423 words / 2.5 minute reading time

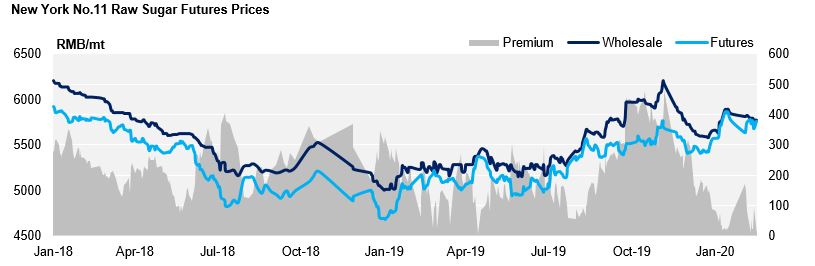

- The local governments are now resuming work in less-infected areas of China, in an attempt to control the epidemic.

- We think that the demand for sugar should recover gradually, and transport should start to resume as normal.

- The sugar mills production and sales data in January was bearish, but February stocks should be higher than they were in the same period last season.

Market News Update

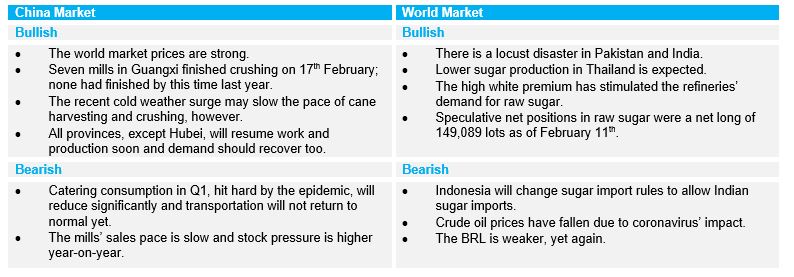

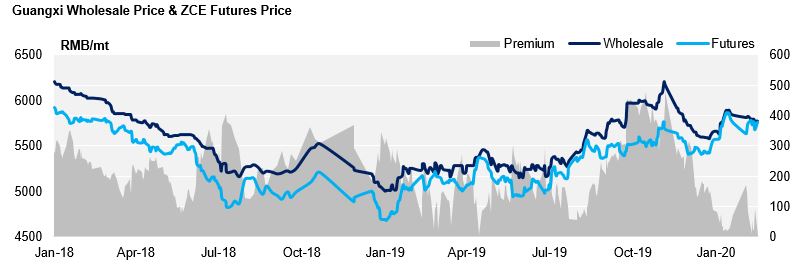

Sugar Prices

- On the physical side, many sugar groups started pricing again.

- Spot prices have been affected and fallen for the second consecutive week.

- As of Monday, the mainstream price range in Guangxi was 5730-5820 yuan/ton, and in Kunming in the Yunnan Province it was at 5750 yuan/ton; Guangxi’s physical premium was close to flat price.

- ZCE sugar futures closed lower at 5,669 yuan/ton on Friday but quickly rebounded to 5,789 yuan/ton on Monday.

- The No.11 fell back last week’s surge, but remained stable above 15 cents.

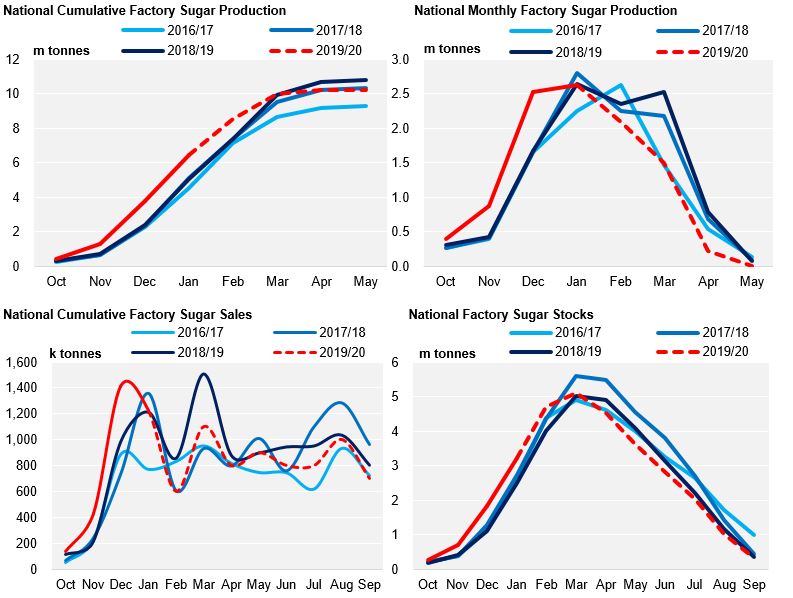

19/20 Mills’ Production & Sales (Jan’20)

- By the end of January, total sugar production for the 19/20 season was 1.4m tonnes higher year-on-year (YoY); total sales were 678k tonnes higher and stocks were 704k tonnes higher YoY.

- We expect the coronavirus’ impact to lower sales performance in February, but then recover in March.

- We also think stocks by the end of February will be much higher than they were this time last season.