This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

- Question marks linger over the health of outdoor beet piles and Mexican production.

- Still the USDA slashing beet production forecasts took the market by surprise.

- In the Red River Valley, slicing programs were almost complete.

Buyers Try Not to Repeat Mistakes

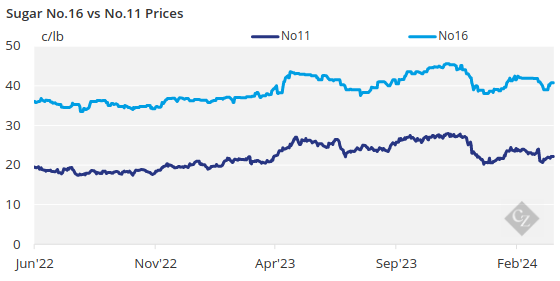

Sales of bulk refined sugar progressed at a modest pace during the week ended March 15. Prices were unchanged but with a firm tone.

Bulk refined beet sugar for 2024-25 was offered at 53¢/lb to 55¢/lb FOB Midwest with variations depending on volume and other factors. Bulk refined cane sugar for 2025 was offered at 60¢/lb FOB Northeast and West Coast and 56¢/lb to 58¢/lb Southeast and Gulf.

Beet sugar was offered for 2024 steady in the range of 55¢/lb to 58¢/lb Midwest. Refined cane sugar for 2024 was offered at 62¢/lb Northeast and West Coast and at 58¢/lb to 60¢/lb Southeast and Gulf.

Buyers remained hesitant to book large volumes of sugar, unlike last year in the weeks following the International Sweetener Colloquium in March when contracting was the heaviest for the period in memory.

There was speculation that some were still holding out for lower prices, but the general consensus was most buyers still were trying to determine their needs for the year and were hoping to not repeat last year’s strategy of overbuying but ultimately underutilizing contracted supplies.

Several sellers were waiting for buyer responses to 2024-25 price quotes. One processor said he was limiting sales to small-volume spot requests only while waiting on developments from larger contracts to process. He said once those contracts come through, the company will cease offering further coverage for 2024-25 until more is known about the as-yet unplanted beet crop.

USDA Slashes Beet Forecasts

Attention was turned to planting of the 2024 sugar beet crop. One cooperative said it was expecting its members to utilize the full acreage allotments that they have been given. Planting of the crop in some areas was expected to begin after completion of test trails, set to start in mid-March, weather permitting.

As for the current year, some processors were nearly complete with their slicing programs. Others, in the Red River Valley, anticipated their slicing programs to run through May or even into early June, but much was dependent upon the quality of outdoor beet piles that have experienced varying degrees of damage due to warmer-than-ideal winter temperatures.

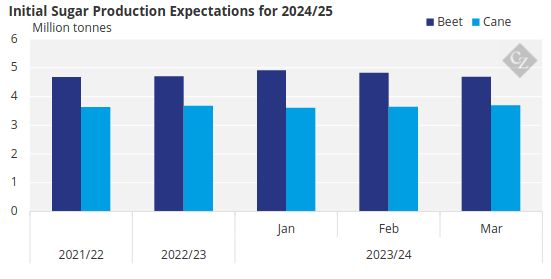

Weather-related beet pile shrinkage was one reason given by the USDA for reducing its forecast for 2023-24 beet sugar production. In the March 8 WASDE report, the USDA forecast combined beet and cane sugar production at 9.2 million short tons (8.4 million tonnes), down 1.2% from the February outlook. The USDA raised from February the 2023-24 cane sugar forecast by 47,000 short tons to 4.i million short tons, but it lowered its outlook for beet sugar production by 155,000 short tons to 5.2 million short tons.

Source: USDA

Note: Values translated from short tons to metric tonnes

This large slashing of beet sugar production in one month took some market participants by surprise, noting that the USDA typically stair-steps its changes between the monthly reports as opposed to taking out large chunks like it did in the March WASDE. One source said this may be an indication that the USDA is planning to cut its 2023-24 US beet production even further.

Mexico Problems Persist

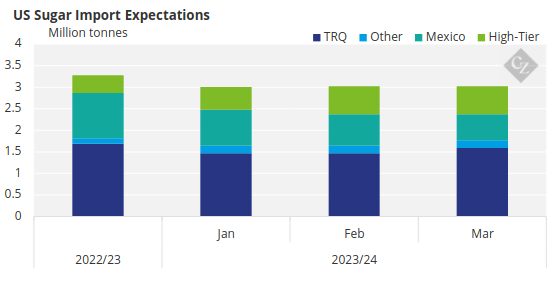

In the March WASDE report, the USDA also reduced its forecast of US imports of sugar from Mexico in 2023-24 to 666,000 tons, down 17% from the February forecast. The current forecast for sugar production in Mexico is now the lowest since 1999-2000 amid a second year of drought-reduced production.

Source: USDA

Note: Values translated from short tons to metric tonnes

Health of outdoor US sugar beet piles and US sugar imports from Mexico are the main concerns for US sugar supply, with both having the potential to reduce 2023-24 US sugar supplies.

The corn sweetener market was quiet.