- CS is heading for a record sugar season.

- Cane allocation remains focused on sugar production.

- Excellent weather so far for operations has seen cumulative crush at 6.5% ahead yoy.

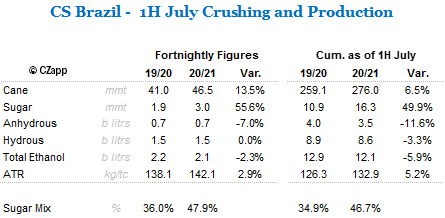

Summary Table 1H July

So far, so good

- Cumulative cane crush has reached 276mmt – 6.5% ahead yoy.

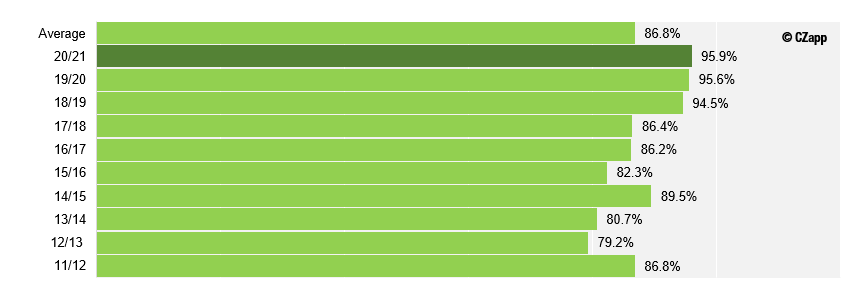

- This is a consequence of dry weather allowing for a higher time efficiency so far, that reached 96% until the 1H of Jul.

CS Time Efficiency until 1H Jul – Dry weather has allowed for excellent pace of operations

- The excellent weather for operations has been one of the reasons why sugar production is so advanced at 16.3mmt – a record for the period.

- Other is of course the mills maximizing sugar mix and a higher quality of the cane, with cumulative ATR at 132.9kg/ton – which is the highest in 13 years.

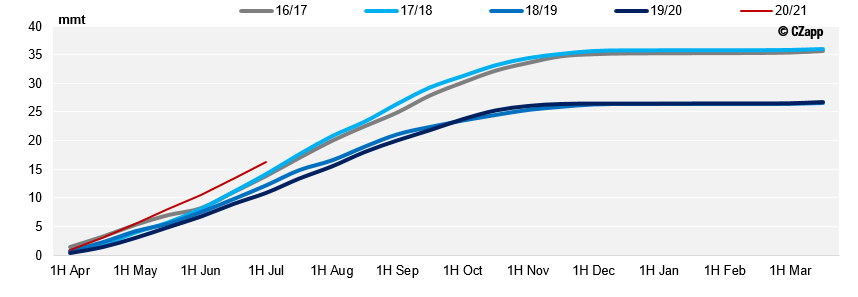

CS Cumulative Sugar Production – Until 1H Jul CS sugar output has reached 16.3mmt

- Despite the positive impact dry weather has had so far in mills efficiency, we do not fail to point out the impact on cane agricultural yields.

- We have made a crop revision this week, downgrading crush for the season to 587mmt.

- However, the higher sugar content has offset the loss in crush leading to an estimated CS sugar production in 2020/21 of 36.8mmt.

Ethanol Market

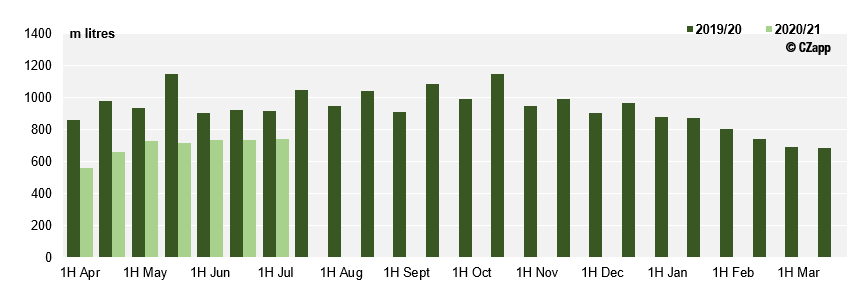

- Hydrous sales by the mills totalled 741mi litres in 1H of July.

- Gradually fuel demand is increasing – although gasohol has seen a faster recovery than hydrous.

- With gasohol prices rising at the gas stations, hydrous is expected to become more attractive for the consumer leading to a rise in market share and consequentially increase in mills ethanol sales.

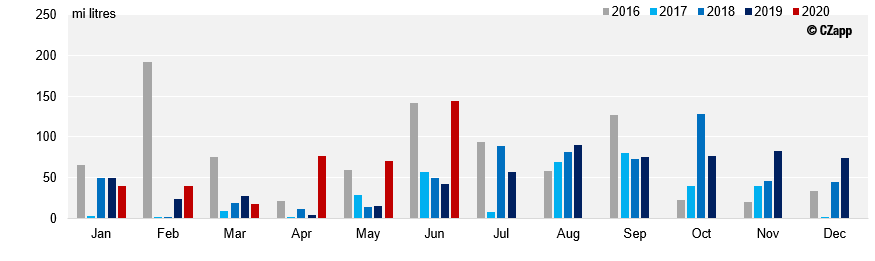

CS Fortnightly Hydrous Sales – slow and steady ethanol recovery of the domestic market

- The pandemic has led to an expressive increase in hydrous exports.

- Data until June reports cumulative hydrous exports at 388mi litres – 225mi litres higher yoy.

- The increase is due to a rise in need of hand sanitizers.

CS Hydrous Exports – Secex Data shows hydrous exports are 137% higher yoy