388 words / 2.5 minute read

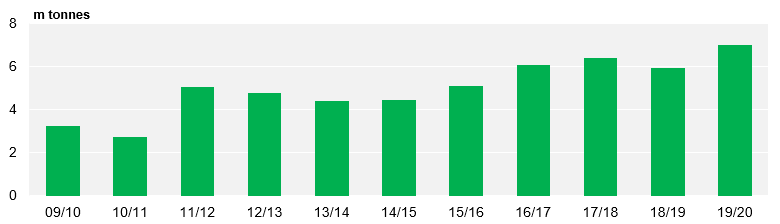

- Russian production is on track to be at least 7m tonnes, which is 10% above the previous record.

- There will be a substantial production surplus within Russia of at least 1.1m tonnes.

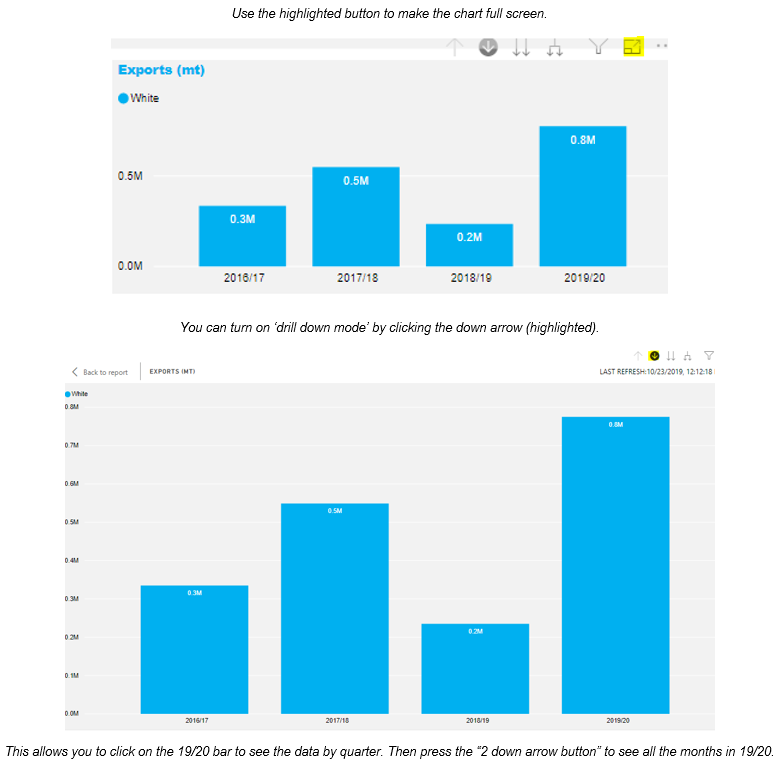

- Russia will become a significant whites exporter, from being a large scale importer just three years ago.

Large Production Surplus – Export Pace Increasing

- As we have highlighted before, Russia will have the availability to export a significant volume of white sugar over the next year.

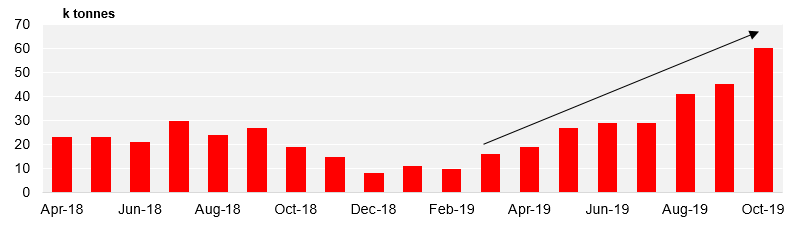

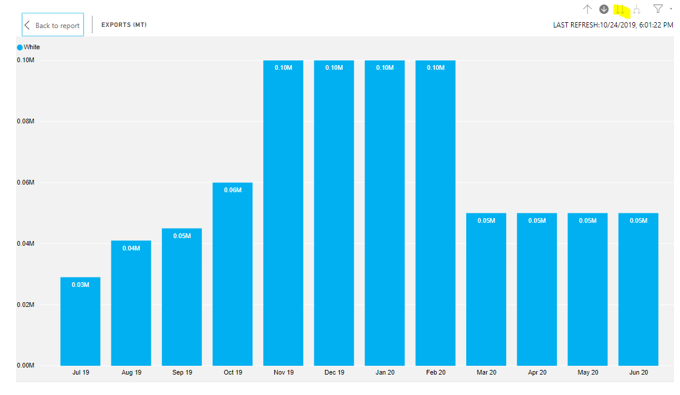

- The monthly export pace in Russia has started to increase with monthly exports of over 50k tonnes per month.

Russian Export Pace Increasing

- However, we think that due to logistics Russia will struggle to export more than 800k tonnes.

- Inland railway freight is slow and expensive whilst ports lack the infrastructure to efficiently handle large shipments.

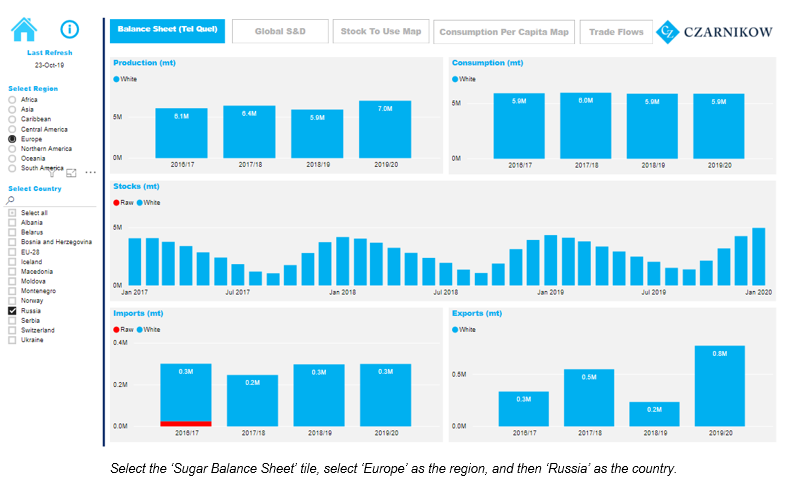

- See how this compares to previous years and the impact on stocks via our new interactive data section on Czapp.

- We now forecast Russia will produce 7m tonnes of sugar during the 19/20 campaign, 1.1m tonnes above consumption.

- This is 0.6m tonnes higher than our previous forecast and a record for Russia by over 10%.

Russian Production Setting New High

- As of mid-October, production has crossed 3m tonnes, 0.3m tonnes more than last year (10%).

- Yet the harvested area to date is 12% below at the same time in 2018.

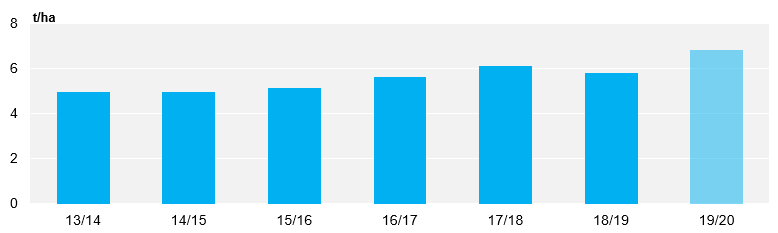

- This is because the average beet yield (44.3 t/ha) is 25% higher than the last season.

- However, we estimate that sugar yields will only increase by 18% compared to 2018.

- This is because sugar content was below average during the beet testing.

Sugar Yield Also a Record

Why Have Beet Yields Been Better Than Expected?

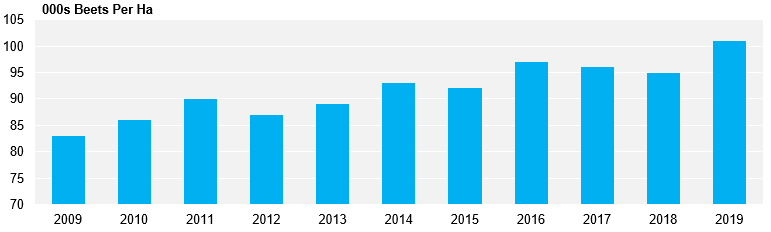

- One factor that led to the increase in beet yield was that beet plantings per ha increased by 6%.

Russian Beet Population

- The weather and soil has been slightly drier than usual, which has been perfect for harvesting conditions.

- However, it was not so dry that the beet’s growth was impacted that poorly.

- We think that there has been significant investment in harvesting and processing in an effort to increase yields and reduce costs to make Russia more competitive in the world market.