532 words / 2.5 minute reading time

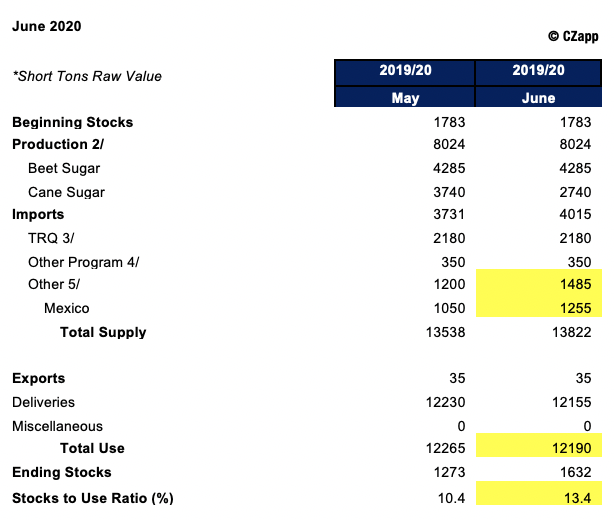

- The June WASDE has normalised the USA’s 19/20 closing sugar stocks (now at 13.4mmt), meaning no further import quotas are necessary.

- This is due to an increase in estimated duty-paid imports and Mexican quota imports, as well as a small decrease in consumption.

- As the closing stocks for 19/20 recover, Mexico’s estimated quota allocation for 20/21 has fallen to 1.2m tonnes.

The June WASDE Release: 2019/20

- The WASDE has increased estimates for Mexican sugar imports this season by 205k short tons.

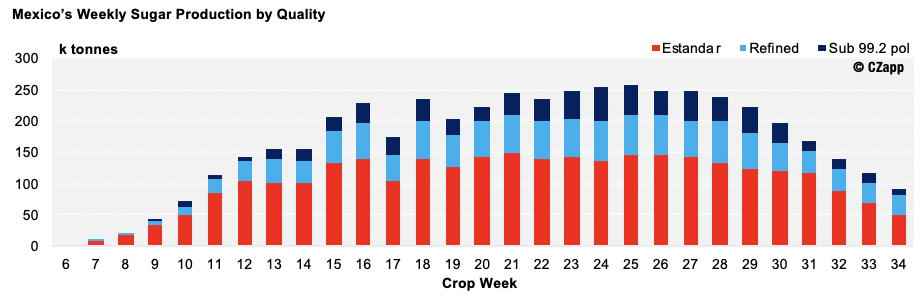

- This comes as a result of the Mexican sugar industry’s significant effort to prioritise exports to the USA, despite having a disappointing crop.

- The sustained production of 99.2 or below polarity sugar exemplifies this, all of which is destined for the USA.

- 700k tonnes of 99.2 sugar has been produced so far.

- On top of this, the US has made further allocations this season for refined and white sugar.

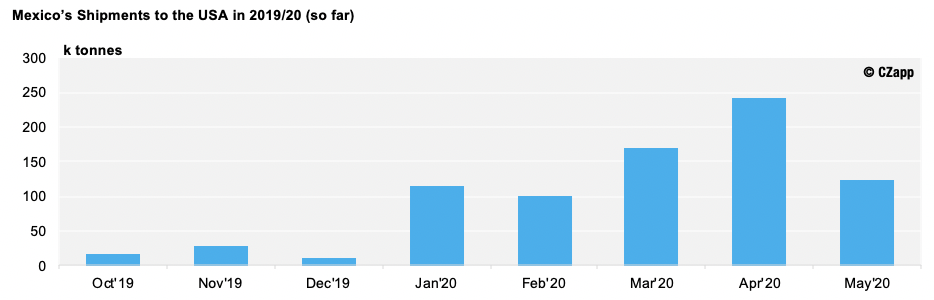

- We have seen 805k tonnes shipped under the quota to date.

- Considering at least 700k tonnes of 99.2 sugar will be shipped, it is reasonable to assume 1.2m tonnes will be shipped overall.

- We expected the consumption estimates to be reduced this month after a prolonged period of restaurant and bar closure due to COVID-19.

- However, 2019/20’s sugar consumption has only fallen by 0.6% so far.

- We may see further decreases in the coming months as the coronavirus’ impact on consumer habits begins to show more.

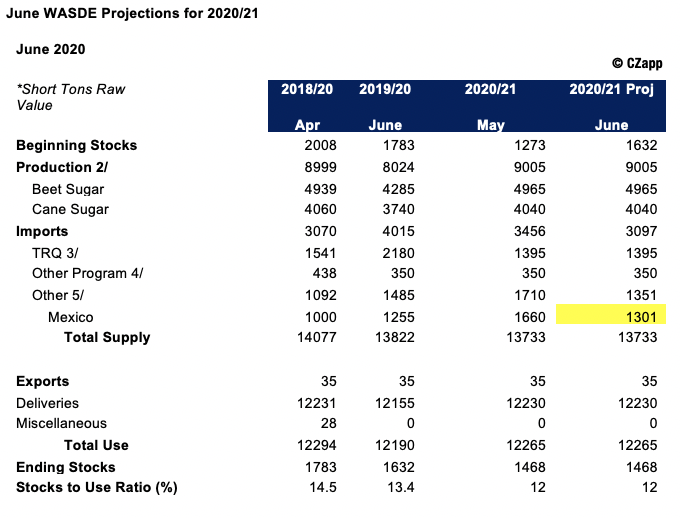

WASDE Projections for 2020/21

- The only change to 2020/21’s forecasts comes as a direct reaction to the higher closing stocks in 2019/20.

- The estimated imports from have been downgraded to 1.3m short tons as stocks will open higher in 20/21.

- However, if consumption remains as it is for next season, there is currently a 200k ton supply shortfall.

- In normal circumstances, this would be allocated to Mexico, pushing their quota to 1.5m tons.

Note: You can keep track of all these figures inside Czapp’s USDA Dashboard.