450 words / 3 minute reading time

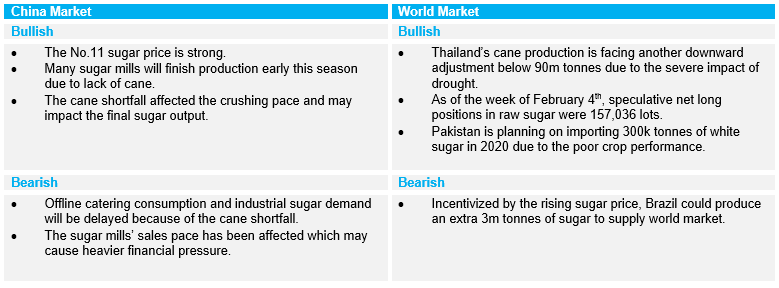

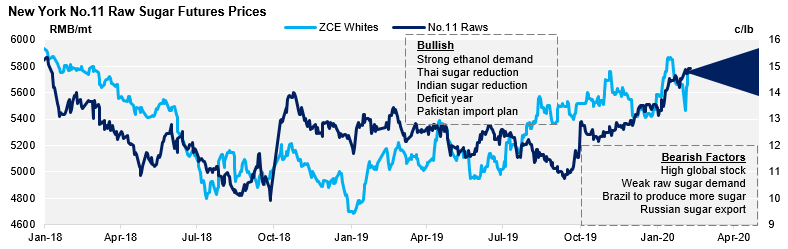

- The ongoing Coronavirus epidemic (2019-nCov) has slowed sugar demand, limited transport, shut down factories and caused offline catering to significantly reduce.

- The 19/20 cane crush has also been poor and sugar production may be lower than expected.

- Pay attention to the Coronavirus’ developments as the production and sales data for January will be released soon.

Market News Update

Sugar Prices

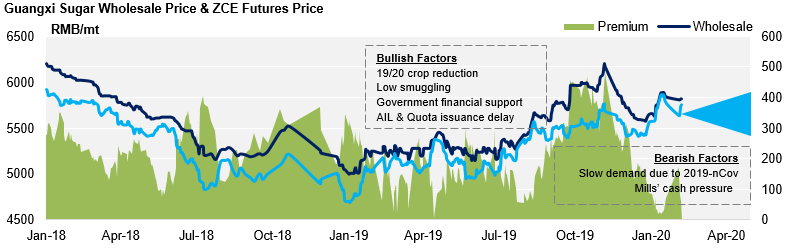

- Some sugar groups have stopped quoting prices because factories have not resumed operations.

- Nanhua Group’s quotation has gone down to 5780-5870 yuan/mt. The physical premium is in the range of 26-116 yuan/mt.

- ZCE futures price quickly rebounded to 5754 yuan/mt after falling 200 points on February 3rd due to the impact of the coronavirus.

Lower 19/20 Sugar Production

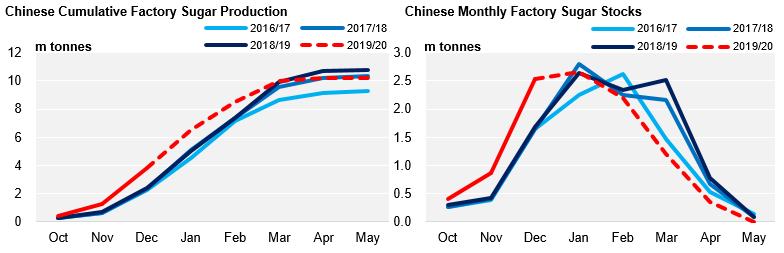

- Current 19/20 sugar production forecast is 10.2mmt, 300kmt lower than CSA’s (China Sugar Association) forecast.

- This is mainly due to the dry weather in 2019, leading to a poor cane performance.

- Guangxi’s sucrose yields by December was much higher than last season’s, which partly offset the lower cane production.

- However, crushing pace could be affected by the epidemic which may lead to a lower sucrose yields and therefore a lower sugar production.

2020 Import Licences Could Be Delayed

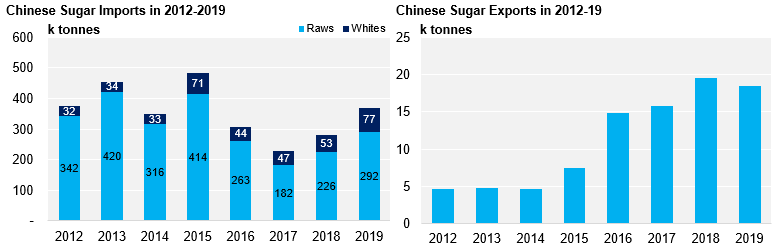

- In December, China imported 142k tonnes of raws and 72.9kmt whites and they exported 21.7k tonnes of white sugar.

- In 2019, 3.7m tonnes of sugar were imported, including 300k tonnes of Pakistani whites; this is a year-on-year increase of 32% (total exports were 185k tonnes).

- We think there is over 800k tonnes of bondedsugar pending 2020 import licences; but this year’s quota and AIL issuance could delay due to coronavirus epidemic impact.