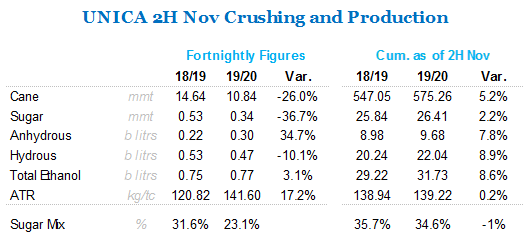

- Cumulative sugar production stands at 26.4mmt – 2.2% higher yoy;

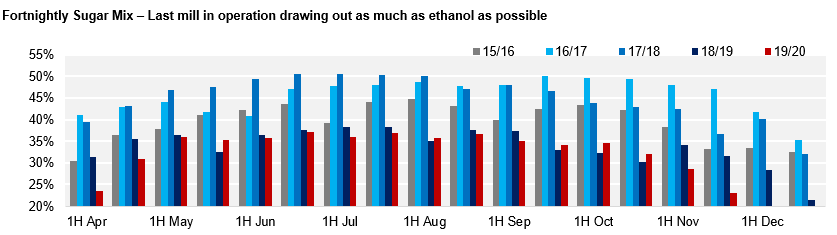

- Mills still in operation are drawing the last crop out of ethanol as possible;

- Record ethanol mix for the fortnight at 23.06%;

Summary Table

This is the end

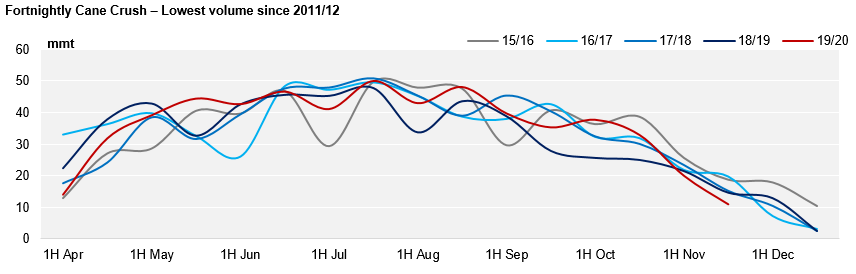

- During the 2H of November, around 27% of CS mills where in operation – vs. 52% last season;

- As a result, crush over the period has been the lowest for the past 9 year with 10.84mmt of cane processed;

- Over the upcoming fortnights more mills will shut down for the crop – according to UNICA, by the end of December only around 6% in CS will still be operational;

- The season in CS is virtually done;

- Despite an unusual high ATR (sugar content) for the period, the mills still in operation were able to draw out as much as possible of ethanol;

- Sugar mix was the lowest since the start of our database (i.e. 1997/98) at 23.06%;

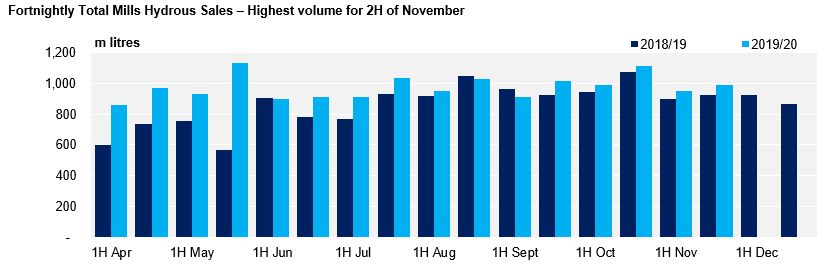

Hydrous Sales

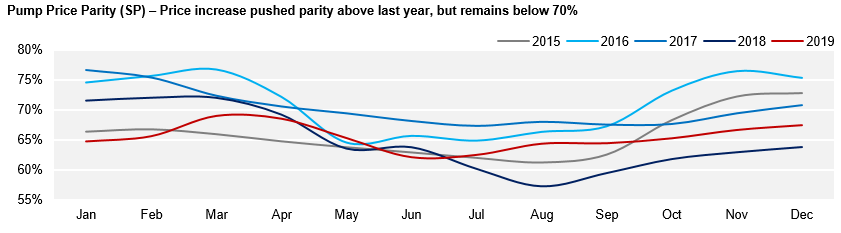

- Hydrous prices have been rising since September, and with it the price parity against gasohol;

- The higher the relation, the less hydrous is competitive against the fossil fuel – changing consumption preferences;

- However, parity is still below 70% and gasohol prices are high – both keep incentivizing hydrous demand;

- Hydrous sales at the 2H of November registered 993mi litres, posting both an increase against the previous fortnight and the year before – and another all-time high;

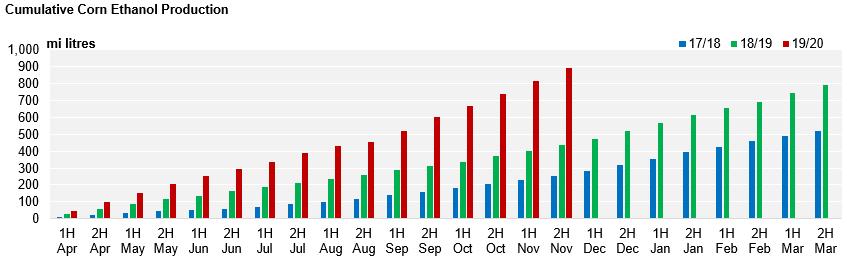

Corn Ethanol Production

- Total corn ethanol production is 104% above yoy at 890mi litres;

- The majority of the output remains focused on hydrous, with 618mi litres of production until the 2H of November;