- The Vietnamese Government could increase import duty on Chinese HFCS (High Fructose Corn Syrup).

- We therefore think Vietnam’s HFCS imports will reduce and the corresponding demand will switch to sugar.

- This should have a positive impact on Vietnam’s sugar market, as it will help ease their large refined sugar stocks.

Vietnam’s Anti-Dumping Investigation on Chinese HFCS

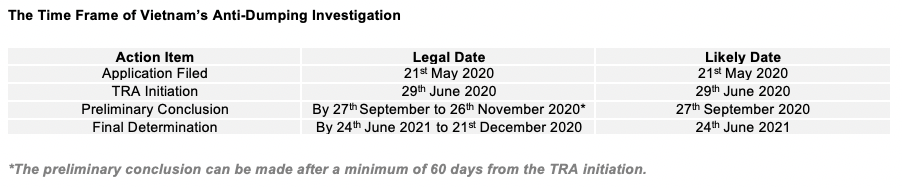

- On 21st May 2020, the Vietnamese Government received dossiers requesting that restrictions were placed on HFCS imports from China and South Korea.

- Between 2010 and 2020, Vietnam has initiated 14 trade remedy cases against China, nine of which got confirmed, and the other five still under investigation.

- Statistically, we think it’s likely that Vietnam will increase import tariffs on Chinese HFCS.

- Temporary AD (anti-dumping duty*) can be imposed within 67-150 days, and Vietnam has the right to claim AD duty 90 days before the issuance of the temporary measure.

- In theory, this means the Chinese HFCS into Vietnam can be levied with high import duty from July.

- We think the HFCS importer may not want to take that risk.

*An anti-dumping duty is a protectionist tariff that a domestic government imposes on foreign imports that it believes are priced below fair market value.

How Much HFCS Has China Exported to Vietnam?

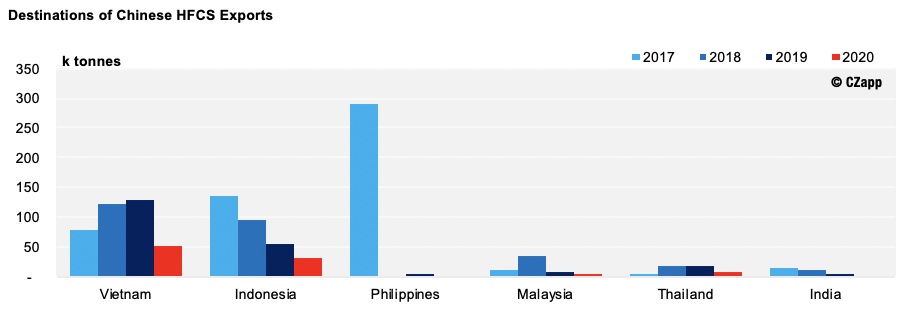

- China exported 97k tonnes of HFCS between January and May 2020; this is a year-on-year (YoY) increase of 10%.

- Vietnam became the top destination for Chinese HFCS exports in 2018, receiving over 50% of their exports.

- The Philippines used to be the top destination back in 2017, but it then levied heavy tax* on HFCS-containing beverages.

- The tax switched the domestic consumers’ interest back to sugar and Chinese HFCS exports therefore reduced from 547k tonnes in 2017 to 303k tonnes (45%) in 2018.

- Similarly, we could now see a reduction of HFCS exports to Vietnam and an increase in Vietnam’s domestic sugar demand.

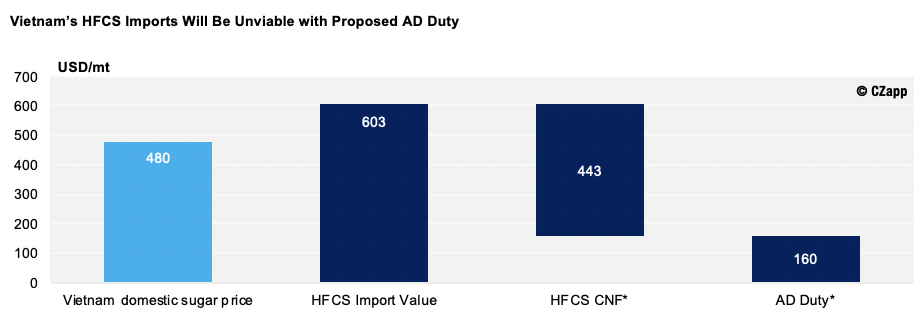

- The tariff on Chinese HFCS imports is currently zero under the China-Asean Free Trade Agreement (CAFTA).

- The requester proposed 36.09% AD duty on Chinese HFCS.

- In this case, HFCS’ landed value will be US$133 higher than the domestic sugar price, making imports unviable.

What Does This Mean for the Sugar Market?

- This is good news for Vietnam’s domestic sugar market because refined sugar stocks in Vietnam are quite high now, as mentioned here.

- Some additional demand switched from HFCS should help resolve part of the stock pressure.

- On the contrary, this isn’t such good news for the Chinese sugar market.

- Any unsold HFCS must go back onto the Chinese domestic market and it has a price advantage over white sugar.

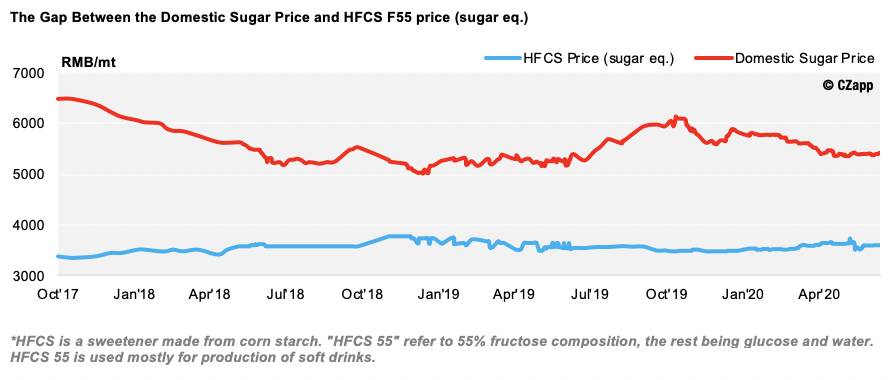

- The current price difference between sugar and HFCS (F55* sugar equivalent) is around RMB2000 per tonne.

- But the volume would be too small compared to China’s 14.5m tonne sugar consumption to make a significant impact.