- Slowdown with 430kmt of raws nominated in CS this week.

- The logistical efficiency of the terminals has been excellent, and over 3mmt could be exported in August;

- Algeria was the main offtaker this week with 77kmt.

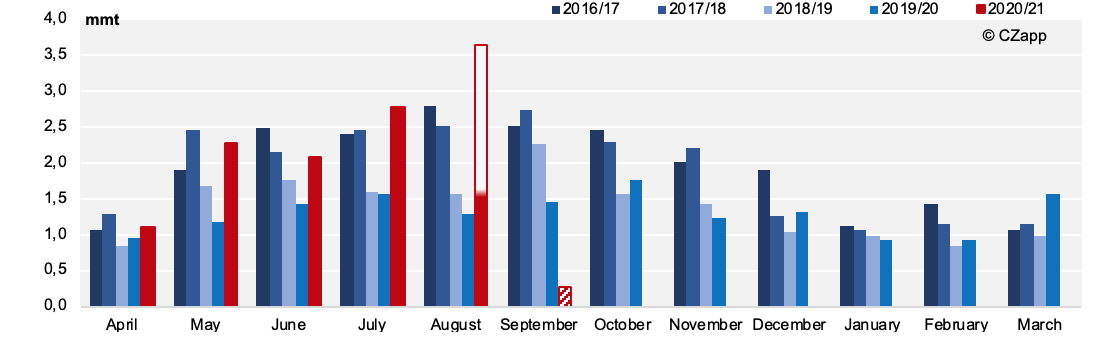

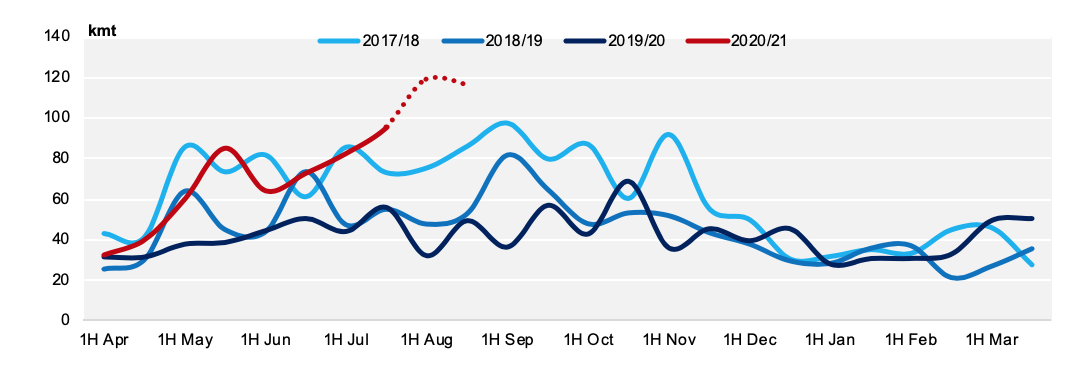

CS Brazil Monthly Exports

- Currently, CS August line up stands at 3.6mmt.

- So far, 1.3mmt have been shipped.

- September has 260kmt nominated.

CS Raws Line Up – August could see a record of exports out of CS

- One refined breakbulk nomination of 32kmt in Paranagua for September shipment.

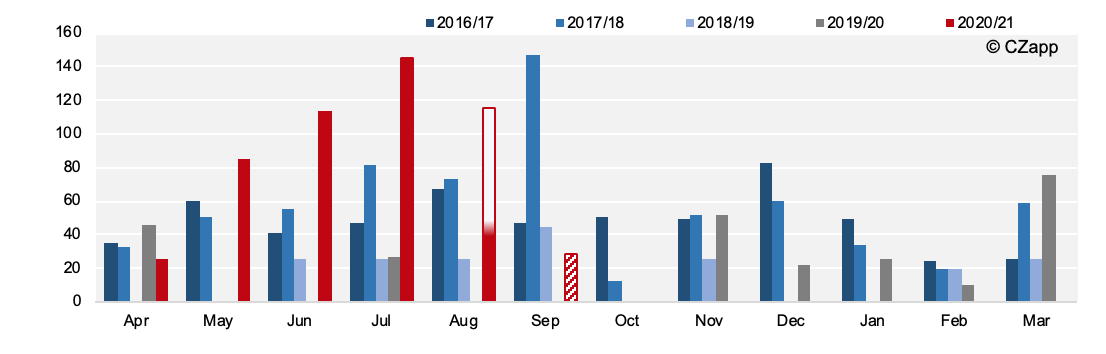

CS Whites Breakbulk Line Up – August whites exports, the highest in 7 years

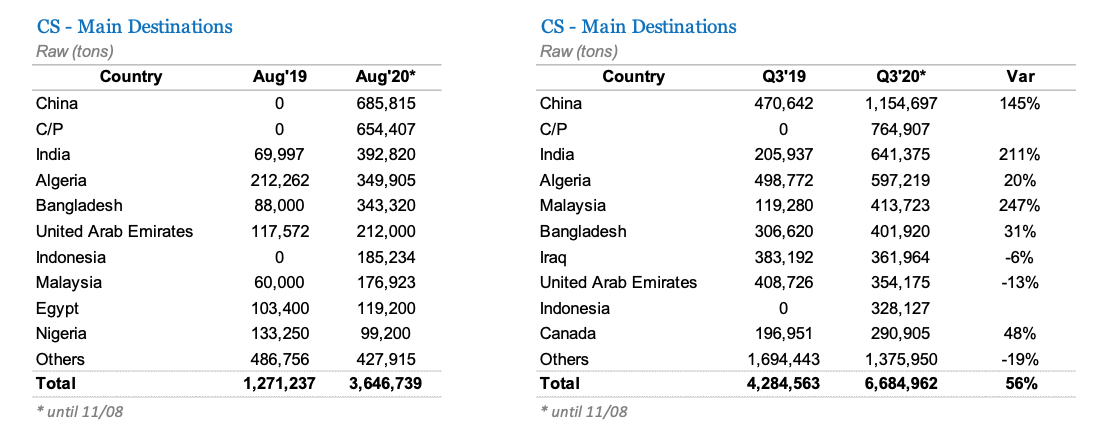

Destinations

CS Brazil Raw Sugar Main Destinations

- Out of the nominations this week 70kmt are for Algeria – total nominations in Q3 stands at 0.6mmt.

- For Egypt, 60kmt nominated this week, taking total Q3 offtake to 174kmt.

- Have a look at our interactive data to see Brazilian top destinations: Global Shipments.

Port Situation

- Pace of operations have increased significantly in the first days of August.

- It the average is maintained, CS could see a record of exports this month perhaps as high as 3.5mmt.

- However, there are programmed stops in 2 terminals which could affect pace of operations in the coming days:

- T-12A: dredging services will be carried out from 14th to 18th August;

- Tiplam: programmed maintenance from the 21st to the 23rd August.

CS Raws Daily Loading Rates

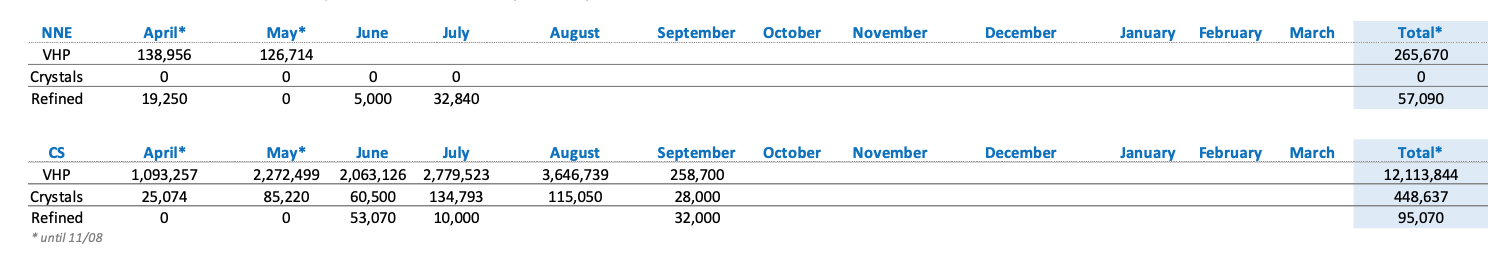

Summary Table

2020/21 Brazil Summary Table of Exports (tonnes)