426 words / 2.7 minute reading time

- Sales in the Chinese production areas recovered last week after the Government supported the resumption of work outside Hubei.

- However, sugar consumption is still restricted by the epidemic and may face another downgrade.

- In the first half of the year, the supply source was concentrated in the hands of sugar mills so prices will be largely affected by their production and sales pace.

Market News Update

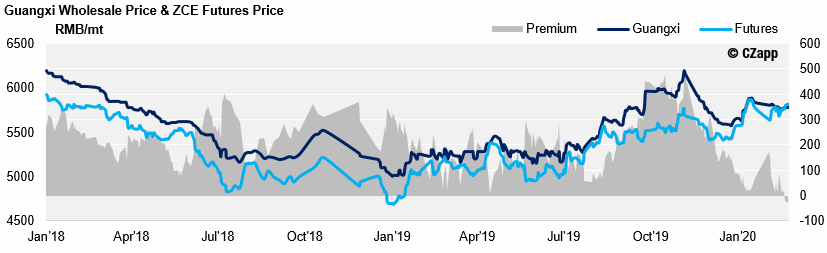

Domestic Sugar Prices

- As of Monday, Guangxi’s spot prices were in range of 5750-5840 yuan/mt, 20 yuan higher than last week; The spot price in Kunming Yunnan was 5770 yuan/mt.

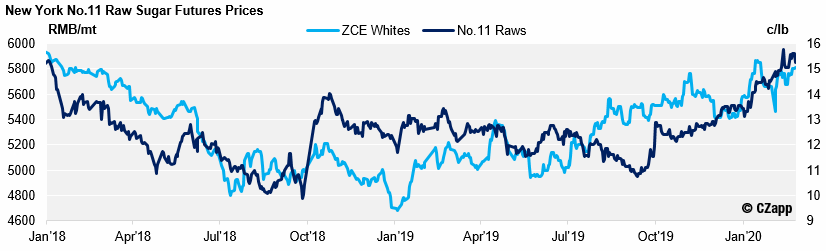

- The No.11 raws price remained strong, above 15 cents. Driven by the raws, the ZCE active contract price went up to 5800 yuan/mt.

- The Guangxi spot premium went down to discount range for the first time since 2018.

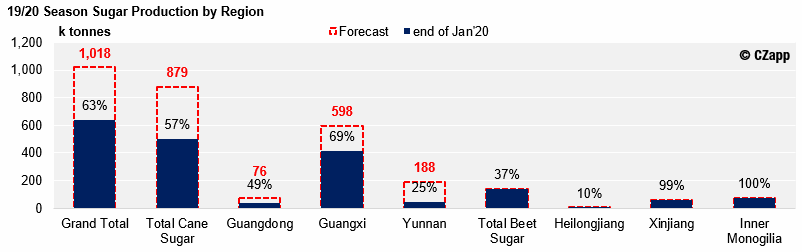

Will 19/20 Production Fell Below 10mmt?

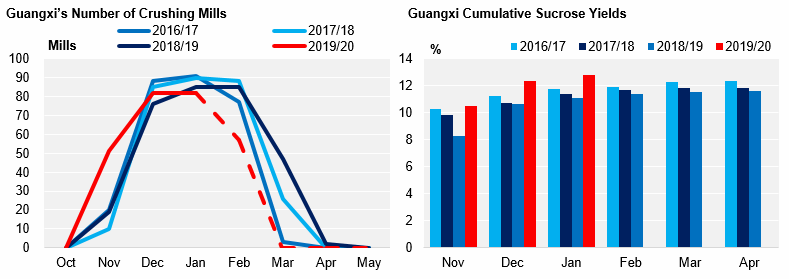

- The sharp advance in Guangxi crushing has raised concerns that the 19/20 sugar output may be below 10m tonnes.

- As of the end of January, beet production had almost completely stopped, and sugarcane harvesting was halfway towards completion.

- Guangxi and Yunnan accounted for 94% of unrealized production.

Will Guangxi Reach 600k tonne forecast?

- Guangxi’s sucrose yield by the end of Jan’20 was 12.81%; this is the highest since the 09/10 season.

- The Chinese Sugar Association estimated Guangxi’s cane production to total 54m tonnes.

- However, the actual volume would be much lower, but the high sucrose yields offset the impact of this.

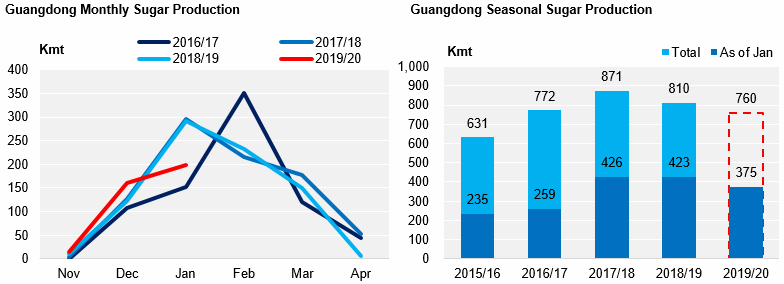

Why Did Guangdong’s Sugar Output Fall In January?

- Guangdong produced 198.6k tonnes of sugar in January, 32% lower than last season’s 291.9k tonnes.

- This is due to the suspension of production during the Spring Festival and the impact of epidemic.

- We are currently maintaining our forecast of 760k tonnes.