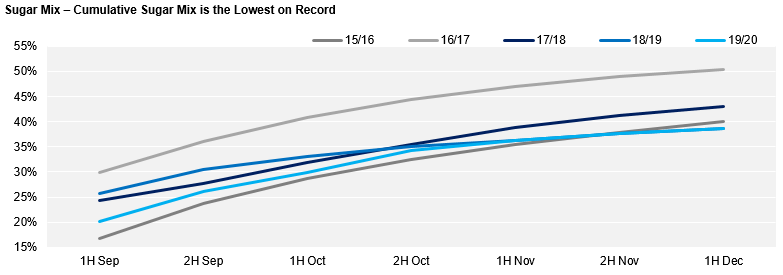

- The 2019/20 season in NNE is 70% done;

- Mills remain focused on ethanol production, similar to last season;

- Total sugar production should be around 2.6mmt – small increase yoy;

272 words / 2 minute reading time

Steady Increase

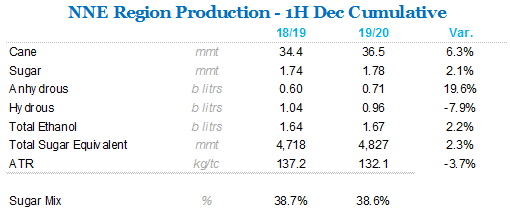

- Crush pace in NNE has remained steady so far in the season, with 36.5mmt of cane processed until the 1H of December;

- This is an increase of 6% when compared to the previous crop;

- With a higher cane availability this season, crush should remain strong for another month;

- Overall, estimates point to a season with over 50mmt of cane crushed – a figure not seen since 2014/15;

Focus on Ethanol

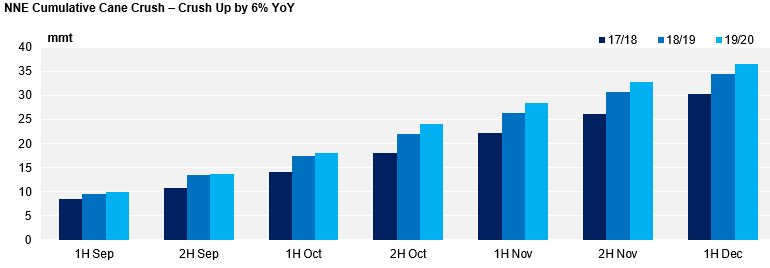

- Cumulative sugar mix until the 1H of December stands at 38.6% – slightly lower than last season;

- Producers in the region continue to focus on ethanol production, as the biofuel remains the highest source of revenue;

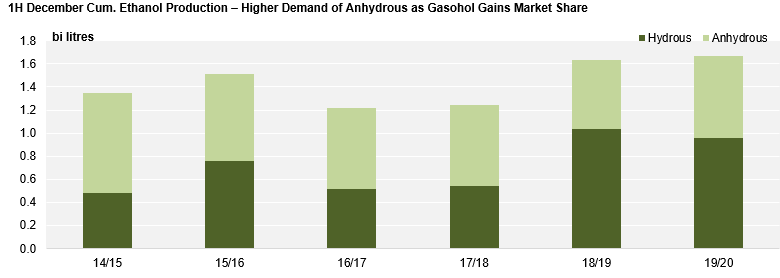

- Fuel demand in NNE has seen a recovery this past year – like the CS region;

- However, while in the CS gasohol demand is down by 2%, the fossil fuel saw a growth of 3% in 2019 in the region;

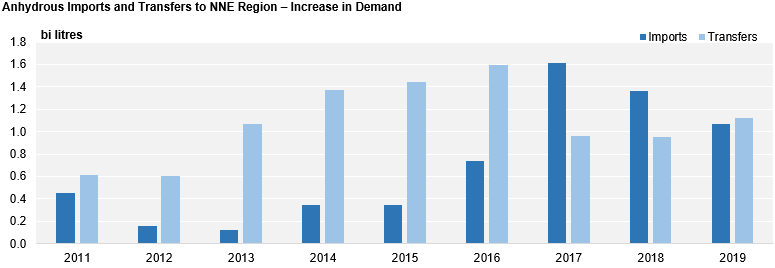

- Since in Brazil an anhydrous ethanol mix of 27% is required in gasoline, the demand for this type of ethanol has increased as well;

- In part, the demand has been supplied by an increase in production in the region;

- While the other is supported via imports and transfers from the CS region;

Crop Summary Table