- This week, 700kmt were nominated in CS.

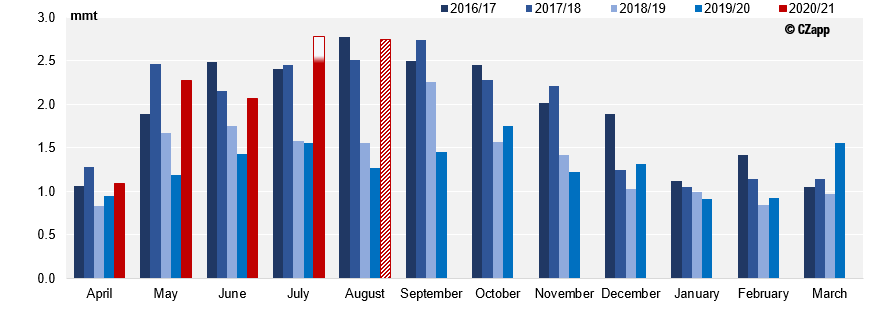

- July raws CS line up stands at 2.7mmt, with 2.5mmt sailed to date;

- August line up stands at 2.75mmt.

CS Brazil Monthly Exports

- As expected, around 300kmt rolled into August leaving a total of 2.7mmt to be exported in July.

- For August, this week 700kmt of raws were nominated in CS.

- August line up already stands at 2.7mmt.

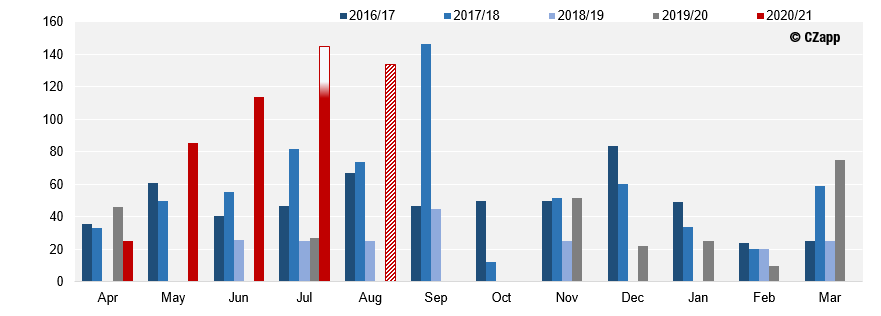

CS Raws Line Up – volume expected to roll from July into August

- No whites nominations this week.

CS Whites Line Up – July whites exports, the highest in 8 years

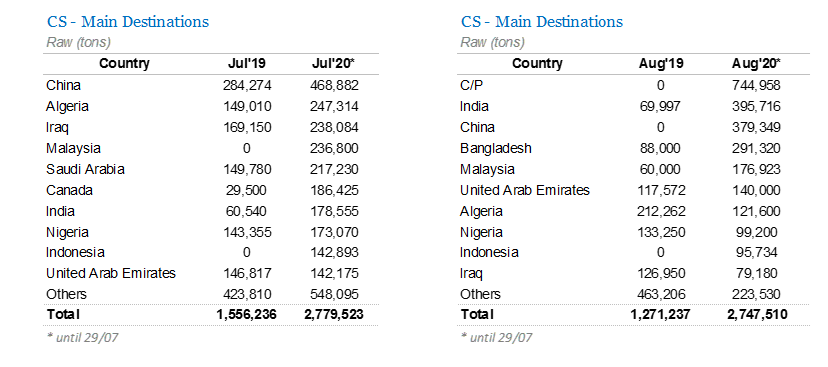

Destinations

CS Brazil Raw Sugar Main Destinations

- Out of the nominations this week 100kmt are for China – total nominations in Q3 stands at 850kmt.

- So far, tit is the largest volume for China since 2015/16.

- For India, 82kmt nominated this week, taking total Q3 offtake to 574kmt.

- Have a look at our interactive data to see Brazilian top destinations: Global Shipments.

Port Situation

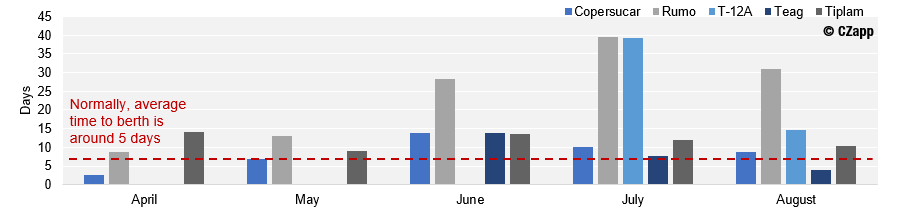

- The vessel line remains high, as does the waiting time to berth.

- Rumo remains the terminal with the highest waiting time.

Santos Average time to berth per terminal

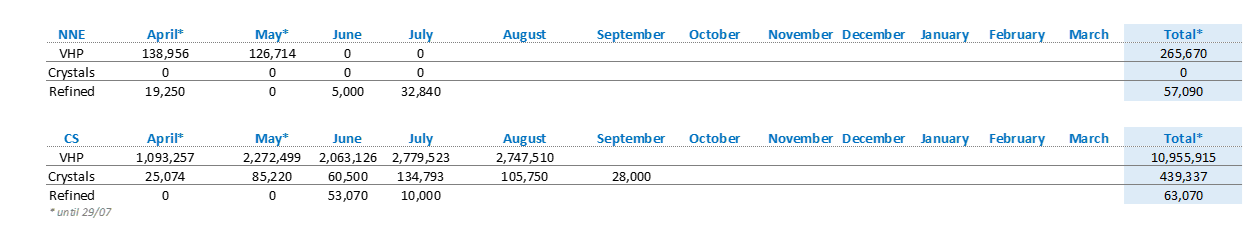

Summary Table

2020/21 Brazil Summary Table of Exports (tonnes)