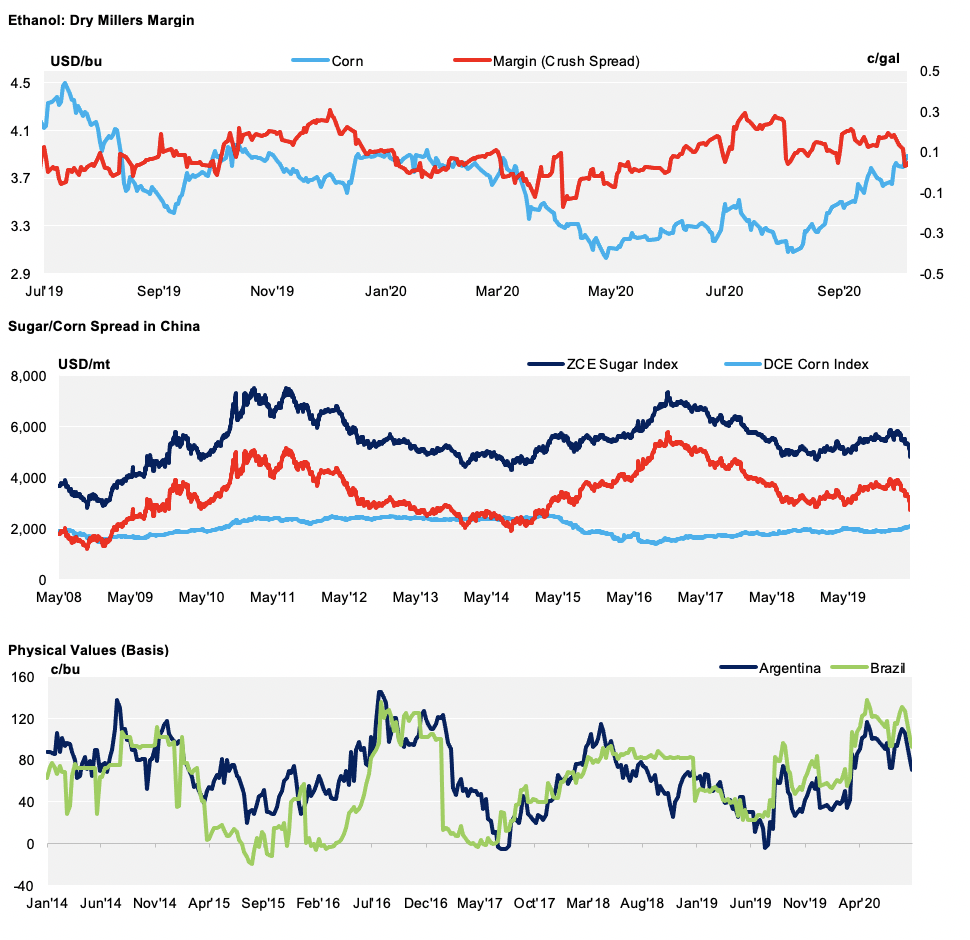

On the demand side, this continues to be a Chinese story with their restocking program. US export inspections showed a 30% decrease last week due to weaker buying from China. However, export sales were better than expected by the end of last week, showing a 69% increase in exports so far this year.

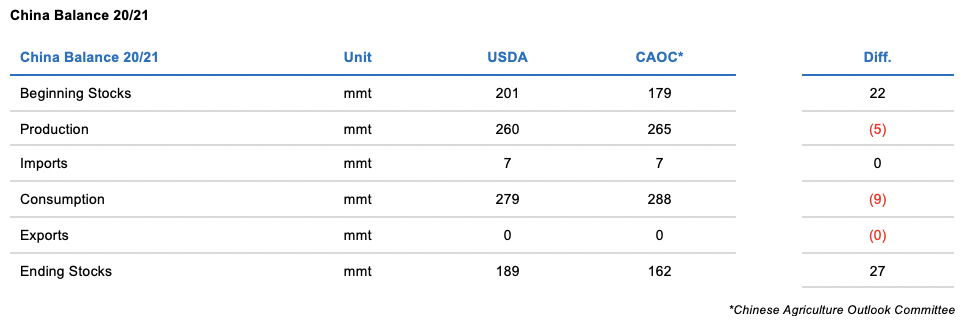

We have the November WASDE coming next week, with the big question centering the USDA’s export forecast. The controversies come from the the 7.2m tonne import quota officially approved by China, the larger number shown in the export inspection, and import demand ranging between 10 and 20m tonnes. The problem lies in the unknown impact of typhoons on the Chinese crop (est. 10m tonnes) and the level of Government stocks (0). Chinese buying continues to be the main bullish element for corn and soybean prices.

France’s corn harvest is 80% of the way complete compared to 60% this time last year. The Ukrainian harvest is 56% complete. We think weather will be favourable for harvesting over the next two weeks in both Europe and the Black Sea region.

The IGC lowered global corn production by 4m tonnes, with cuts in the US, Ukraine and the EU. However, global output remains at record levels.

On the wheat front, we had losses in both the US and Europe, with Chicago suffering losses of 5.4%.

French Wheat planting is 66% complete, up 21% week-on-week, 12% year-on-year and down 6% from the five-year average.

US Wheat planting is 85% complete, compared to the five-year average of 80%. The crops condition ranked just 41% good-to-excellent due to dry conditions. We think we’ll see some improvement here as rains have arrived.

Rains in the Black Sea region have alleviated the dryness. Sovecon now thinks the wheat condition will improve and all hectares will be planted. The current mild temperature is good for wheat development, but colder months are right around the corner. Planting is 91% of the way complete in Ukraine and it has finished in Russia.

The IGC raised their global wheat production forecast by 1m tonnes, meaning it now totals 764m tonnes. They also increase consumption by 2m tonnes, meaning it now totals 751m tonnes. They lowered ending stocks by 3m tonnes, meaning they should now total 291m tonnes.

Despite last week’s correction, nothing has changed fundamentally. Rains arriving in key areas will alleviate the dryness, but rains were expected anyway. This will take away some of the risk premium we had from weather, but La Niña is still an uncertainty and justifies some weather worry still.

Chinese buying continues to be the most supportive factor and everything points to this continuing.

The sizable length of spec funds could trigger further long liquidation like we saw last week, but unless China steps back from buying, we don’t see much downside risk.

Supply

WASDE Projections

Weather in Main Corn Growing Regions

Brazil Balance

China

Demand

EU