448 words / 3 minute reading time

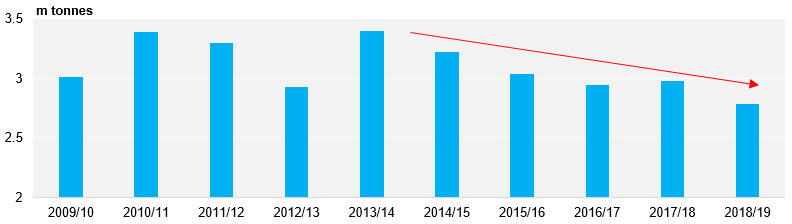

- In 2018/19, the US imported 2.8m tonnes of sugar, the lowest in the last 10 years.

- The US increased Mexican and TRQ allocations in June, but it was too late to secure further volume.

- A larger volume could be needed this year as there are fears over US production of beet.

US Imports This Season

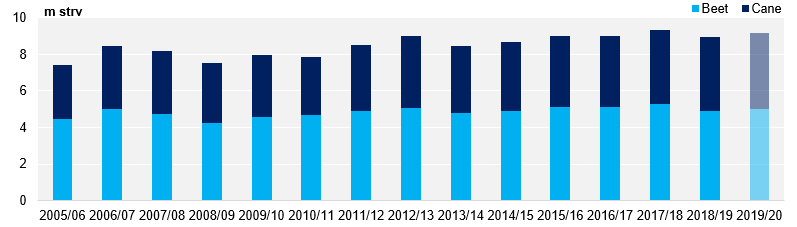

- Total US sugar imports have been steadily declining since 2013/14.

Total US Imports

- This is due to the increasing production of sugar from beet across the northern states.

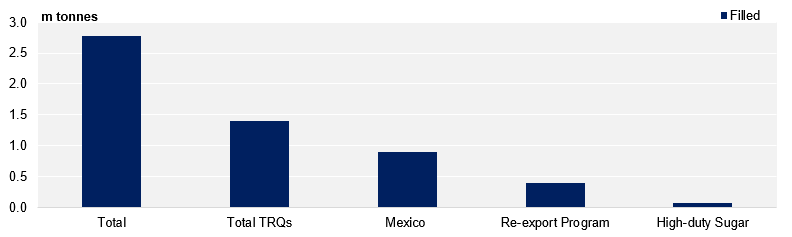

- The USDA are able to control the volumes that are imported by adjusting imports from Mexico, while Tarif Rate Quota (TRQ) imports have a minimum volume of 1.17m tonnes, but can be increased if necessary.

- This season, 50% of all imports came from the TRQ program and 35% came from the Mexican import programme.

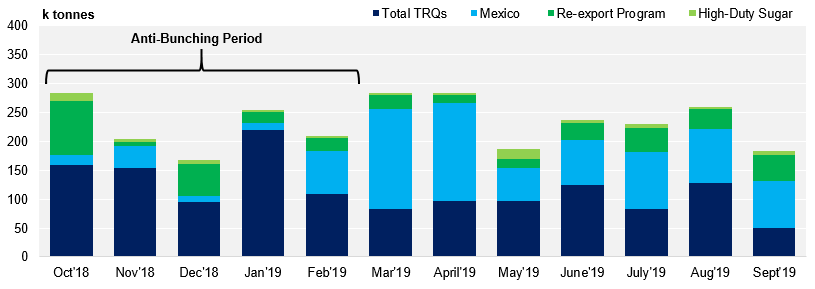

- More quota volume was allocated to Mexico and TRQ-holders in June, but it was too late to secure all the further volume.

- The Anti-Bunching agreement in place with Mexico has limited the amount of sugar Mexico can export to the US before March.

- This means that refiners are dependent on TRQ sugars in this period before Mexican sugar can substantively cross the border.

US Imports Summary

- During this period, US refiners will import from the major producers that hold TRQs, as they are more likely to have sugar in stock.

- Brazil, Australia, Argentina, Guatemala, El Salvador, Nicaragua, and South Africa combined for 490k between Oct and March.

- In total, 60% of the TRQ volume entered in the first five months of the cycle.

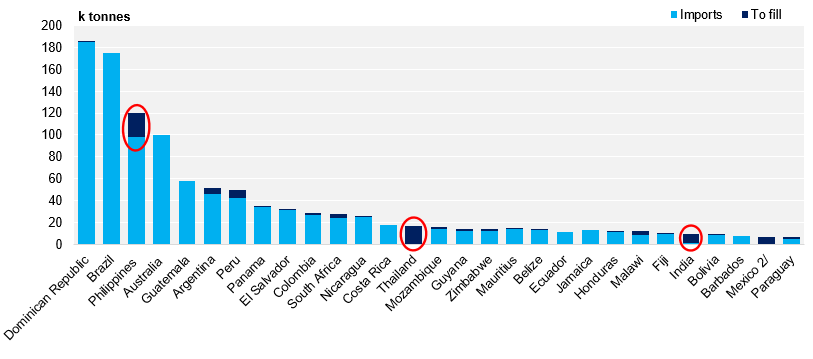

- However, a total of 92k tonnes were not filled this season, even after quotas were reallocated in June.

US TRQ Fill Rate

- The Philippines were expected to fall behind the fill rate due to complaints from the farmers, as the domestic price is higher than the US price.

- It is surprising to see India did fill their TRQ last season as with the export subsidy, exports should have been profitable for them. It was filled in the 2017/18 season.

- Overall, the shortfall of 92k is not overly significant as the USDA always expects some volume to remain unfilled.

- This coming season we may see an increase in allocations if the beet crop struggles to perform due to early cold weather.

US Historical Sugar Production

- A smaller beet crop would mean the USDA would need to allow more TRQ and Mexican sugars to maintain stocks at acceptable levels.

- The WASDE release next week should give us a clearer picture on the current beet forecasts.

- Ideally, this would happen mid-way though in April or May before stocks become too tight and so producers can organise shipments in time.