409 words / 2 minute reading time

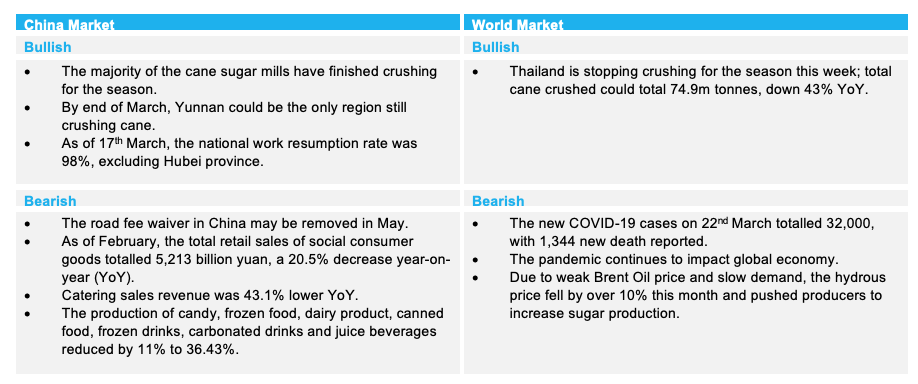

- The turning point of the coronavirus pandemic is yet to arrive and its impact on global economy continues.

- Domestic companies continue to resume work and improve, plus the consumer demand is growing rapidly.

- As we move through March, fresh supply continues to enter domestic market, but the demand is relatively weak.

Market News

Physical & Futures Prices

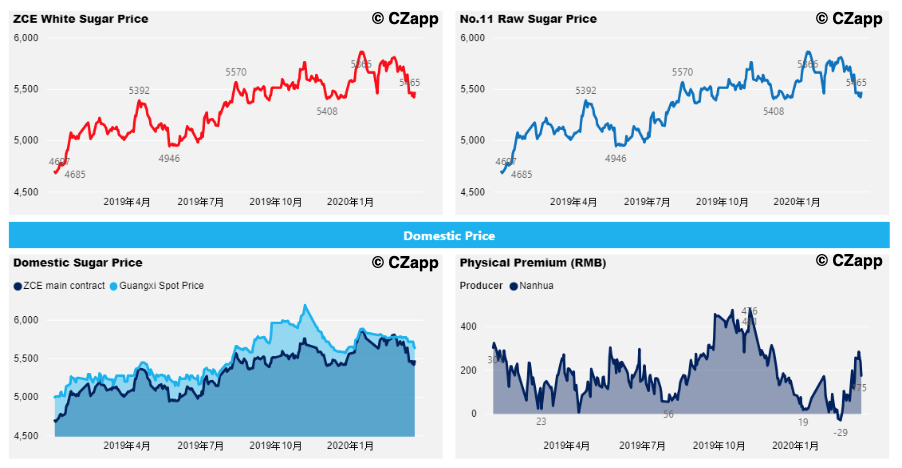

- Last Friday, the No.11 raws price closed at 10.9 c/lb, up 1.87% from the previous day.

- Last Friday, the ZCE main contract closed at 5496 yuan/mt – this is a slight increase of 0.16% from the day before.

- The average price of Guangxi was 5640 yuan/mt, down by 1.4% from the previous week; physical premium at 175 yuan/mt.

Domestic Production & Sales

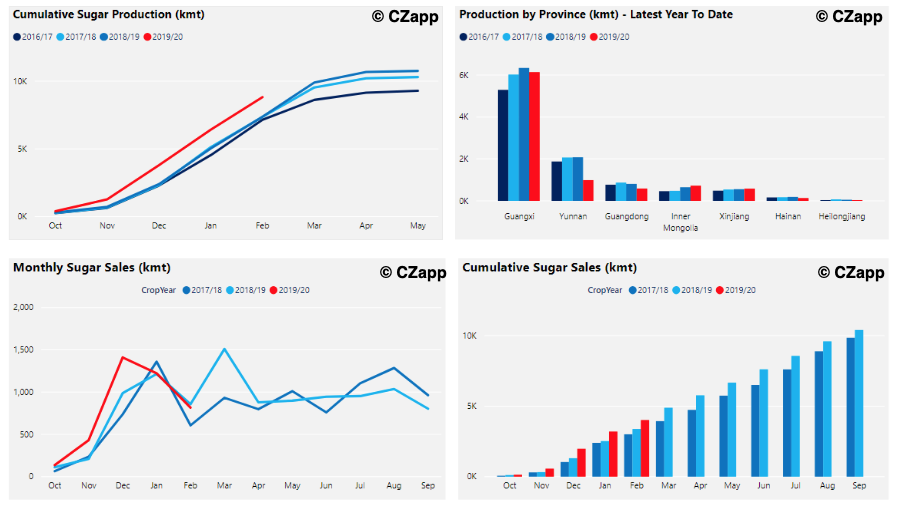

- Hainan has finished cane crushing for the season; Guangxi and Guangdong are also closing in this week.

- Yunnan would be the only region crushing and supplying fresh sugar.

- The pandemic’s impact could show on the March sales data.

Imports and Currency

- Refineries in both Northern and Southern China have starting operations and their supply is increasing.

- We think they are processing the 400k tonnes of Cuban raws carried from 2019 because the new import quota and additional import licences (AIL) have not issued yet.

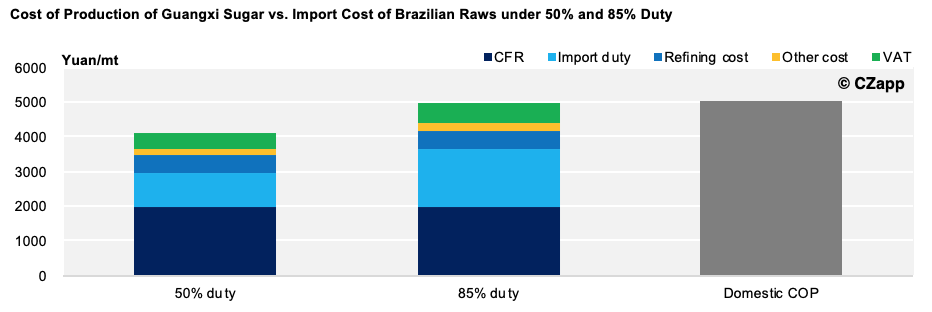

- The current import cost is 4100 and 5000 yuan/mt under 50% and 85% duty respectively.