566 words / 3.5 minute reading time

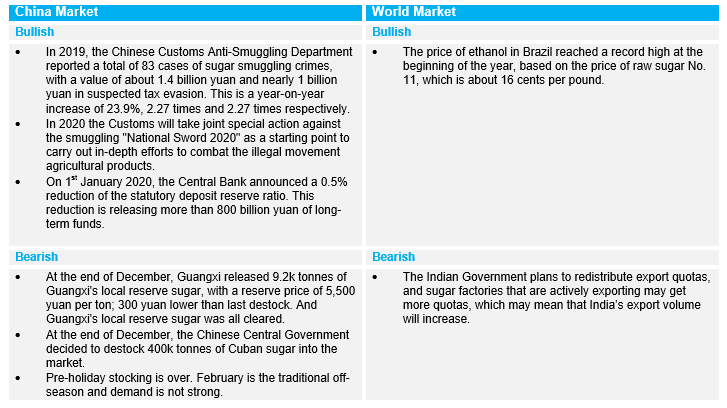

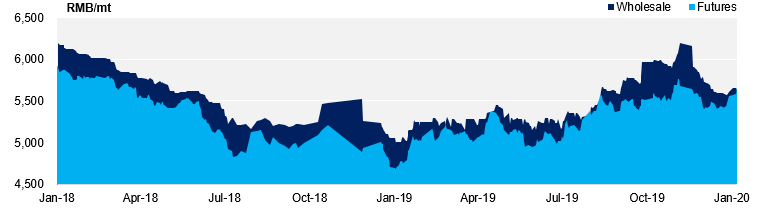

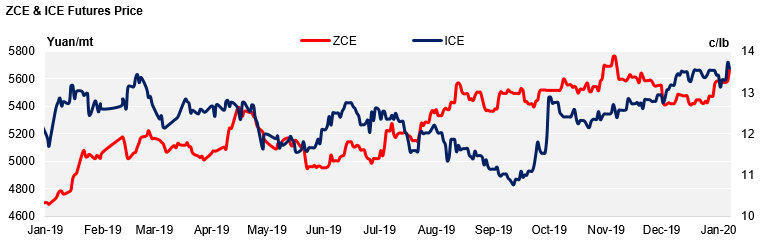

- The spot sugar price fell under the pressure of the new crop supply, and then rose with the increase of the No.11 raws and the position building of local spec funds.

- But looking at the fundamentals, the supply pressure in the next two months cannot be underestimated.

- The reason is that the crushing pace this season has occurred earlier and been more concentrated and the destocking of Cuban raw sugar is topping up the short term supply.

Market News Update

Sugar Price Movement

- Thanks to the general rise in agricultural products, ZCE sugar has rebounded by 100 yuan to 5,664 yuan per tonne so far in 2020. And Guangxi’s wholesale price also rebounded by about 100 yuan per tonne.

- The physical premium has narrowed to within a hundred yuan.

Guangxi Sugar Wholesale Price & ZCE Futures Price

19/20 Season: Early Crushing, Short Term Pressure

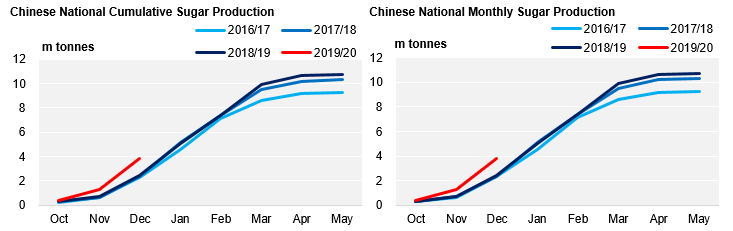

- As of the end of December, Chinese cumulative sugar production was 3.8m tonnes, a year-on-year increase of 58%. Among them, cane sugar production was 2.6m tonnes, which is an increase of 86.7% year-on-year; beet sugar production was 1.2m tonnes, an increase of 20% year-on-year.

- We expect January and February production to remain high and the overall crushing period to be shorter than last season. This means the supply of new crop sugar will enter the sugar market even faster, which is not conducive to spot prices.

- The 19/20 forecast is currently maintained at 10.5m tonnes, down by about 260k tonnes year-on-year.

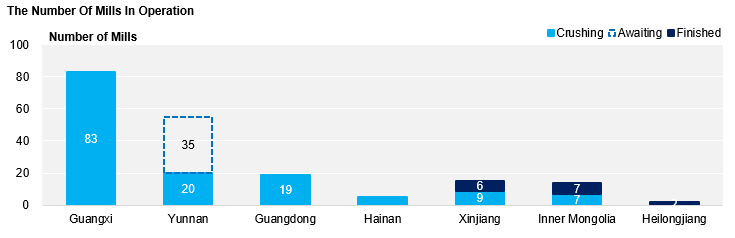

- Up to now, there are 127 sugar mills in the four major producing areas in the south; 16 sugar mills in the main producing areas in the North are still in operation, with 15 having just finished.

- 35 sugar mills in Yunnan that have not yet been crushing will also start soon (this month).