560 words / 2.5 minute reading time

- The People’s Bank of China (PBOC) announced on Friday it would cut the reserve requirement ratio (RRR) by 50-100 basis points for the banks to support the economy.

- With more and more enterprises resuming work and production, consumption should be restored.

- However, the prices in the production and sales areas are upside down, meaning the end users’ stock is still being digested and new demand has not yet started.

Market News

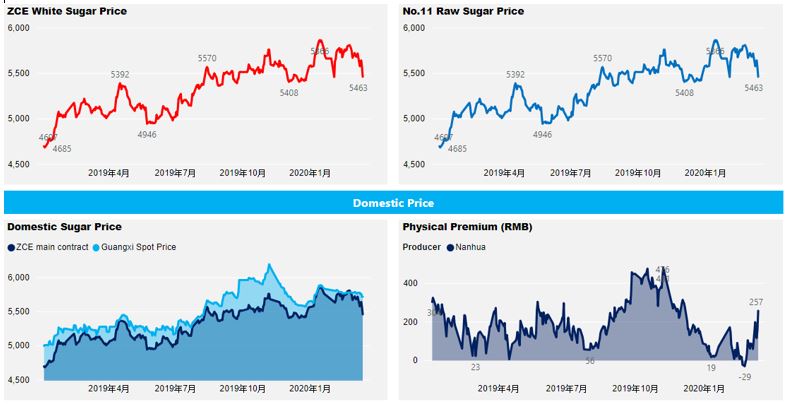

Physical & Futures Prices

- Last Friday, the ZCE main contract closed at 5553 yuan/mt, a slight increase of 5 yuan/mt from the previous day.

- Last Friday, the No.11 raws price surged and then fell back to 11.68 c/lb, down 0.05 c/lb from the previous day.

- And the average price of Guangxi was 5720 yuan/mt, down by 1% from the previous week; physical premium rose to 257 yuan/mt.

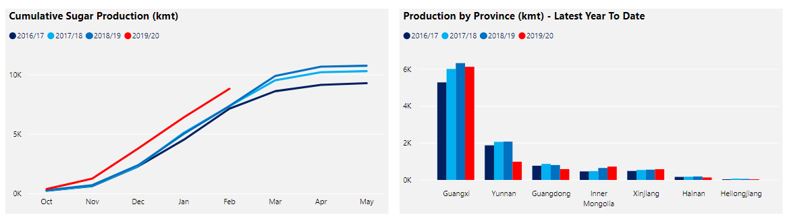

Domestic Production & Sales

- As of 12th March, 65 of the 82 sugar mills in Guangxi have closed down, an increase of 63 mills from the same time last year. Guangxi’s 19/20 crushing is expected to finish by the end of March.

- At present, the beet slicing in northern China has already finished, and the cane crushing in the southern China now focuses on Yunnan, the second largest producing area in China.

- As of the end of February, the sugar production in Yunnan was 990kmt, which was the same as last year; it is important to pay attention to the production progress to see whether it’s in line with the reduction expectation.

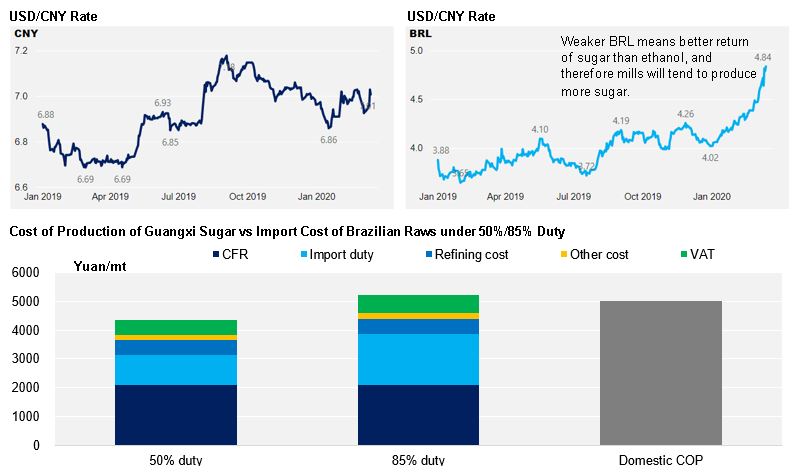

Import and Currency

- Sugar import quotas and AILs for 2020 have not been issued.

- This year’s AIL volume, affected by the epidemic, may be at the bottom of the expected range of 1.5-2m tonnes.

- If released this month, the current lower price of raw sugar may stimulate refineries’ to purchase in advance. However, the actual import is still likely to be after the expiration of the safeguard duty on 22nd May.