- The beet crop is starting in the US; the crop performance will impact Mexican export volumes.

- Stagnating consumption levels and the TRQ import fill rates are other factors that can impact market dynamics.

- In the US, a smaller crop and a demand exceeding expectations would help reduce the world market surplus.

What Should We Look Out For?

- The monthly WASDE release sets out some key indicators for the US sugar balance sheet and supply needs.

- The report aims to manipulate production, consumption and most importantly imports, so that the domestic stocks remain at 13.5%.

- This means that certain key indicators can give us some warning as to what may happen in the next year.

Domestic Crop Progress

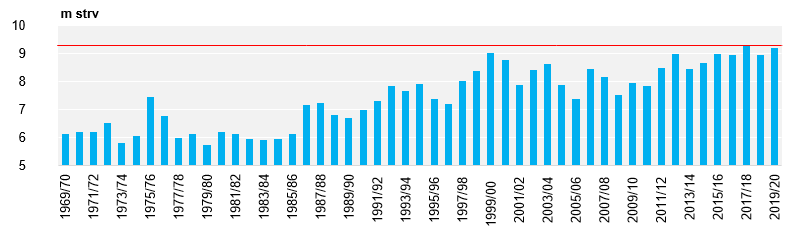

- The early WASDE crop forecasts expected a record crop, due to good cane condition and increasing beet plantings.

- However, they have now reduced these expectations due to poor beet yields at the start of the crop.

- The early forecast of 9.3m strv has now been revised to 9.18m strv (Short Tonnes Raw Value).

US Historical Sugar Production

- Poor beet yields may be a lasting effect of the May floods that delayed planting in the Midwest.

- Early snow conditions across the northern USA could also impact beet condition as it is harvested.

Changes in Consumption

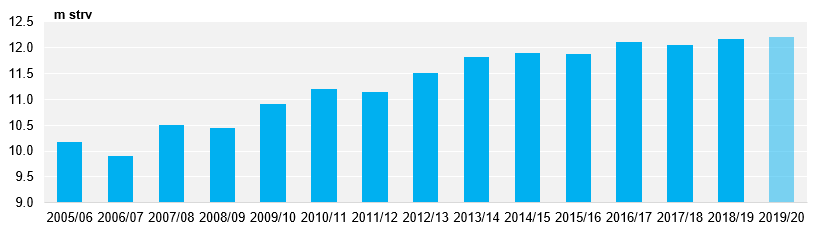

- US consumption levels may also be an important factor this season.

- After a continually strong increase since 2006, consumption has been stagnant and the forecasts conservative.

- If the USDA were to adjust consumption upwards in 2019 or 2020, more imports would be needed to balance stocks due to the increased demand.

US Consumption

- Conversely, if their projections are still deemed to be unrealistic, less sugar will be needed in the market and imports will be revised down.

And What Could It Change?

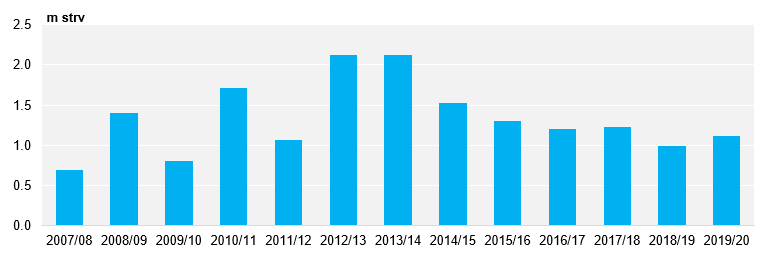

- As we pointed out above, any changes to domestic supply and demand dynamics will impact potential import volumes.

- Greater production than the USDA currently expects would cause the Mexican quota volume to fall simultaneously.

- If crop yields deteriorate further, we may see the Mexican market access rise.

- Mexican access to the US will dictate their available world market export volume, meaning the domestic crop in the US will directly either increase or decrease the world market surplus out of Mexico.

- We have a further look at the Mexican market available here.

Mexican US Market Exports

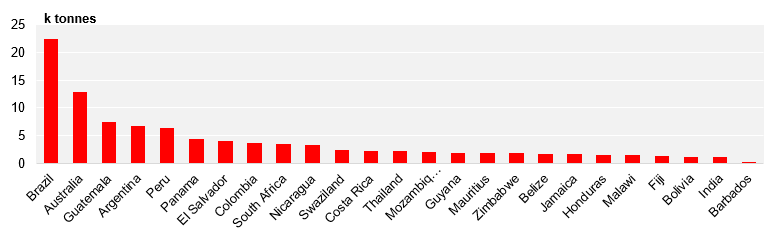

US TRQ Reallocation

- The USDA may also look to reallocate unused raw sugar TRQ volumes throughout the season.

- This means that certain quota holders who still have sugar to export can gain further access to the US market.

- In 2018/19, the USDA reallocated 100k tonnes to countries in surplus, reducing world market volume in the process.

2018/19 TRQ Reallocation

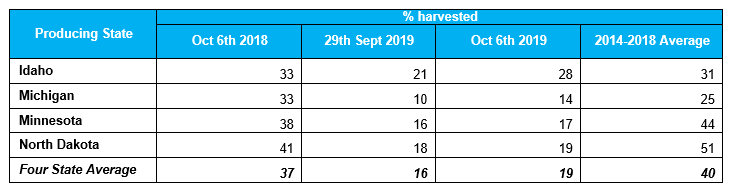

How Is the Beet Harvest Going?

- The US beet harvest began in the last few weeks across the country.

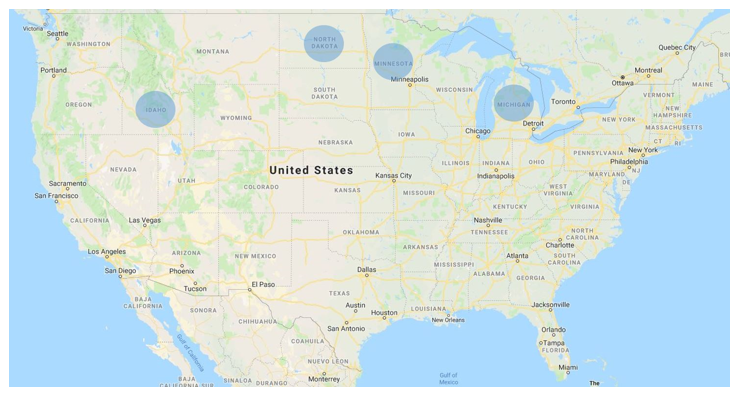

- The USDA focuses on the harvest in Idaho, Michigan, Minnesota, and North Dakota as representative for the overall crop.

- This is because these four states account for 84% of the acreage last season.

Map of Major Beet Growing Areas

US Beet harvest progress

- Sugar beet harvesting has been hampered in the early part of the season and issignificantly behind.

- For instance, Idaho suffered serious thunderstorms throughout the first half of September.

- The weather is expected to continue causing issues for the harvest, with snow falling across some northern states.

- However, the slightly slower harvest start may help offset the delayed plantings due to flooding in May.

- Snow and early freezes are a more significant worry as there is a risk the beets in the ground are damaged.

- We believe the USA will produce 4.6m tonnes (5.1m short tons) this season, in line with the September estimate.

- Overall, we currently forecast the US crop should reach 8.4m metric tonnes this season.

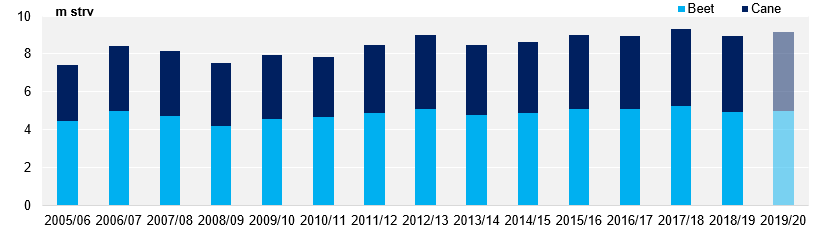

American Sugar Production by Season