757 words / 6 minute reading time

- American sugar supply is likely to be below acceptable levels in 2019/20, thanks to this year’s disastrous beet harvest.

- The US Department of Agriculture (USDA) will therefore intervene to ensure there is enough sugar available.

- This will mean increased imports into the USA.

The Rules of the Game

- The USDA has a mandate to ensure sugar stocks at the end of September each year are 13.5% of annual consumption.

- It can use four methods to ensure this occurs, and these are likely to be used in the following order:

- Reallocate unfilled Tariff Rate Quota (TRQ) import volumes to countries with sugar available.

- Increase Mexican quota access.

- Increase the total TRQ Quota amount.

- Introduce an emergency refined sugar quota (last used after Hurricane Katrina).

- For 2019/20, the USDA believes closing stocks will only be 10.5% of consumption, thanks to a disastrous beet crop.

- The supply shortfall currently amounts to around 300k tonnes sugar but could increase as further crop losses are assessed and reported.

- We think resources 1, 2, and 3 are likely to occur to meet the sugar shortfall, while solution 4 will be avoided by allowing the full-duty sugar imports to occur as and when required.

TRQ Reallocation: From Each According to Their Ability

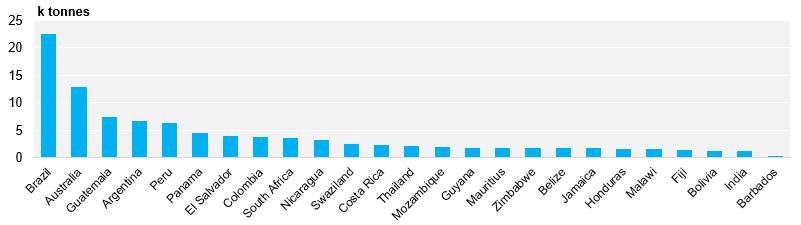

- Each year, the USA imports at least 1.1m tonnes (raw value) of raw sugar from a range of countries as part of a Tariff Rate Quota (TRQ).

- Most countries ship their full quota to America each year because sugar prices in the USA are higher than most other parts of the world.

- However, where a country does not ship, the USDA is able to redistribute their TRQ to other quota holders who have already shipped their allocations.

- This happened on 25th June 2019, when 100k tonnes TRQ were redistributed to the following origins:

2019 TRQ Reallocation

- Five countries have not shipped TRQ in each of the past five years and so we believe are unlikely to ship in 2019/20.

- Other countries such as Malawi and Mauritius very rarely ship and often fall short of the full volume allocated.

- This amounts to a potential TRQ shortfall of 100k tonnes.

- The timing of any reallocation is important.

- 2019’s reallocation was too late to allow all beneficiaries to ship; this could be because the volume reallocated was too small to ship in bulk or the origin no longer had sugar to ship.

- Clearly, the earlier the reallocation the better.

- However, the USDA is expecting a 50k tonne shortfall in TRQ fill, so an early re-allocation would only add 50k tonnes to the supply balance.

Increasing Mexican Access: The Hole in the Wall

- Under the United States-Mexico-Canada Agreement, Mexico gets first refusal on any American sugar quota increase.

- We believe that Mexico will prioritise US exports over any other sugar trade this season because American prices are so attractive.

- However, Mexican supply could also be tight this season.

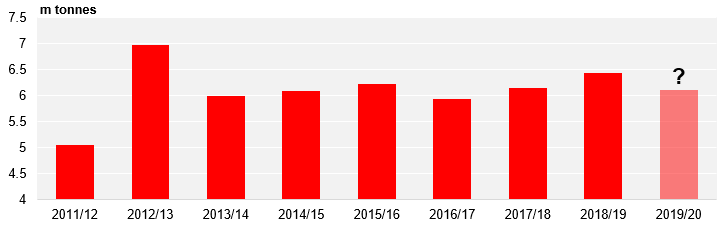

- We expect Mexico to produce 6.1m tonnes of sugar this season, but following dry weather the local cane industry has forecast production at 5.8m tonnes.

Historical Mexican Sugar Production

- Any shortfall in the Mexican crop would limit the volume they would be able to send to the USA.

- We think Mexico could ship an additional 500k tonnes sugar on top of their current 1m tonnes access.

- This would be enough to meet the USDA’s projected supply shortfall.

- However, if Mexico only produces 5.8m tonnes of sugar it would not be able to meet the American shortfall by itself.

Increasing the TRQ: Give Me More

- Once Mexico has declared what volume it can export, the USDA can increase the size of the TRQ.

- The size of the increase is at the discretion of the USDA to achieve the desired 13.5% stocks-to-use ratio.

- This last occurred in July 2017, when the TRQ was increased by 245k tonnes (raw value); the deadline for TRQ shipment arrival was also extended by a month.

- · Occasionally, the USDA also increases the size of the refined sugar TRQ.

Full-Duty Imports: We’ll Pay

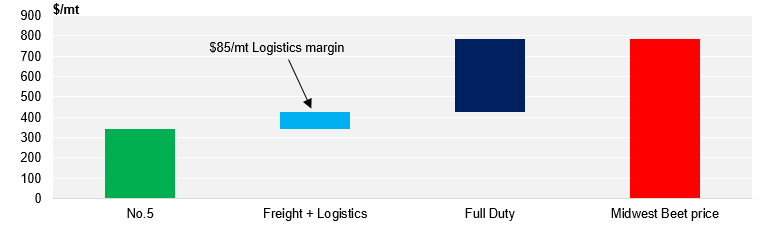

- Full-duty sugar imports into the USA are usually discouraged by the size of the import tariff (15.36c/lb for raws and 16.21c/lb for refined).

- However, if American domestic prices rise far enough, full-duty sugar imports may become workable into some ports.

- If tier 2 (full-duty) imports reach 186k tonnes in a given season, the USDA can reassess whether import duty levels are appropriate.

- Based on current prices, this gives an effective ceiling on the American refined sugar price of around $780/mt.

Full Duty Paid Midwest Refined Beet Parity Model