547 words / 3.5 minute reading time

- Russia and India are expecting record wheat production in 2020.

- Australia’s low 2019 crop should rebound after an extended period of rainfall.

- The coronavirus, however, continues to depress the wheat markets and causes fears of demand erosion.

Russia and India Expect Record Wheat Crops

- Russia is estimating a record 83-87m tonne wheat crop in 2020, compared to a 73.5m tonne one in 2019 (the previous record is an 86m tonnes crop in 2017).

- India, as previously suggested, is estimating a potential record wheat crop of 106m tonnes as well, compared to their 102m tonne crop in 2019.

- It is still raining in Australia, so we should see a recovery from the poorest wheat crop in 2019 (15.2m tonnes) since 2007 (13.6m tonnes).

The US and EU Have No Such Luck…

- In the US, the Ag Forum at the end of last week estimated the total wheat plantings at 45m acres, down from 45.2m acres for the 2019 harvest. This is the smallest acreage since 1919.

- In Europe, it’s dry in the East and wet in the North.

- Rain and flooding have continued to wreak havoc in the UK and to a slightly lesser degree in France and Germany.

- COCERAL estimate the EU soft wheat crop to be 137.9m tonnes in 2020, down from 145.7m tonnes in 2019.

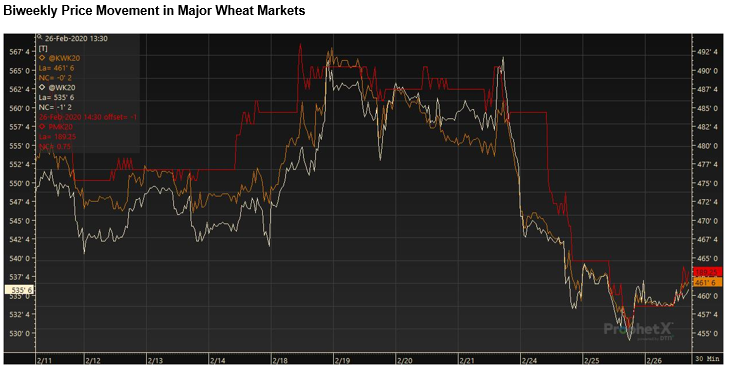

The Coronavirus is Still Weakening the Market

- Last week, we focussed on the Coronavirus and the potential price destruction it could cause, as the global commodity marketsfear a pandemic and demand erosion.

- However, people will continue to eat and need wheat.

- The latest numbers suggest that there are now over 80,000 confirmed cases, with nearly 3,000 deaths and (encouragingly) over 30,000 recoveries thus far.

- The spreads into Italy (the world’s 8th largest economy) and Iran is especially troubling, together with the increasing number of cases in South Korea (the world’s 12th largest economy).

- As with the financial and commodity markets, the wheat market is dropping as we enter uncharted waters.

Source: Refinitiv Eikon

Will the Logistical Issues Caused by the Virus Get Worse?

- People confined to home, not eating out and struggling to get fresh produce would reduce wheat demand.

- Clearly, if it takes hold, the longer it continues, the bigger the impact.

Pests Continue to Batter Wheat Crops

Locusts

- If the current swarms are not controlled adequately, this could turn into a devastating problem for large areas of Africa, the Middle East, as well as India and China.

- Locusts are considered the largest migratory pest in the world; a 1sq km swarm eats the equivalent of 35,000 people.

- A locust will eat its body weight in grain each day and, under the right conditions, the population of the swarm can multiply in numbers some 400 times in less than six months!

Armyworm

- Armyworm are expected to reach the northern parts of China at least a month earlier this year, which could have an impact on the wheat production in China.

Global Trade is Ticking Away

- The usual tenders and business continue, with theEU, Ukraine and the US all maintaining good, if not excellent, export sales and shipments compared to last year.

- Saudi Arabia was the biggest buyer last week and has bought 715,000 tonnes (of optional origin) for delivery between April and June.

- The US exporters remain alert for any indication that the Chinese may start to buy US wheat, in efforts to comply with the ‘Phase One’ Trade Agreement.

So, Where Does This Leave Global Wheat Trade in 2020?

- The coronavirus continues to dominate the headlines and cause market weakness.

- Production for 2020 will keep us guessing as the weather and final acreage numbers are impossible to predict.

- Are you an optimist or a pessimist for the 2020 wheat market? It is going to take a while to finalise which camp is best!