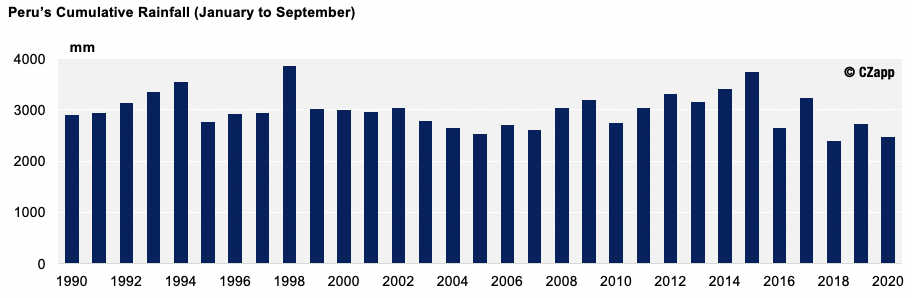

- Peru has suffered its driest year in a decade so far in 2020.

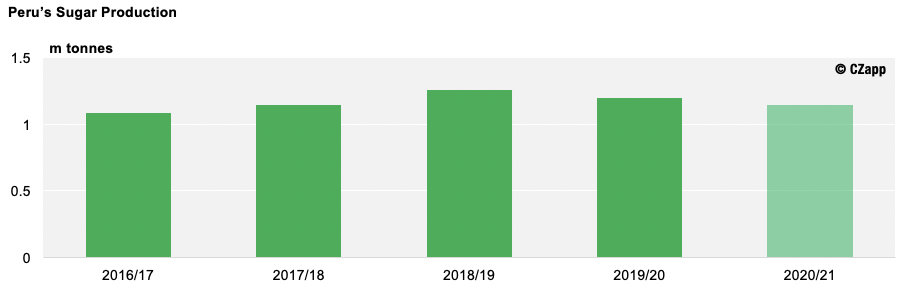

- Its cane crop has performed poorly as a result meaning its sugar production is 56k tonnes smaller year-on-year.

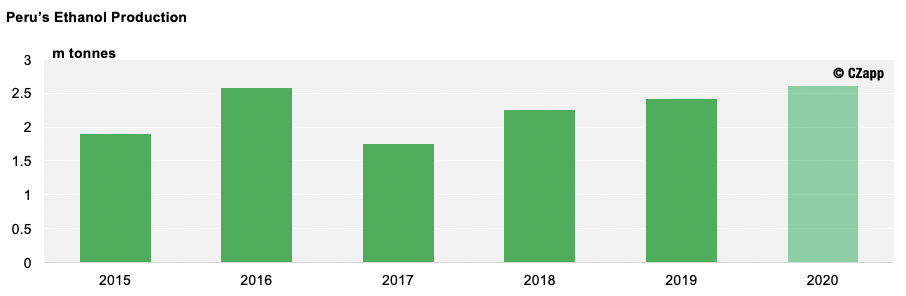

- This, coupled with the increased demand for ethanol-based sanitation products throughout the pandemic, means many Peruvian mills are producing ethanol to earn more money.

Peruvian Mills Choose Ethanol Over Sugar

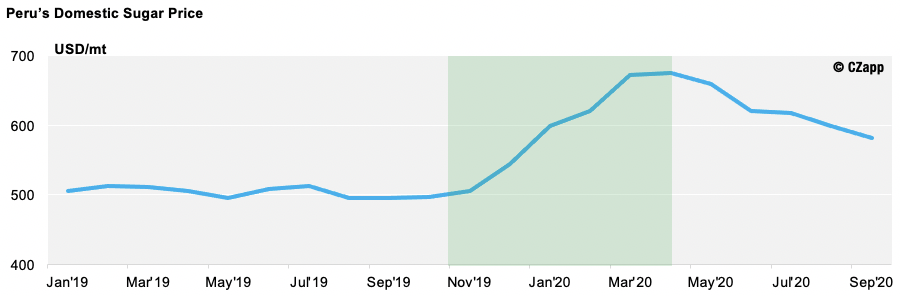

- Peru’s domestic sugar prices have been high throughout 2020.

- They started to increase in November 2019 and reached their peak in March this year, when COVID-19 reached full stride.

- However, the pandemic has caused a surge in demand for ethanol-based hand sanitisers and other such products.

- With this, many Peruvian mills switched to make ethanol from cane as it pays more at present.

- Like Brazil, Peru has the flexibility to produce sugar or ethanol, depending on which offers the best returns that year.

- We think Peru could produce 260m litres of ethanol this year, up 18.6m litres year-on-year.

- We observed similar levels in 2016, which was a dry year and subsequently poor, in terms of cane and sugar production.

- This brings us onto another reason why Peruvian mills decided to make the switch.

- So far this year, Peru’s rainfall has been almost its poorest in 30 years, second only to that seen in the same period of 2018.

- This has cut cane yields and further influenced the mills’ decision.

- When we observed similar weather in 2018, sugar production totalled 1.3m tonnes.

- We therefore think we will see a similar-sized crop in 2020, which is not dire, compared to the five-year average of 1.2m tonnes.

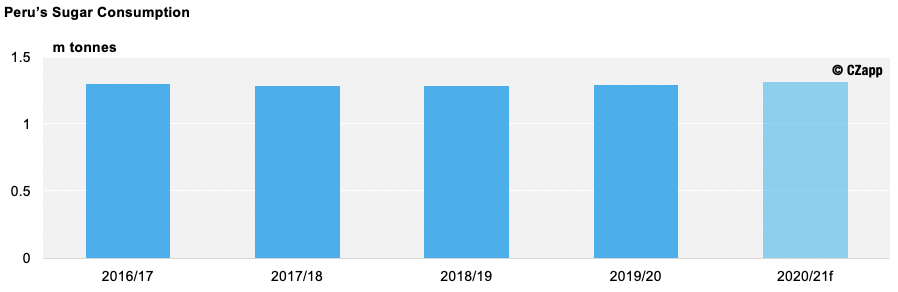

- However, Peru’s annual sugar consumption remains fairly constant at 1.3m tonnes, meaning Peru will have to import an additional 200k tonnes of sugar.

Who Will Fill This Void?

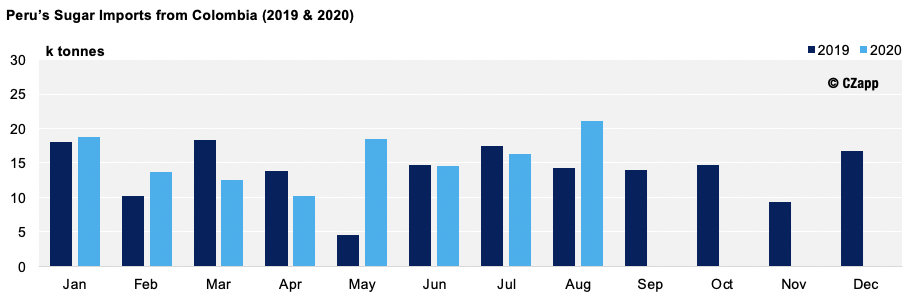

- Peru has imported 126k tonnes more sugar from Colombia this year, in an effort to fill its production void.

- It usually imports and exports sugar to and from Colombia under the Andean Free Trade Agreement, but this trade very much depends on what is happening in each country’s domestic market.

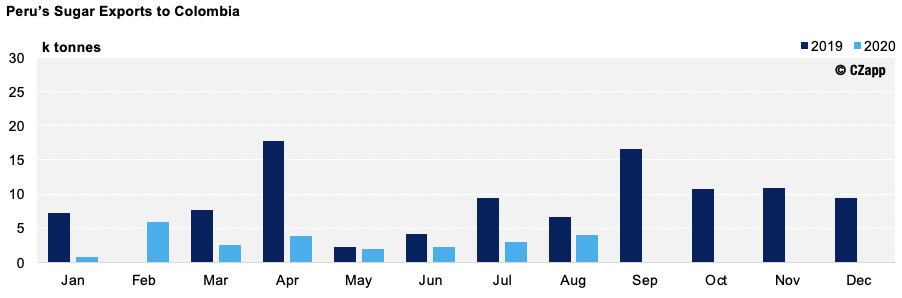

- With Peru’s domestic sugar price currently sat at 582 USD/mt, it is more profitable to sell sugar domestically than it is to export.

- For this reason, Peru has exported just 24k tonnes of sugar to Colombia so far this year, down 30k tonnes year-on-year.

- We think Peru will continue to import sugar from Colombia for as long as its domestic prices stay strong.

Other Opinions You May Be Interested In…

Interactive Data You May Be Interested In…