Insight Focus

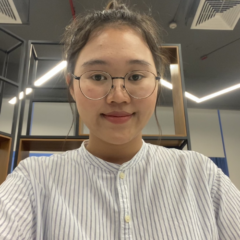

In 2024, Thai cassava root production has hit its lowest point in over a decade, compounded by a significant decline in Chinese demand. Consequently, Thailand may need to explore new markets for its cassava to mitigate the impact of these challenges.

The Thai Tapioca Trade Association (TTTA) recently announced that it expects that production may reduce from 24 million tonnes to 19 million tonnes in 2024. This is because of drought (perhaps thanks to El Nino) and the widespread effects of Cassava Mosaic Disease. Not only has the overall quantity of cassava been hit, but the quality is worse this year too. Export volumes will also be lower.

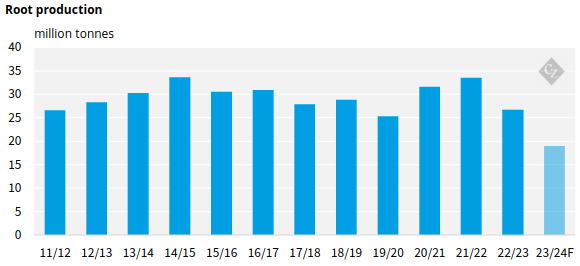

Farmers have harvested their cassava crops early to avoid drought damage. But this has hit quality and quantity. The roots are smaller and have a lower starch content, which is less desirable for export.

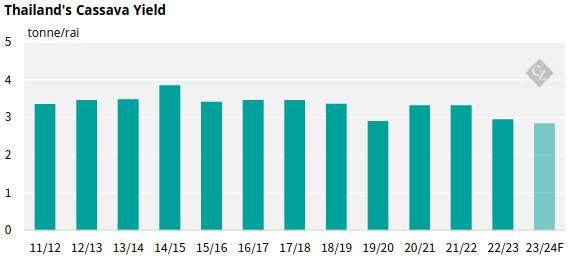

China Imports Decline

In recent years China has been one of the largest importers of Thai cassava roots. But Chinese imports fell in 2023 for the first time in 3 years, and the Thai cassava industry are concerned Chinese purchases could fall further in 2024.

This is because of several factors.

- Chinese cassava demand to make ethanol fell due to low processing margins thanks to low local ethanol prices.

- New regulations exclude cassava as a feedstock to make Baiju.

- Reduced pig herd in China means lower feed demand and lower corn prices, making cassava imports less competitive.

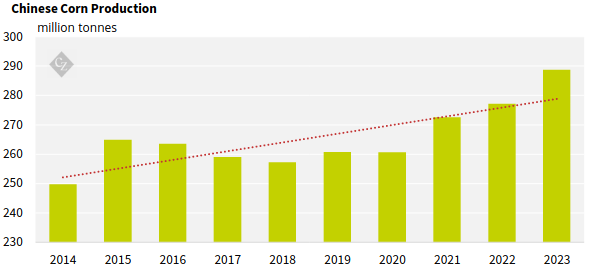

- China’s increased corn production further adds to this competition.

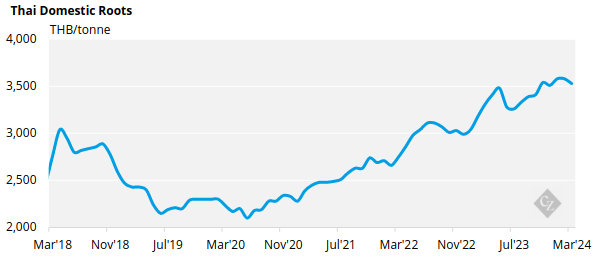

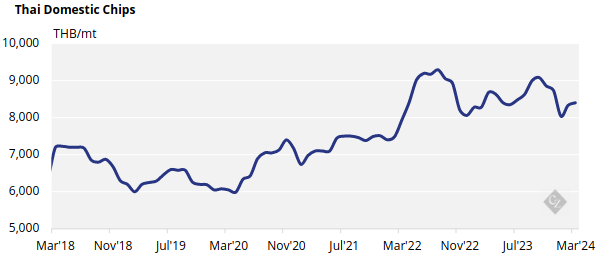

Supply Issues Push Up Prices

Even though sales to China are lower, Thai cassava root and chip prices are strong, owing to the production crunch. But Chinese corn prices have stabilised and even dropped due to increased domestic production. This means that the Thai cassava price is uncompetitive as a starch source for the Chinese market.

Even though Thailand’s cassava crop this year is low, there’s still a risk Thailand cannot export all of its roots and chips. Stocks may build unless it can find other viable export markets.