- As of the end of November, mills’ sugar production will reach 1.08m tonnes, a significant increase of 350kmt year-on-year.

- This is due to the early crushing of Guangxi sugar mills, which means an early supply of new crop sugar and therefore pressure on the physical values.

- We expect end users to build up stocks for Spring Festival in late January which will support the spot values.

Market Hot Topics

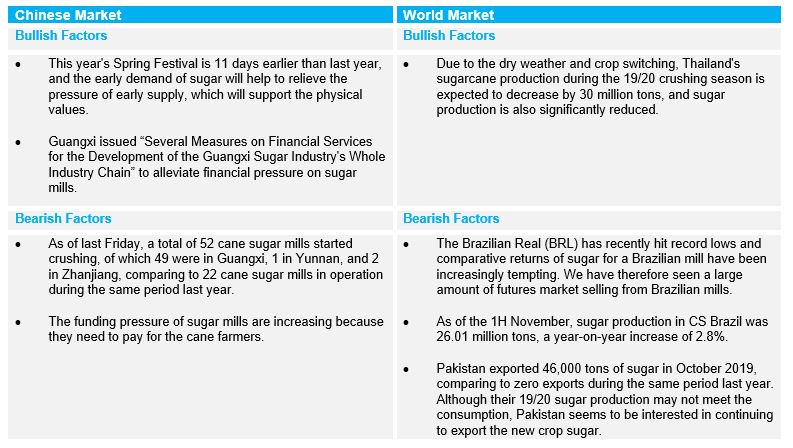

Domestic Physical Values

- This week’s physical values of Guangxi, the top 1 producing area, continued to fall. This is due to the much faster crushing pace of Guangxi sugar mills leading to a larger and earlier supply of new crop sugar.

- The spot premium is in line with last week’s assessment and fell back to the level of 250 yuan/mt. There is still room for downside with the full-wing campaign coming.

Guangx Grade One Physcial Prices & Premium Values

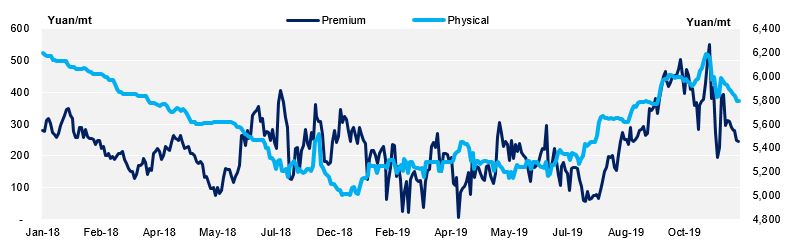

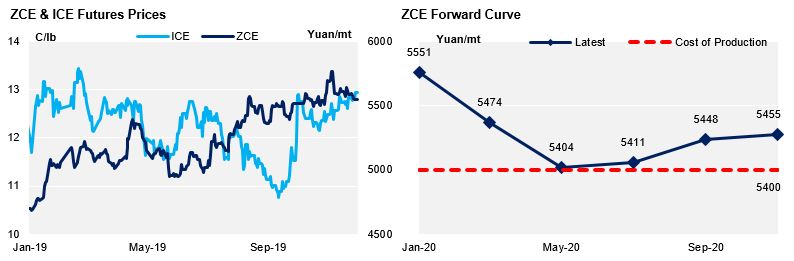

ZCE Futures Price

- ICE raws rebounded to 12.94 c/lb, supported by the widening global supply gap and speculative short positions recovering. But the weakening of the Brazil Real has also stimulated a large amount of futures market selling from Brazilian mills. The ICE raws price has been capped recently.

- The ZCE active sugar price fell by 35 yuan to 5,551 yuan/mt. And the May’20 contract fell by 79 yuan to 5,404 yuan/mt, the cost of production level. The spread between these two contacts expanded to 147 yuan.

19/20 Crushing Progress

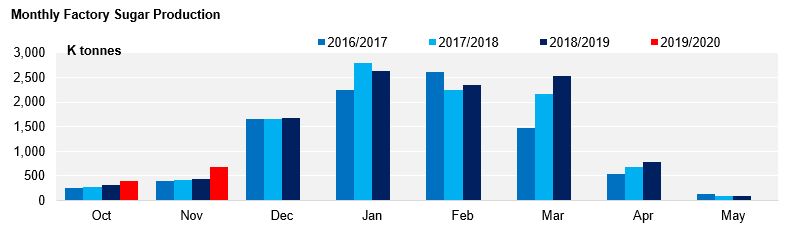

A total of 52 cane sugar mills started operation by end of November, up from 22 in the same period last year. Therefore we estimate the November sugar production to be 680,000 tonnes, and the cumulative output to be 1.08 million tonnes, an increase of 350,000 tonnes year-on-year.

Over half of the harvested beets have been processed. This year’s crushing of beet sugar producing areas (accounting for 12% of total sugar production) was at a faster pace too.

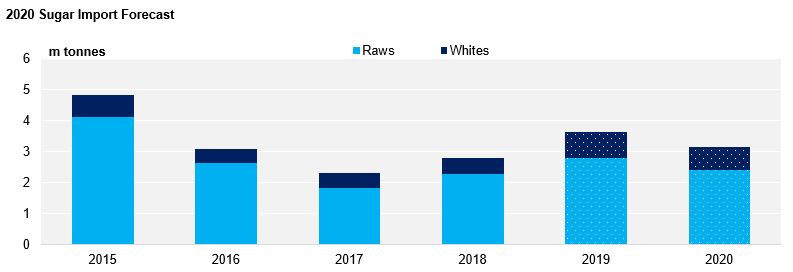

2020 Import Forecast

- We think Chinese government will allocate a larger volume of sugar import quota and AIL in 2020 and the import deal with Pakistan could continue too.

- But we could see a lower shipment volume in 2020 because a decent amount of 2020 demand is advance to 2019. We think over 500,000 tonnes of raw sugar are currently stored in the bonded warehouses pending 2020 clearance.