- No brainer, CS continues to max sugar output.

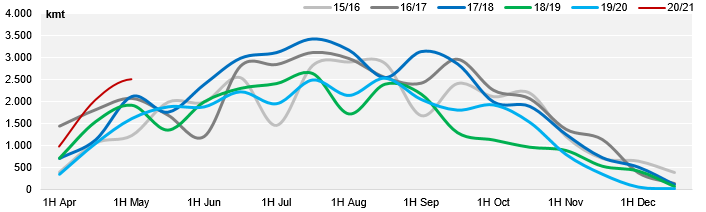

- Record sugar production for 1H of May at 2.5mmt.

- Sugar mix at 47.2% in line with estimates.

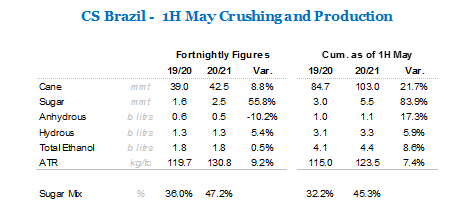

Summary Table 1H May

Record Sugar Output

- Crushing totalled 42.5mmt in the 1H of May – the strongest volume for the period since 2018.

- Despite cloudy weather at the end of the fortnight, no rains were reported in most of CS allowing mills to crush without interruptions.

- Sugar production reached 2.5mmt in the fortnight, a record for the period.

- And although sugar mix was inline with our estimates, the combination of a higher ATR and stronger crush leads us to believe CS sugar production can be closer to 37mmt this season.

CS Brazil Fortnightly Sugar Output – Record 1H of May sugar production

- However, we must remember that weather has been significantly drier which although helps in overall industrial efficiency it does start to raise some flags regarding agricultural productivity.

- Will TCH (ton of cane per hectare) behaviour from now on allow for a cane availability above 600mmt?

- Millers have started to raise the red flag.

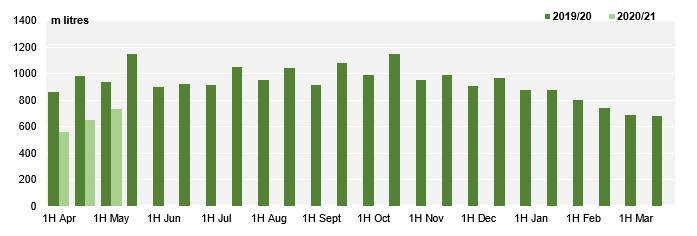

Ethanol Market

- Hydrous sales by the mills reached 730mi litres in the 1H of May.

- Although it is an increase of 12% from the previous fortnight, it is still a drop of 22% yoy.

Fortnightly Hydrous Sales – Sales down 22% YoY

- Demand remains lower due to reduced mobility caused by coronavirus.

- However, we understand that May total figures are likely to post an increase when compared to April since isolation index has been lower, which means more people moving around.

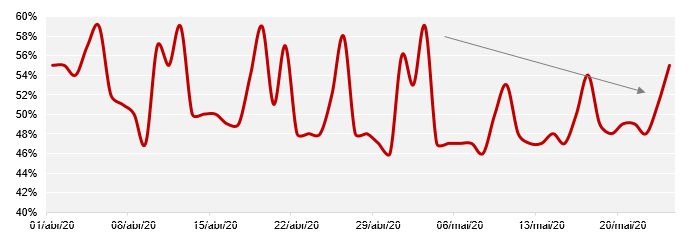

- And hydrous price parity has remained below 65% (SP state).

SP State Isolation Index – Government of SP data