568 words / 3.5 minute reading time

- Both domestic and global sugar prices have continued to rise and domestic sales are good so far.

- But 19/20 is still a full-wing campaign and the current mills’ stocks are at their highest level since the 12/13 season.

- In addition, the Cuban sugar destocking in January and the pick-up of sugar smuggling further increased short-term supply pressure.

Market News Update

Sugar Prices

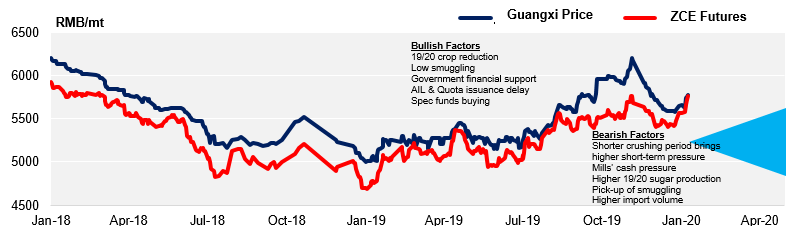

- As of last Friday, the ZCE active contract rose to 5718 yuan/mt, up 188 yuan/mt from the previous week (3.4% increase).

- The price of Guangxi sugar also rose by 124 yuan/mt compared to 5780 yuan/mt, with the physical premium narrowing to within RMB 50.

Guangxi Sugar Wholesale Price & ZCE Futures Price

New York No.11 Raw Sugar Futures Prices

19/20 Crop So Far: More Production, More Sales, Higher Stocks

- The situation of the 19/20 season as of the end of December is summarised in the title of this Opinion. Sugar production increased by 1.4m tonnes YoY, sales volume increased by 670k tonnes, and stocks increased by 730k tonnes.

- We currently maintain the view that 19/20 crushing could finish earlier which would put pressure on short-term market.

- However, it is necessary to pay attention to the current relatively good cane payment situation of Guangxi sugar mills, who also seized the opportunities of recent strength to make more sales and therefore digest the higher stocks.

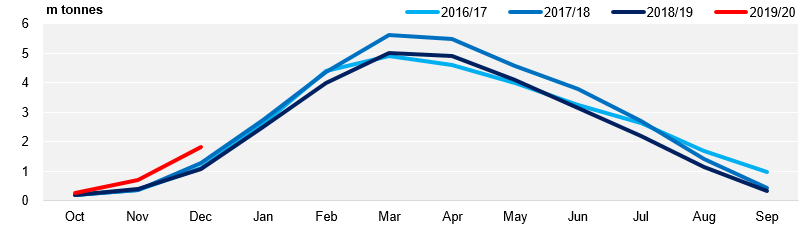

Chinese Cumulative Factory Sugar Stocks

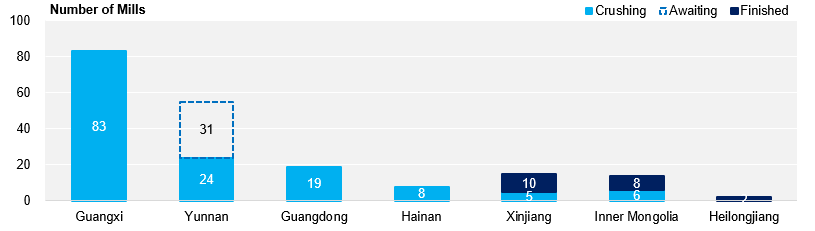

- Up to now, there are 134 sugar mills operating in the four major southern producing areas, up by seven mills from last week’s. And 11 sugar mills in the main northern producing areas, five fewer than last week’s.

The Number of Mills in Operation