514 words / 3 minute reading time

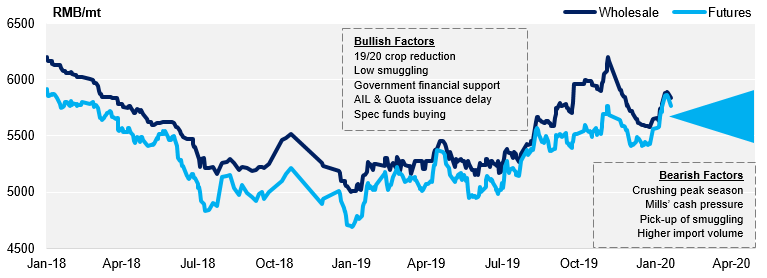

- Domestic sugar prices rose with the raws rally.

- ZCE rushed back down on Monday due to funds taking profits and political news.

- Due to the lower financial pressure of sugar mills, the spot price is relatively firm.

Market News Update

Sugar Prices

- As of this Monday, ZCE sugar’s May contract surged to 5766 yuan/mt, giving up last week’s gain.

- The average EXW price of Guangxi mills has also fallen, but it is still relatively firm.

- The average physical premium this week rose to 72 yuan/mt.

Guangxi Sugar Wholesale Price & ZCE Futures Price

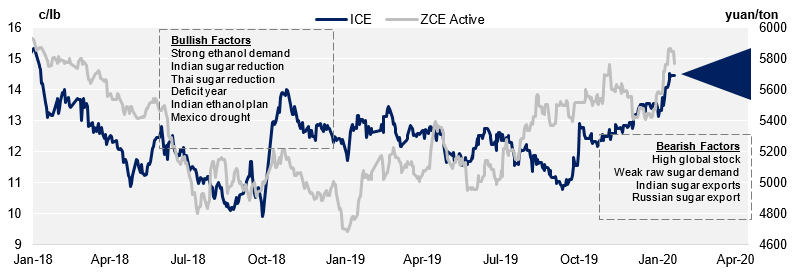

New York No.11 Raw Sugar Futures Prices

Import & Supply

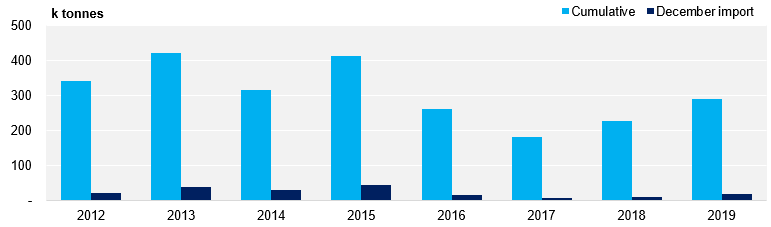

- Sugar imports in December are estimated at about 200-300k tonnes, of which raw sugar is estimated at 150-200k tonnes.

- However, it is estimated that nearly 100,000 tons will enter bonded stocks.

- At present, some refineries have shut down and will restart after Chinese New Year, and the main supply in the first half of the year is still mills’ sugar production.

2019 Chinese Raw Sugar Import

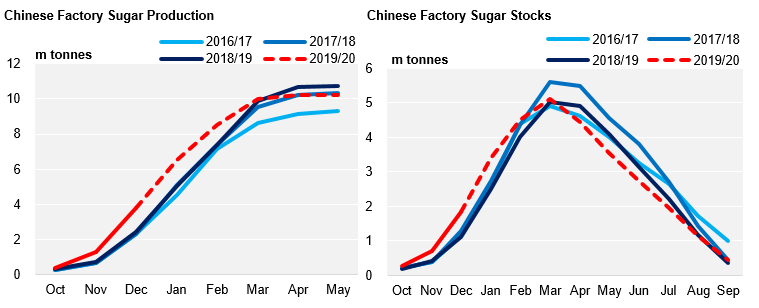

19/20 Crop: Pressure before March

- This week, the production forecast is lowered to 10.2m tonnes, which is about 300k tonnes less than the former estimate.

- This was mainly due to the feedback from Guangxi that sugarcane growth was not good last year and the amount of crushed sugar was reduced.

- It is estimated that the national output and factory stocks will be higher before March and lower after.