484 words / 2 minute reading time

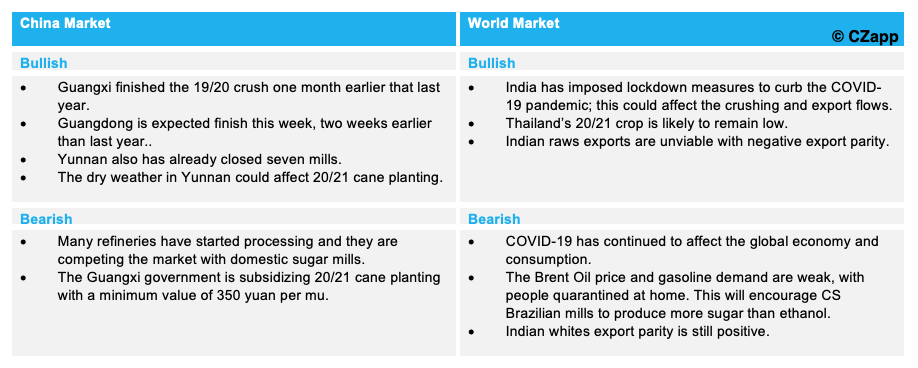

- With the coronavirus now contained in China, the Chinese government is unlocking the country and taking measures to encourage domestic sugar consumption; the pandemic continues to expand outside China and its dark cloud is still over global economy.

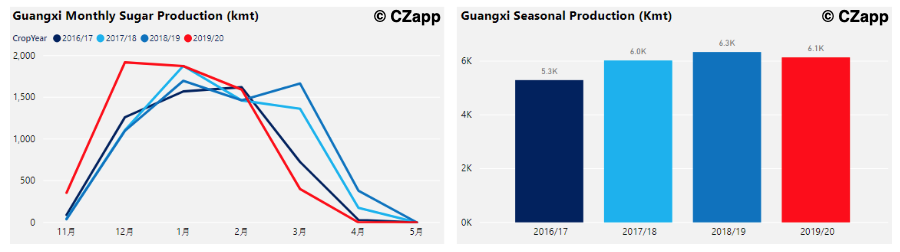

- As of 30th March, Guangxi, China’s top sugar producing region, finished crushing, with a total production estimate of 6-6.1m tonnes; down 300k tonnes year-on-year (YoY).

- With the cane subsidy policy in Guangxi and high beet price in Inner Mongolia, we expect sugar production to grow in 20/21.

Market News

Physical & Futures Prices

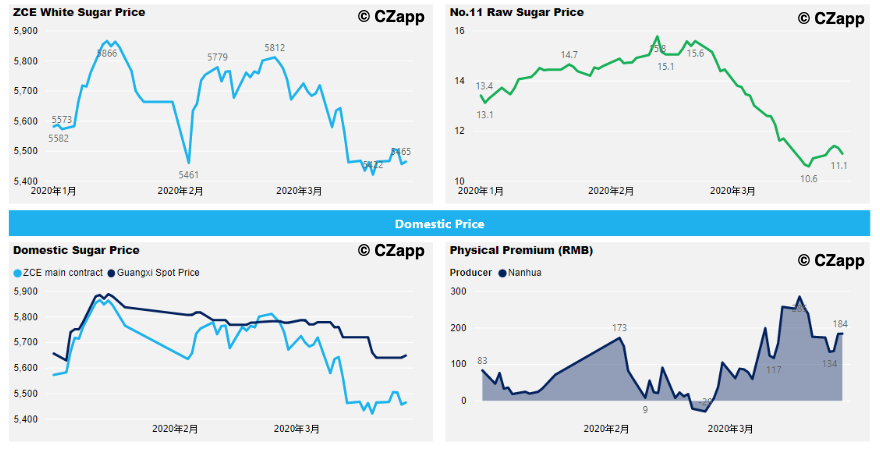

- Last Friday, the No.11 raws settled at 11.1 c/lb, up 1.74% from the previous week.

- The ZCE main contract settled at 5465 yuan/mt; this is the same as the previous week.

- The average price of Guangxi was 5649 yuan/mt, up 9 yuan/mt from the previous week; the physical premium is at 184 yuan/mt.

Guangxi 19/20 Sugar Production & 20/21 Forecast

- Guangxi finished 19/20 crushing on 30th March and the final sugar production could be in range of 6-6.1m tonnes.

- We think 20/21 cane acreage could stay strong and sugar production could recover to above 6.3m tonnes with normal weather.

- So far, the sugar sales in March were not good due to the impact of COVID-19; this means mills may lower prices to make sales.

Imports and Refining

- The main refineries have started operating again and they are mainly processing the Cuban raws which were rotated in Dec’2019.

- The quota and AIL have been issued and we think refineries will start to build up stocks, incentivised by the low prices.

- Sugar could gradually arrive in China from April but they should be customs-cleared after 22ndMay to avoid safeguard duty.

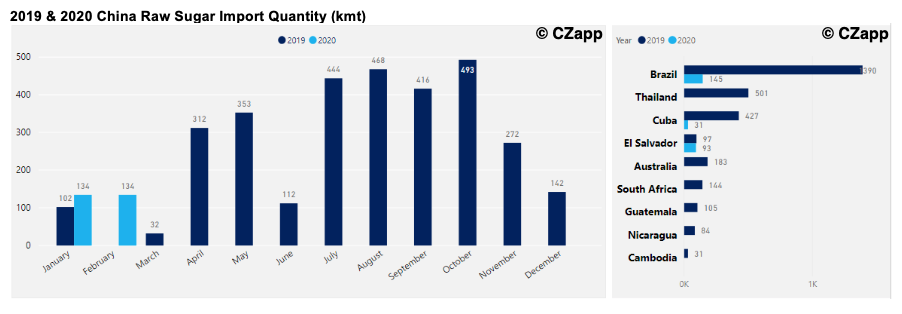

- In January and February 2020, China imported 324k tonnes of sugar with 269k tonnes raws and 55k tonnes of whites.