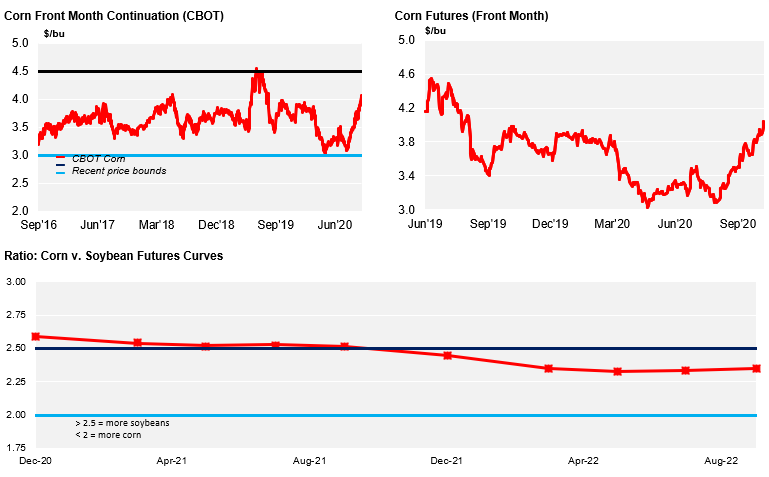

Price Action

Forecast

Our 2020/21 forecast (Sep/Oct) remains unchanged. We think the average price will sit in the range of 3.4 to 3.8 USD/bu. The average price, since the start of the crop (Sep/Aug) is running at 3.72 USD/bu.

Market Commentary

It has been another week of strengthening for grains, with Brazilian corn and EU corn rallying the most. US and EU wheat also made gains.

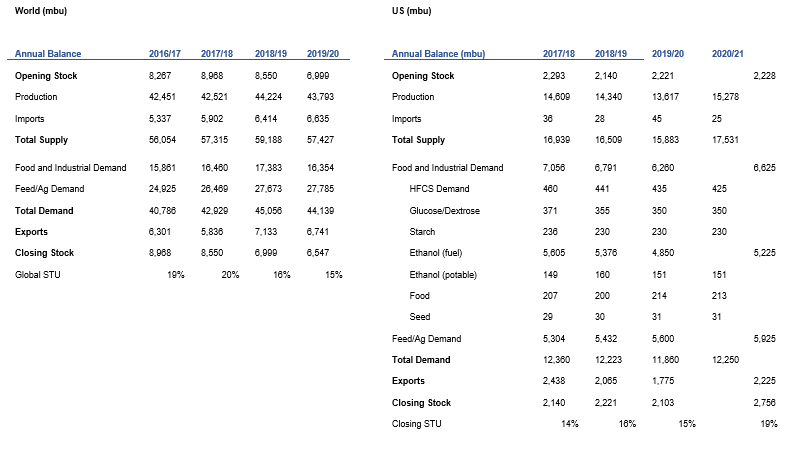

Downward revisions to production forecasts across most geographies, coupled with healthy demand (especially from China), continue to attract spec funds, which nearly reached an all-time high net long in the case of soybeans. Spec funds have increased their net long position in agricultural commodities to the highest level since 2016.

Finally, we have Chicago corn above 4 USD/bu, despite some profit taking at the start of last week. There was also widespread selling activity in Soybeans after the Commitments of Traders showed net spec long positions close to the historical record. Soybeans recovered through the end of the week but closed negative.

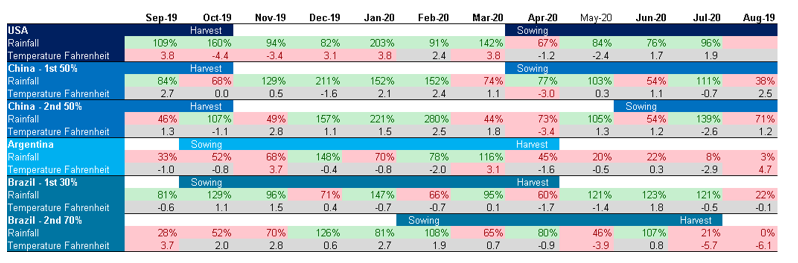

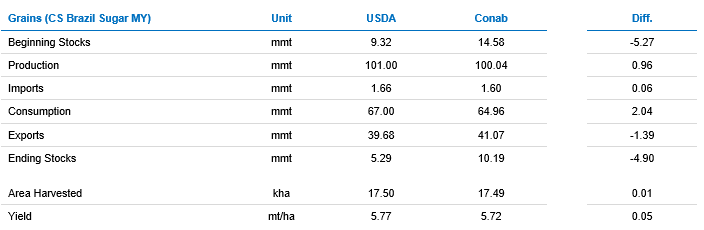

Soybean planting in Brazil is moving slowly, with just 3.4% planted, compared to last year’s 11%. This is a 10-year low. The real problem is Mato Grosso, the largest producing state. Here, just 3% of the crop has been planted, compared to last year’s 19%, and the three-year average of 17%. However, rains have now arrived in Brazil, but these won’t be sufficient after the long period of dry weather and the further trouble caused by the recent fires. Brazil’s first corn crop is also delayed. 39% has been planted so far, compared to last year’s 45%. The problem here, is that the safrinha crop (the second and bigger corn crop) comes after the Soybeans are harvested, meaning there is a potential delay to planting on the second corn crop.

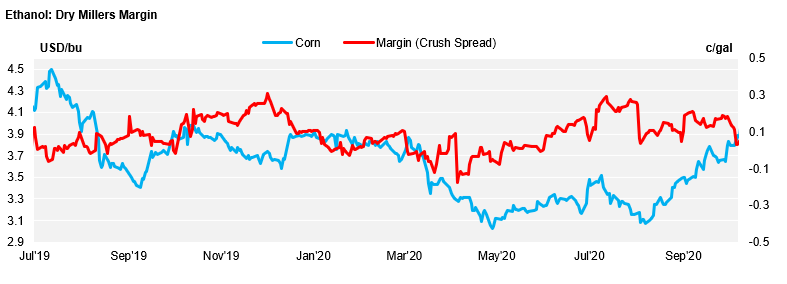

The issue is that Brazil has low stocks from the old crop, and we are entering a period of higher demand both for feed and ethanol. With this, loal prices should continue to strengthen. Brazil’s government has announced a 0% tax on corn and soybean imports, but all imports were already coming from Mercosur countries, which already have zero tax. We will therefore see some flow from the US, but we don’t think it will alleviate local prices. The only thing that could prevent higher prices is lower corn ethanol production.

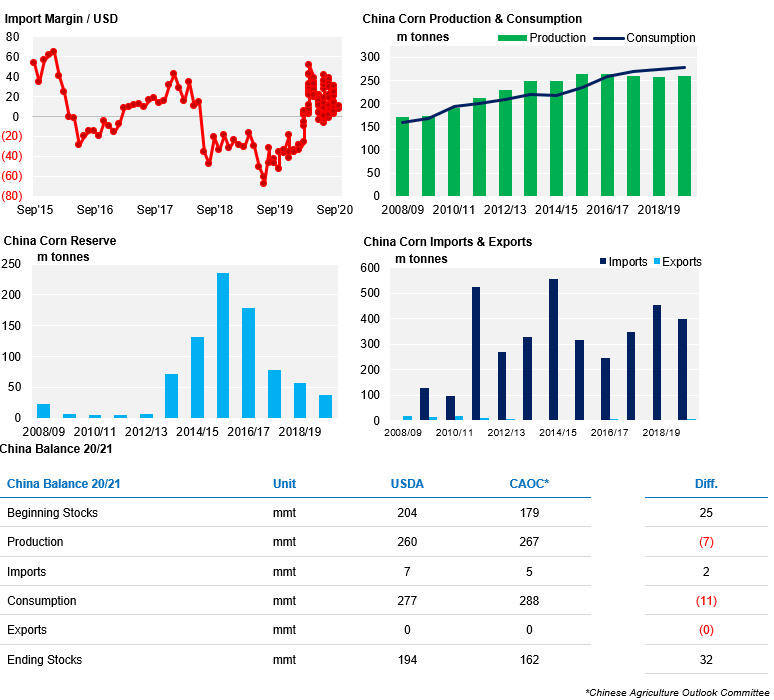

We are yet to forecast the size of China’s corn crop, as the Government has said that the typhoons did not have a material impact on the size of the crop. Private analysts stillbelieve that China could have seen losses of up to 10m tonnes as a result of this. As it stands, China’s harvest is progressing at a very slow pace, as there were rumours lastweek that China would issue new import licenses. They published an import quota of 7.2m tonnes, unchanged from last year. However, it seems clear that this volume is too small, and they will need to increase it to somewhere between 10 and 20m tonnes. China remains a bullish factor as they bought more US Corn last week, as well as more from other origins.

The US’ corn condition worsened by 1% last week, now ranking at 61% good-to-excellent. Its harvest is 41% complete, having made 14% progress in the space of a week. This is also double last year’s pace, which was just 20% complete in the same period. However, this didn’t move the market, which continues to focus on Chinese buying.

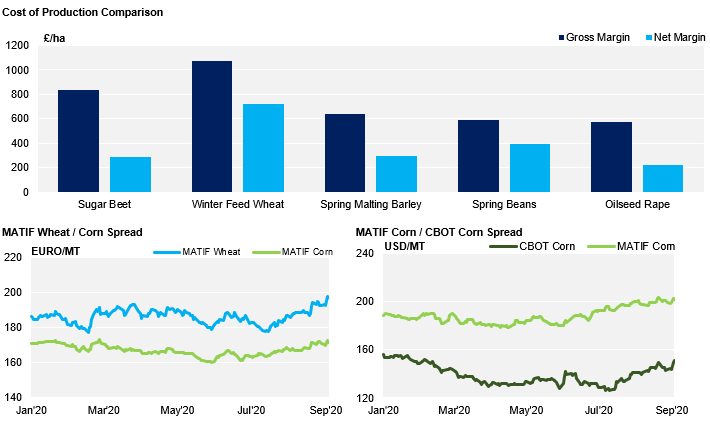

In Europe, corn prices rallied 5.5% as production forecasts tightened for both the EU and Black Sea. The French corn harvest is 64% complete, compared to last year’s 26%.However, this didn’t put any pressure on the market. France Agrimer lowered its Corn production forecast again by 600k tonnes. This is still 6% higher than last year’s forecast. However, the strength came from the Black Sea with Ukrainian cooperative, UGA, which lowered its Corn production forecast to 32.5m tonnes, compared to the 35.3m tonnes they had forecasted prior to the dry spell. With this, the Black Sea prices rallied. The Ukrainian harvest is 33% complete and the Russian harvest is 48% complete.

Wheat rallied as well, both in the US (+5,3%) and the EU (+4,4%), with healthy demand and lower production forecasts.

In the US, we may have some doubts surrounding higher acreage, as planting is going incredibly well (68% complete); well ahead of last year and of the five-year average, both at 61%.

European Wheat almost reached 210 EUE/mt in Paris. This was helped by quite a few tenders last week. France Agrimer lowered its their Wheat production forecast again by 303k tonnes. Planting is now 12% complete.

The Black Sea was a major bullish factor last week, with UGA lowering its production forecast to 25.3m tonnes, compared to the 26.6 they had before. Planting is now 63% complete in Ukraine and 84% in Russia. The anticipated rains should improve soil moisture after the dry spell we’ve seen up until now.

In South America, the Rosario Stock Exchange lowered its production forecast for Argentinian wheat to 17m tonnes, down 2m tonnes from last year due to dry weather.

As is stands, the market is looking at Brazilian and Black Sea weather and Chinese buying, rather than the supply and demand projections for corn, which show global stockshigher for the new crop. Pure fundamentals don’t justify higher prices, but the 2020/21 season has just started, and we have too many risks ahead of us that would justify the actual strength in the market. We don’t know how hard China’s production will have been hit by the typhoons, but this will directly impact China’s buying. We also don’t know what the impact to Brazil’s crop will be, if safrinha planting is impacted by the delay in Soybean planting. Black Sea weather is another point to look at. This has attracted spec fund buying, which is now holding the largest net long of the last five years.

The momentum continues to be positive, but rains have arrived in Brazil and the Black Sea area, and the sizable net long of spec funds leaves the market vulnerable to the downside. We may see some profit taking but expect some consolidation at actual levels.

Supply

WASDE Projections

Weather in Main Corn Growing Regions

Brazil Balance

China

Demand

Other Opinions You Might Be Interested In…

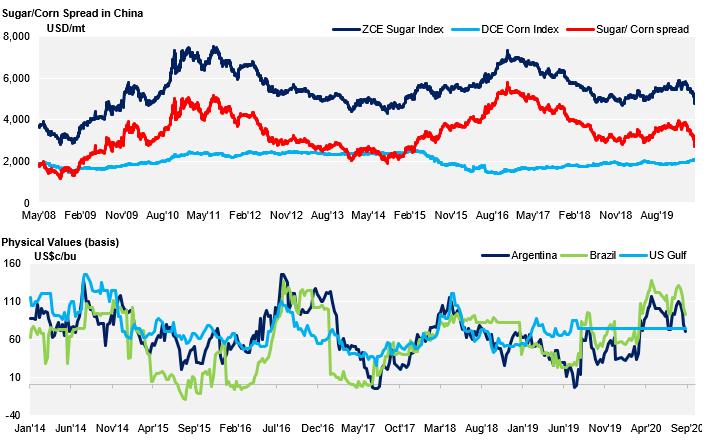

· Fire in CS Brazil’s Cane Fields

· How Much More Corn Will China Buy?