479 words / 3 minute reading time

Price Action

Comments:

Grains

Forecast

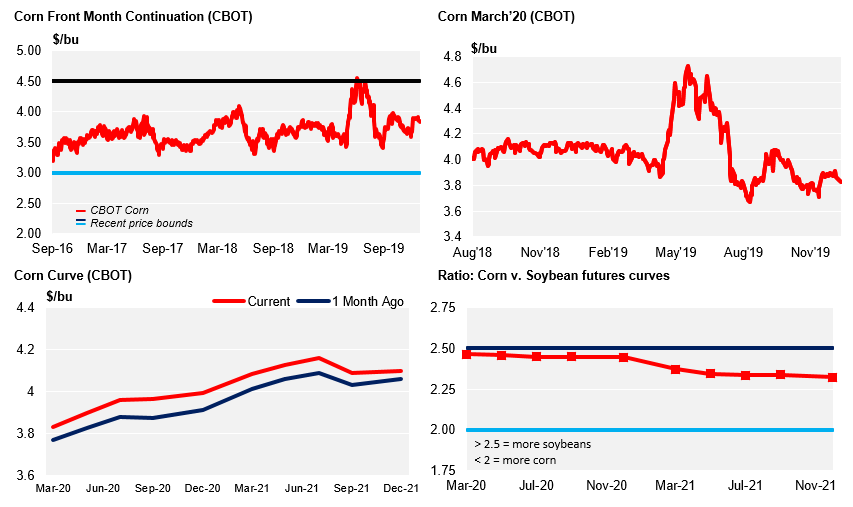

- No changes to our forecast in a range of 3,5 to 4 USD/bu for Chicago Corn in average for the 19/20 crop (Sep/Oct), with a bias closer to 4 USD/bu. The year-to-date (YTD) average is running at 3,772 USD/bu.

Market Commentary

- Chicago Corn closed the week slightly down after having traded lower during the week and with some volatility last Friday after a disappointing WASDE. EU Corn was also almost unchanged week on week and Brazil’s BMF rallied 5,4%.

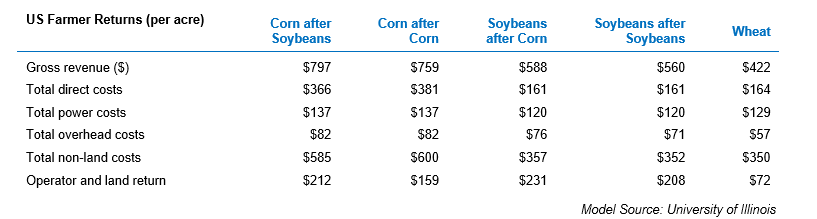

- The January WASDE disappointed as the market was expecting lower ending stocks basically coming from lower production. The yield was expected lower at 166,2 vs. 168 of the WASDE and ending stocks were expected at 1,76 bill bu vs. 1,89 of the WASDE.

- The market fell in a first moment but it did recover all the losses and closed in positive as the USDA said they will resurvey farmers on harvested acres later in the spring, which is pretty much in line with our view that harvested acres will be lower.

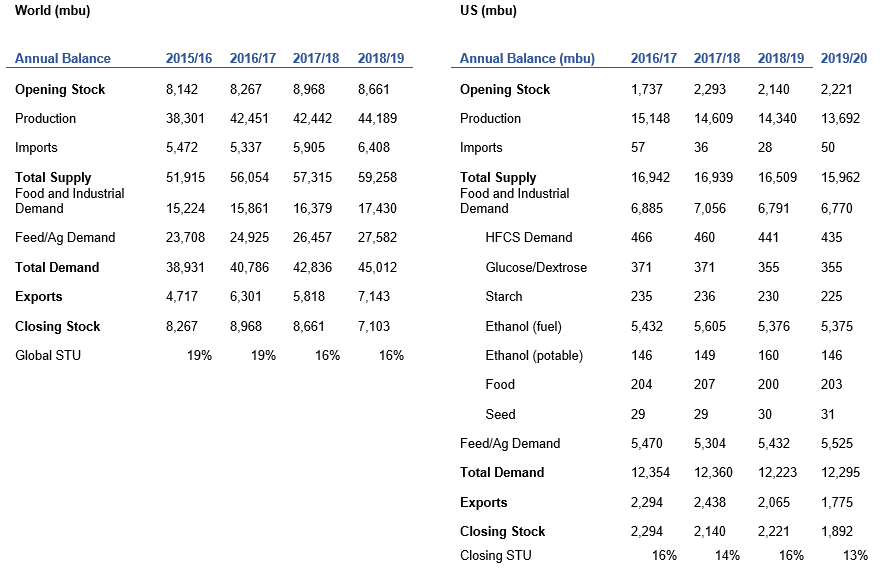

- The WASDE showed very small changes to the Corn forecast leaving stock to use basically unchanged from the December report. Changes were made to the old crop production lowering it by 80 mill bu and also to feed demand, which was down by 185 mill bu, resulting in higher 18/19 ending stocks by 107 mill bu.

- Changes to the 19/20 crop were not significant: acres were reduced by 0,2 mill and 0,3 mill planted and harvested respectively and yield was up by 1 bpa increasing the total supply by 138 mill bu. On the demand side, feed usage was increased by 250 mill bu, food reduced by 20 mill bu and exports reduced by 75 mill bu increasing total demand by 155 mill bu. As a result, ending stocks were reduced by just 17 mill bu vs. the December WASDE.

- Globally, ending stocks were down by 3m tonnes in a combination of higher production but also higher consumption. Only Russia and the EU saw changes in production both increased by 500k tonnes.

- It was basically a neutral report which in reality is kicking the ball forward to the February or maybe March reports to assess or reveal the real impact of the unfavorable weather conditions during planting and harvesting in the US. We continue to think the key will be in harvested acres.

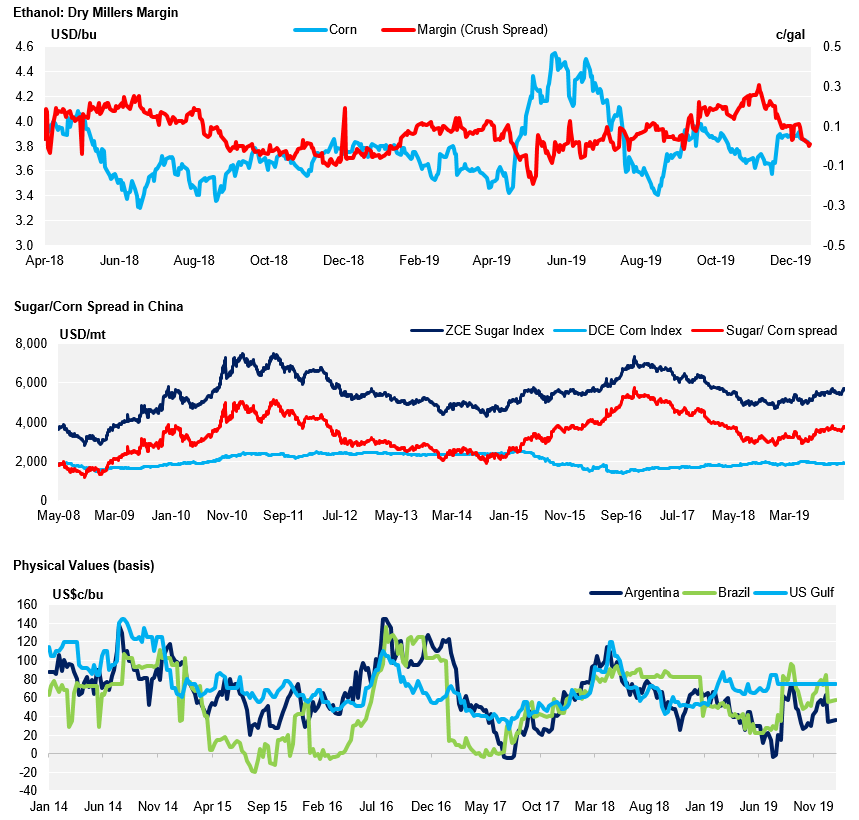

- Corn in Brazil rallied 5,4% week-on-week with farmers holding on to stocks and high demand continuing for local feed and Ethanol production; nothing different than what we have been seeing for a while. It should continue strong.

- Wheat production was unchanged in the US but consumption was increased by 10 mill bu, thus the same impact to ending stocks. Globally, Wheat production was lowered in Australia by 500k tonnes, increased by 500k tonnes in the EU, and reduced by 1m tonnes in Russia.

- Despite the neutral Wheat report, the USDA did forecast the second lowest planting on record for the 20/21 season which is behind the weekly rally we saw both in Chicago and Matif.

Supply

WASDE Projections

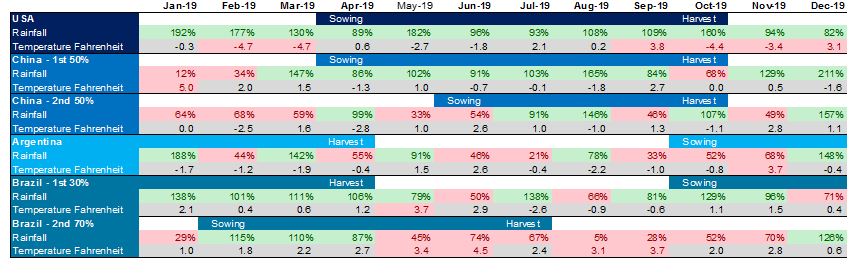

Weather in Main Corn Growing Regions

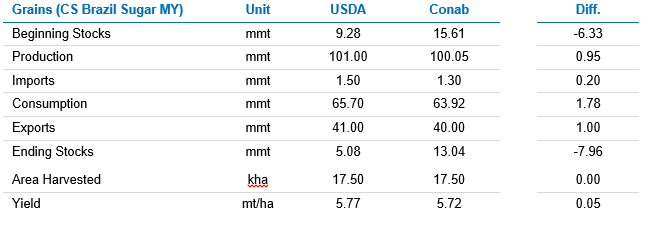

Brazil Balance

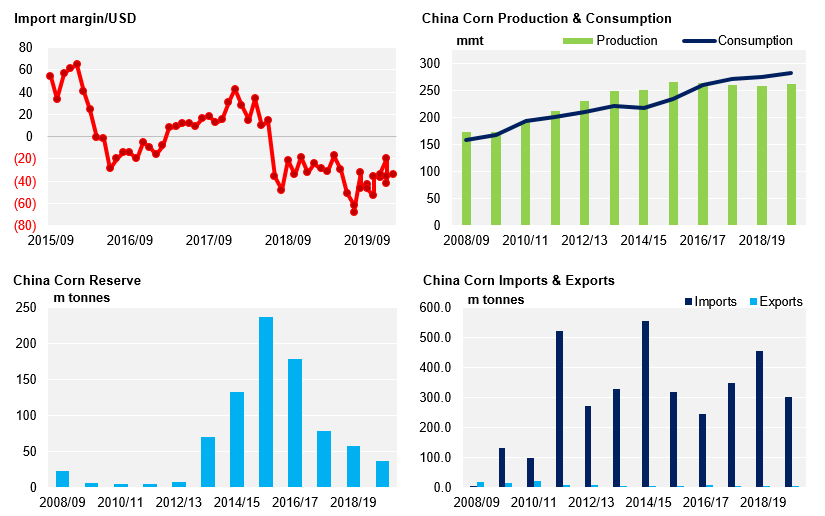

China

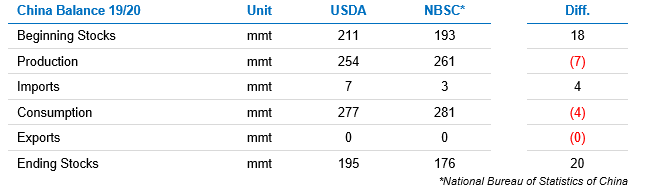

China Balance 19/20

Demand

EU