Price Action

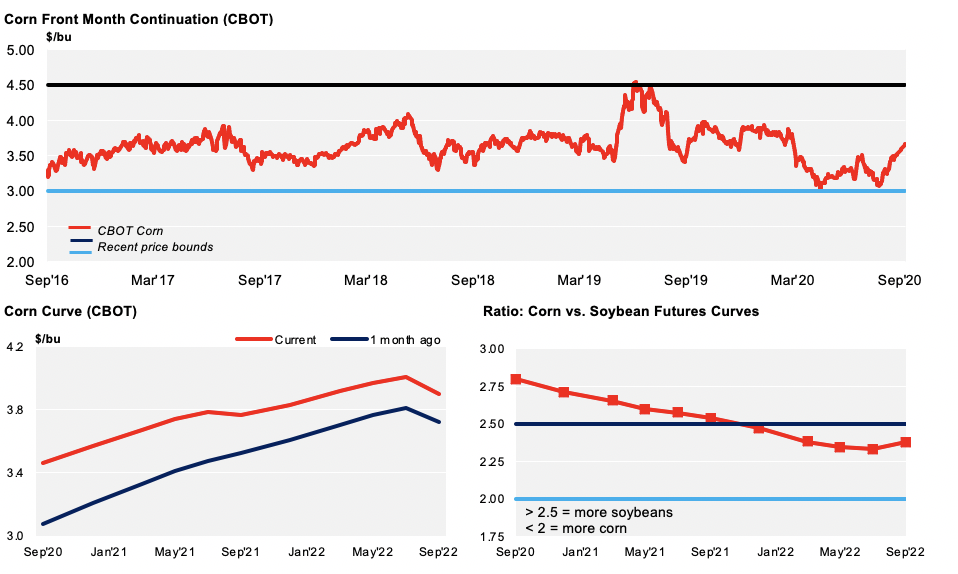

Our 2020/21 forecast remains unchanged, with the average price somewhere in the range of 3.25 to 3.75 USD/bu.

Market Commentary

Grains rallied in almost all geographies last week, with Brazilian Corn being the only exception. This came in response to the news of China’s large supply.

Soybeans rallied the most last week, followed by Corn and Wheat, which had no fundamental reason to trade higher but were pulled by the whole complex.

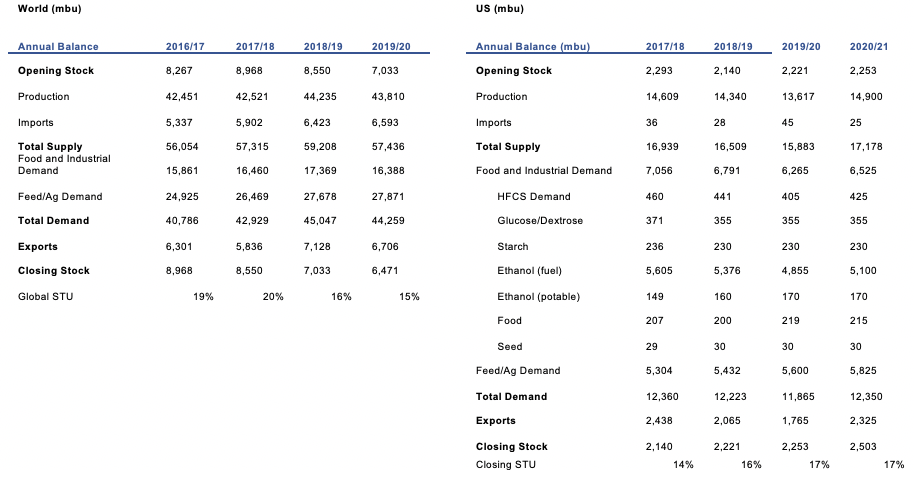

We have sizeable crops ahead of us, even with the weather issues experienced throughout the past couple of months. Fortunately, we should have now seen the extent to which these adverse conditions have impacted wheat, corn and soybean production. With this, supply concerns should now disappear, and demand will be the main price driver, with China playing the main role as it continues to grain grains.

Last Friday, the USDA published the US’ Export Sales, which confirmed that more Corn and Soybeans were sold to China, along with sizable volumes to unknown destinations, which may well include more to China.

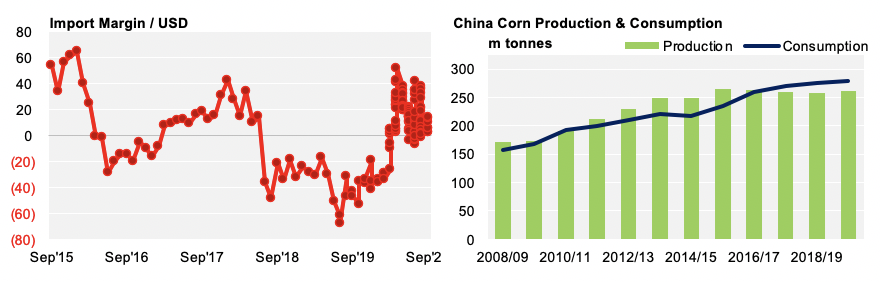

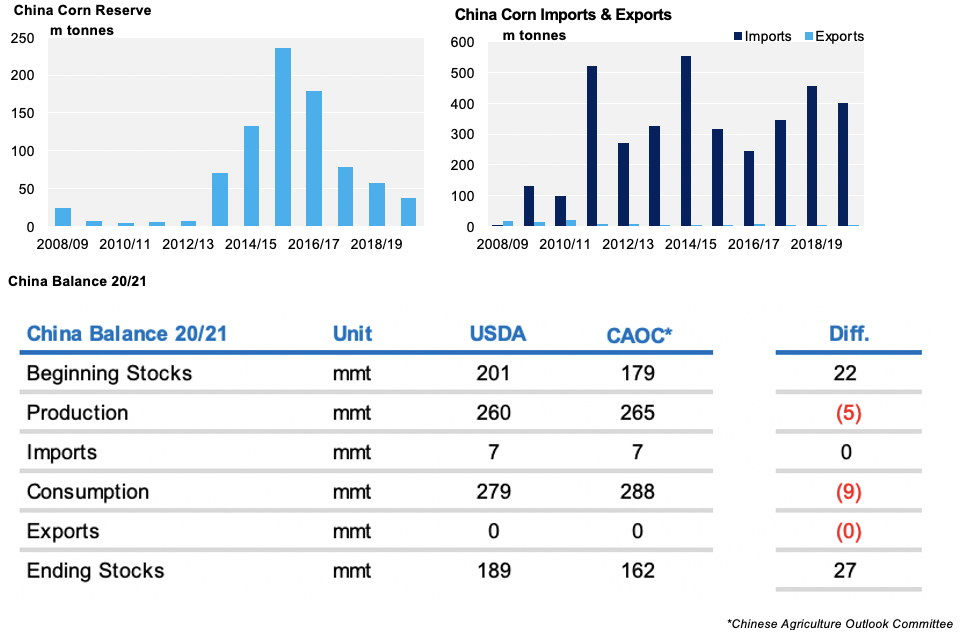

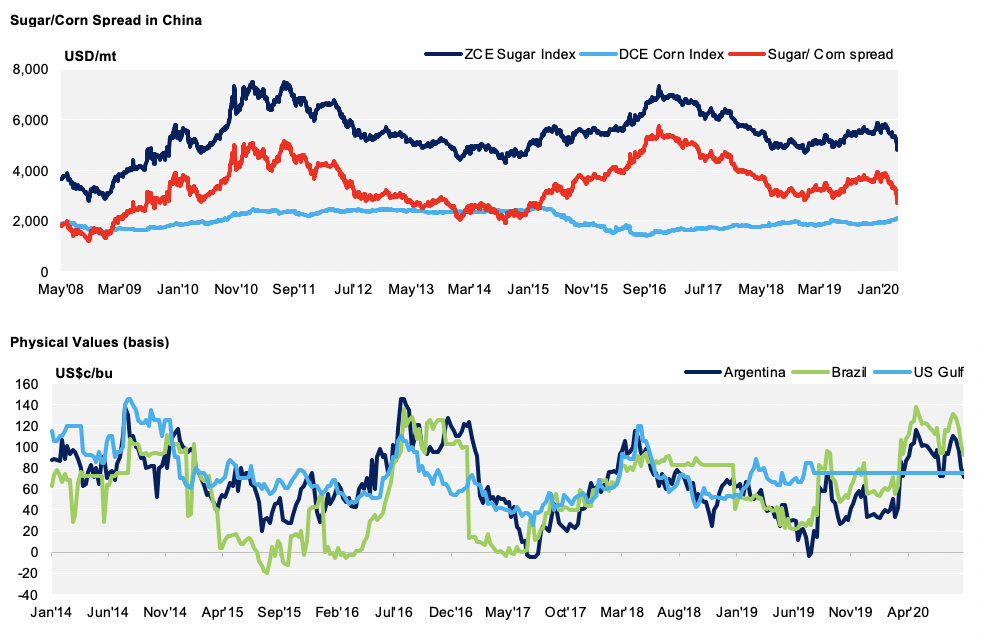

China has sold its strategic corn stocks and needs to restock again. Unofficial data show stocks are close to zero, having not made any purchases over the past five years. This means it needs to quickly restock and is aggressively buying as a result. Its need to fulfill the Phase One Trade Agreement with the US is also playing its part.

Some of the strong Chinese demand also comes as the hog population is set to expand after its massive reduction in the last couple of years amid the outbreak of African Swine Fever.

However, the big unknown is how much will China buy. The Government has made no changes to its 7.2m tonne Corn import quota for 2021, but this may need to be increased if it wants to restore Government stocks.

Chinese Corn production will fall due to the impact of typhoons, with losses of around 10m tonnes on the cards. Despite this, the Government has lowered its production forecast by just 1.8m tonnes, meaning it’s now at 264.7m tonnes, compared to the USDA’s forecast of 260m tonnes.

The US’ Corn condition has worsened by another 1% for the sixth week in a row; it’s now at 60% good-to-excellent. Its harvest has started and is 5% complete, aligned with the five-year average.

The Australian Weather Institute still believes there’s a 70% chance of La Niña after the US had officially declared it two weeks ago.

The WTO said that the US breached international law by imposing more than 400 million USD on Chinese imports when the trade war started in 2018.

In Europe, Strategie Grains decreased their Corn production forecast for the EU-28 in 2020/21 last week by a sizable 2.5m tonnes. It now sits at 64.9m tonnes. This means it is very close to last year’s 64.5m tonne production.

France’s Corn condition worsened a further 1% last week. It’s now at 59% good-to-excellent. Its harvest is 4% complete.

Last week, Strategie Grains increased its wheat production forecast for the EU-28 in 2020/21 by 1.3m tonnes. It’s now at 129.3m tonnes, compared to the prior 128m tonne forecast. Russia’s harvest is 89% complete. Its average yields dropped by 3.1% week-on-week. There are some concerns surrounding wheat planting in the Black Sea area, as soil moisture is very low after the dry weather. If rains don’t arrive soon, yields here will be compromised.

US Wheat planting started last week (earlier than usual). This is one reason that we saw lower prices towards the start of the week. Planting is 10% complete, ahead of the long-term average of 8% at this point.

The momentum with the harvests, coupled with China’s strong purchasing appetite, is positive for the market. We are yet to see how much China will buy, but its need to restock, feed its increasing hog herd and fulfill the Phase One Trade Agreement suggests it won’t stop yet. We are therefore supportive for price in the short-term, but the big picture points to higher ending stocks by the end of the new crop that has just started.

Supply

WASDE Projections

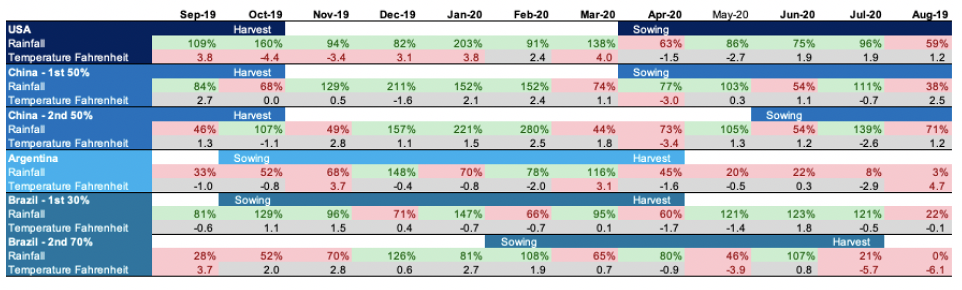

Weather in Main Corn Growing Regions

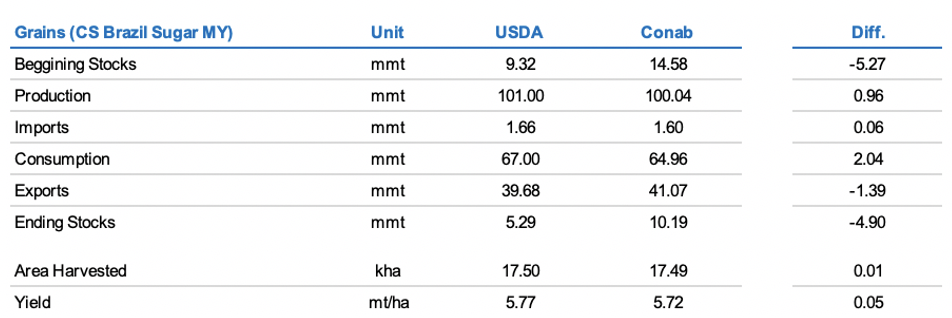

Brazil Balance

China

Demand

EU