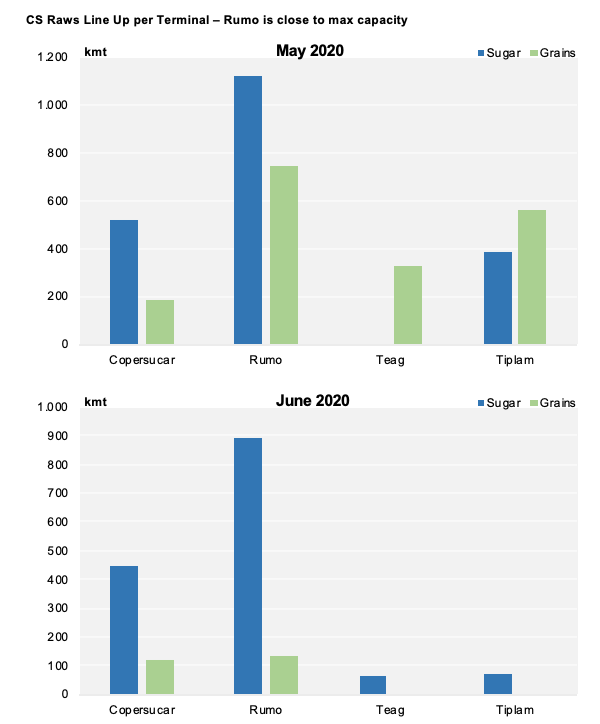

- This week, 1.2mmt were nominated in CS;

- June line up already stands at 1.7mmt;

- Terminals seem to be seeking to accommodate more sugar.

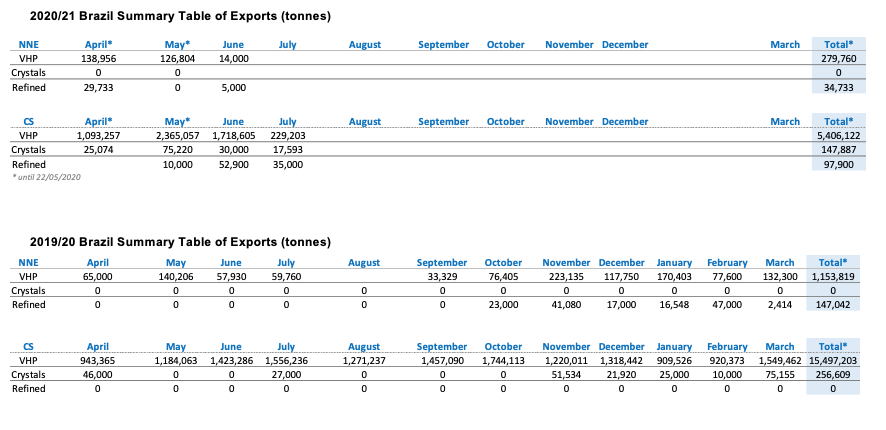

CS Brazil Monthly Exports

- May sugar line up now stands at 2.4mmt, with some terminals now exceeding their capacity.

- We believe that vessels might be diverted to other terminals and part of the volume will end up rolling into June – almost 900kmt need to be shipped in 9 days.

- The nominations made this week have taken the June line up already to 1.7mmt.

- We understand that terminals in both Paranagua and Santos are trying to increase the sugar share, so an increase in capacity for sugar is expected from June onwards.

- However, given the huge volume to be shipped it might not be enough to reduce the logistical pressure over the next month.

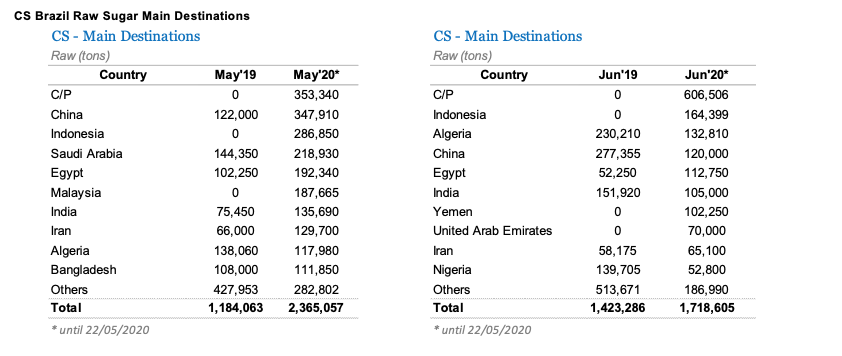

Destinations

- Out of the nominations this week, 250kmt are for China – total Q2 nominations stands at 541kmt.

- One vessel nominated for UAE this week, the first since last November.

- Have a look at our interactive data to see Brazilian top destinations: Global Shipments.

Port Situation: Covid – 19

- Santos is operating normally , despite some news that circulated earlier this week.

- A lockdown in São Paulo state is still under consideration and could have a logistical impact for sugar arriving at Santos.

Summary Table