1,176 words / 7 minute reading time

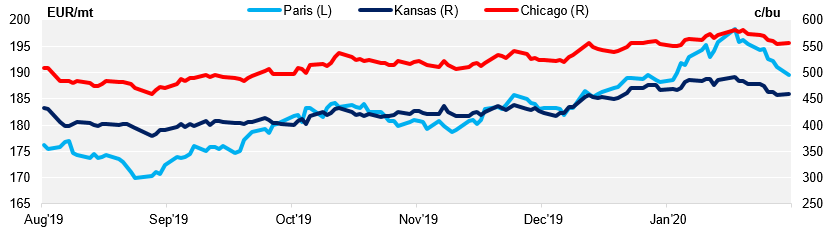

- The wheat market rose during the first two to three weeks of the year.

- It then spiralled downwards over the last 10 days of January, as more headlines concerning the Coronavirus emerged.

- This piece discusses some key events which impacted the global wheat prices last month.

January Price Movement in Key Wheat Markets

Supply, Demand and the January Monthly WASDE

Wheat stocks around the world are falling. They were expected to fall from December’s 289.5m tonnes to 287.3m tonnes in January. In reality, the United States Department of Agriculture (USDA) pegged them only slightly lower at 288m tonnes.

The reduction in the major wheat exporters’ stocks from December’s 33.4m tonnes to January’s 31.6m tonnes was of greater note, however. Compare this to the 2017/18 number of 39.6m tonnes and the exporters are losing more ground than the global stocks might suggest.

A slight increase of feeding in the US didn’t get much in the way of headlines, although it does help reduce the US carryout stocks from 26.5m tonnes to 26.3m tonnes.

So, why are the stocks drawing down? Or more importantly: Is the increased US feeding number the start of a wider increase for feeding livestock, to supply the large growth in global meat exports to China associated with the African swine fever issues? As we have mentioned in the past, the major wheat exporters are also major suppliers of the increased meat exports to China. This could further reduce their wheat stocks in the coming months.

Australia had production problems, with a reduction from 16.1m tonnes to 15.6m tonnes. This is still above other estimates, such as FC Stone’s January figure of 14.5m tonnes. Russian wheat production also lowered from 74.5m tonnes to 73.5m tonnes, which would reinforce the slower exports thus far this season. They also exported less (from 35m tonnes to 34m tonnes), but they were still well above the most recent SovEcon estimate of 32.2m tonnes.

Coronavirus

This new virus outbreak, last week declared a ‘global health emergency’ by the World Health Organisation, has hit all markets hard, with wheat being no exception. There are now more than 17,000 confirmed cases with some 361 deaths recorded thus far. Most of these cases are in China, with only 150 or so cases confirmed in other countries.

The lockdowns imposed on cities such a Wuhan, the extension of the Lunar New Year holidays, together with encouraging people to stay at home and/or work from home in efforts to prevent further spread of the virus, have raised many questions. Will the virus spread, forcing some economic areas into recession? What might be the impact on demand in the wheat markets?

There are also the surrounding logistical complications with the areas in lockdown, with reports of some 300 million chickens currently at risk of starvation due to a lack of feed deliveries. Markets have dropped and the coming weeks and months are uncertain.

We will have to wait and see before we can really estimate the impact, great or small…

US/China ‘Phase One Trade Agreement’

As expected, this was signed and sealed back in mid-January, giving the wheat bulls something to grab hold of…or not?

Anticipation of up to 5 million tonnes of wheat exports from the US to China, most likely hard red winter wheat, to make up some of the tens of billions of US$ worth of agricultural products due to be exported to China over the coming couple of years.

Signed and sealed maybe…but delivered? Not as of yet. There have been reports of China purchasing wheat from Australia and the EU over the last few weeks, and a few 100k tonnes at that! Where this leaves US wheat exports to China, we will have to wait and see…

African Swine Fever

This has taken a little bit of a back seat in terms of wheat market news in January. Nonetheless, we have seen continued and increased outbreaks in Eastern Europe. This is a significant cause for concern in Germany as outbreaks have been found in wild boar just over the border in Poland. A spread into Western Europe is clearly a risk to local production but also the pork exports to China, which have been ramping up over the last few months.

Global Trade

Soft wheat exports from the EU for the season so far reached 15.9m tonnes by 26th January; this is 69% above last year. The latest numbers for Ukraine’s wheat exports this season have reached 15.6m tonnes, 4.2m tonnes above the same time last year as they continue at a good pace.

With Russian price rises and slower exports, the latest Egyptian wheat tender in the last week of January saw a record number of offers, 22 in total, with French wheat offered by Glencore securing all of the 180k tonnes. They were reported to be a significant discount to the Russian and other Black Sea offers.

Global Weather

During January, we finally received some positive news for the drought-stricken Australian farmers; it has rained!

This is due to a shift in the Indian Ocean Dipole and the expected arrival of La Nina weather phenomenon in the Pacific Ocean, there are reports that the rain may continue to fall and give some respite to farmers who have had to endure three years of drought.

Rain and snow are due to fall during the month of February in the Black Earth Central areas of Russia, a key wheat-growing region. This will help replenish moisture, but the snow will also protect the wheat crop from bouts of freezing temperatures and the associated potential winter kill.

Europe has faced weather issues as well, being too try in the East and too wet in the West. The coming months will give us more insight as to the acres and yield potential of the West European wheat crop in particular. In France, there are suggestions that the wet weather will reduce winter plantings by 10%, while in the UK many are suggesting winter wheat plantings 30-40% lower than originally hoped for. Time will tell…

Locusts

Swarms have been devastating crops during January in areas of East Africa and have spread as far as Pakistan. People are reporting disasters and this may lead to more imports around the Indian Ocean.

In Short, January Was a Busy Month for the Wheat Market

- The USDA WASDE report did not offer anything particularly new, but strong exports and reducing global stocks were initially supportive.

- The US/China Phase One Trade Agreement is yet to create the spark to drive things higher.

- The weather is not giving us too much certainty for the growing wheat crop. In fact, it has been causing us a great deal of uncertainty.

- The Coronavirus, as well as the ongoing African swine fever problem, leaves us pushing and pulling at the potential impacts on wheat demand, both now and in the months ahead.

- For now, the markets are on the defensive, although it would appear funds remain long of US wheat.

This all makes February a month to keep us on our toes…