- Mexico’s cane production was badly impacted by drought in 2019/20.

- This meant it was only able to produce very small amounts of sugar, ethanol and molasses.

- However, its molasses production should rebound next season as the weather looks favourable, but it will remain a net ethanol importer.

Mexico’s Molasses Production to Rebound

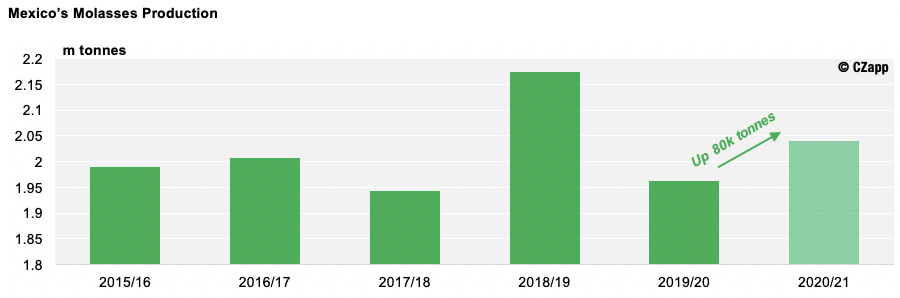

- We think Mexico will produce 2.04m tonnes of molasses in 2020/21, up 80k tonnes year-on-year.

- This is a 4% increase from last season yet 130k tonnes shy of the 2018/19 record.

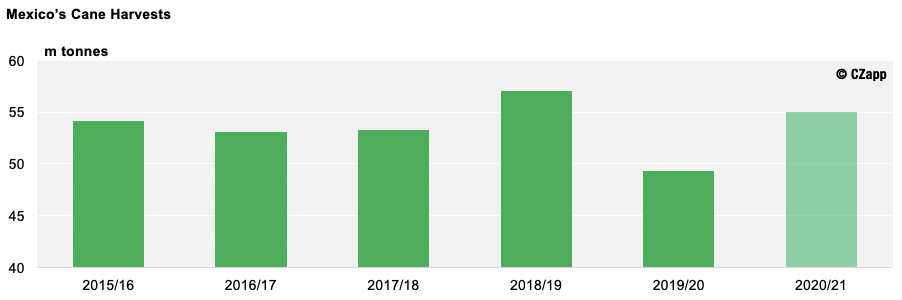

- The lows of 2019/20 came as Mexico suffered widespread drought, which reduced the amount of cane it was able to harvest.

- Fortunately, Mexico’s cane area should recover next season, provided the weather does not disappoint again.

- Despite this, some cane was irreparably damaged last season and won’t recover enough to be harvested in 2020/21.

- With this, we do not think Mexico’s cane harvest will reach the high seen two seasons back.

- However, the Mexican molasses market remains strong, with demand coming from the United States, tequila and mezcal producers, local bakeries and yeast producers.

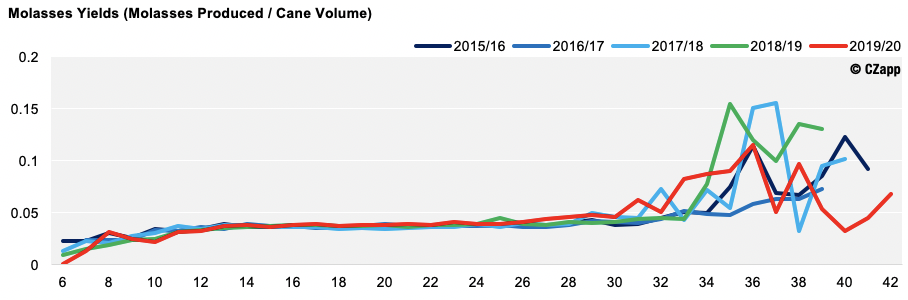

- We currently think Mexico will harvest 55m tonnes of cane in 2020/21, with an average yield of 0.037.

Mexico’s Ethanol Production Stays Low

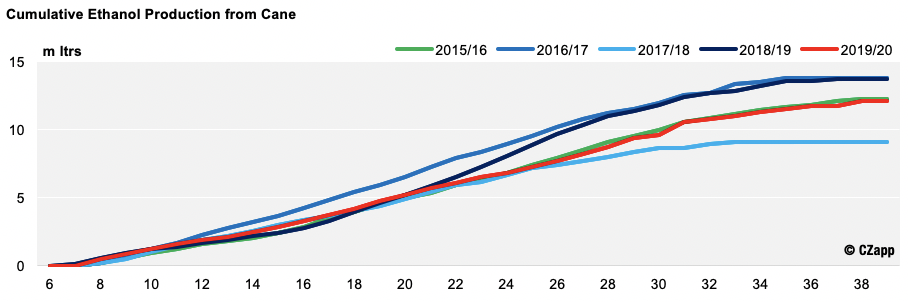

- Despite the rebound in molasses production, ethanol production remains low at 500m litres due to increased domestic and foreign demand.

- Mexico’s yearly ethanol demand totals 498m litres, but just 12m tonnes of this came from cane last year.

- This was an 11.74% drop year-on-year, and again, was down to Mexico’s reduced cane availability following the drought.

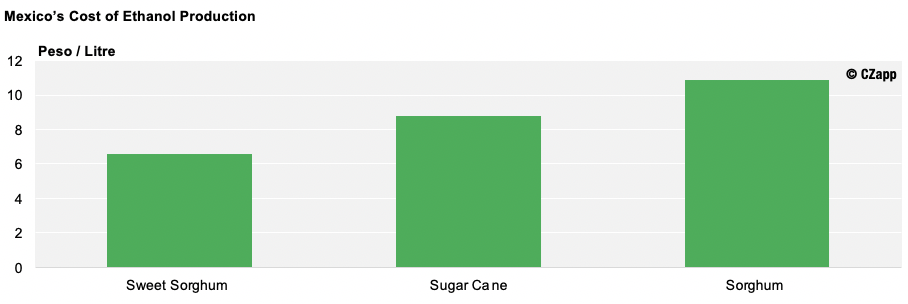

- Despite this, Mexico’s ethanol industry is in decline due to the poor returns on offer.

- In fact, ethanol margins are almost obsolete as mills that choose to produce ethanol face heavy taxes because the Government raised taxes for products that have a negative impact on health and the environment.

- This meant that, last season, there were just three mills producing ethanol directly from the cane they harvested.

- Therefore, Mexico only produces around 250m litres of ethanol each year given the expensive nature of the process.

- All the other ethanol Mexico requires to satisfy its domestic demand comes from the United States.

- This should continue to be the case for the foreseeable future.

- In 2018, the Mexican government legalised the use of ethanol blends as gasoline substitutes in all cities except Mexico City, Guadalajara and Monterrey.

- As a result, Mexico’s drivers now use high concentrations of ethanol to fill their tanks as a cheaper alternative for gasoline.

Other Opinions You Might Be Interested In…