484 words / 3 minute reading time

- Since 2014, shipments of Thai raw sugar to Japan have been displaced by flows from Australia.

- This follows a change in Japanese import rules in 2016.

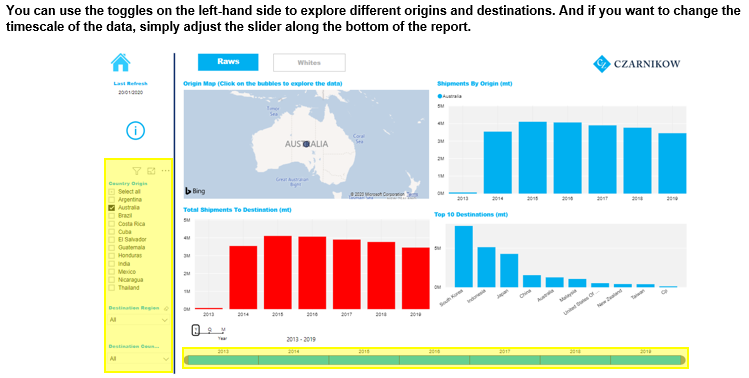

- Take a closer look at our Global Shipments data using Czapp’s Interactive Data section.

Japan Switching to Australia

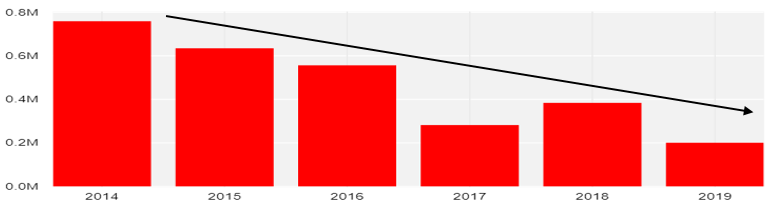

- Shipments of raw sugar from Thailand to Japan have been gradually decreasing.

- In 2014, 760k tonnes wereshipped compared to 200k tonnes in 2019.

- This represents at 75% decline over five years.

Thailand to Japan Raw Shipments

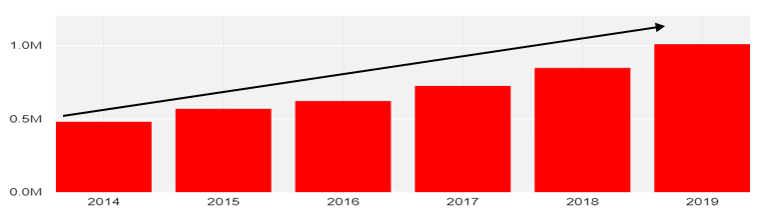

- Meanwhile, flows from Australia to Japan have been increasing each year.

- The flow has more than doubled over the same five-year period.

Australia to Japan Raw Shipments

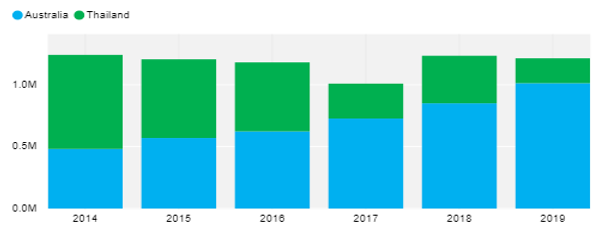

- However, when combining shipments from both origins we can see that imports into Japan have not really changed.

Total Japanese Raw Imports

What Is Driving The Change?

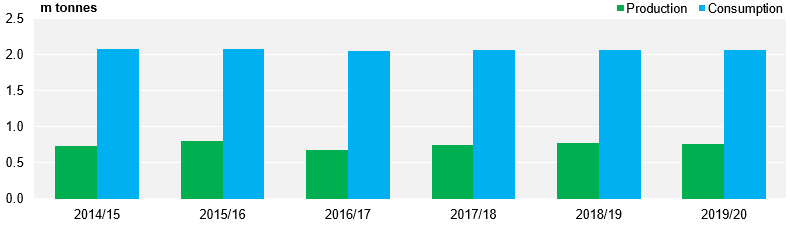

- Japan only produces enough sugar domestically to cover 30% of its yearly demand.

- Production is relatively similar each year whilst total consumption is falling by around 1% per year.

Japanese Production and Consumption Not Changing

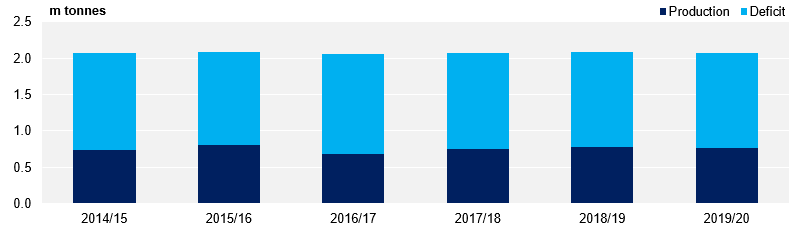

- As such, consumption exceeds domestic production by about 1.3m tonnes each year.

- To fill this deficit, raw sugar for local refining is imported via a quota system.

Japanese Deficit

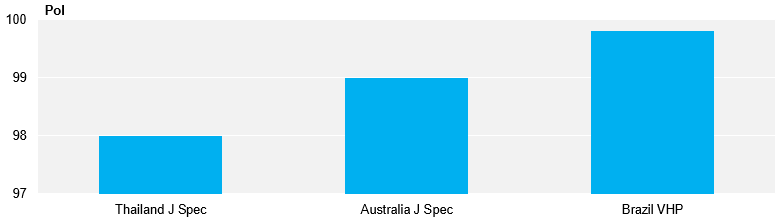

- These imports are subject to a maximum polarisation (quality) to protect the domestic sugar industry.

- Sugar that meets this requirement is often referred to as J-Spec.

- In 2016, the restrictions for Australian (J-Spec) sugar were relaxed following the Japan-Australia Economic Partnership Agreement (EPA) agreement.

Polarisation of Several Qualities of Raw Sugar

- Due to the higher quality of Australian sugar, it is cheaper to refine as fewer impurities need to be removed.

- In addition, Australia has been granted a 1,500 JPY/mt (13.5 USD/mt) duty reduction.

- This means that Australian sugar represents a significant saving over Thais, despite a $7/tonne freight disadvantage.

For Analysis Nerds: More on Polarisation and the Regulations

- All sugar imports to Japan must be maximum of 97.99 pol, other than those from Australia, which since 2016, can have a maximum of 98.99 degrees.

- Polarisation is a measure of the concentration of sugar in a solution and is measured by its effect on the polarisation of light through solution.

- This means that refineries have to allocate more of their import quota per tonne for Australian sugar creating an effective higher duty.

- However, this is offset by the 1,500 JPY/mt (13.5 USD/mt) duty reduction and the reduced refining costs.

- Refining costs are reduced as more sugar can be extracted per tonne of processing. Also, there are fewer impurities so refinery downtime for maintenance is reduced.