This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

- There was only a modest uptick in activity in the weeks after the Colloquium this year.

- The USDA announced an additional 125,000 tonnes for the TRQ to reduce high tier imports.

- Processors are still concerned about weather damage to outdoor beet piles.

USDA Increases Raw Sugar Quota

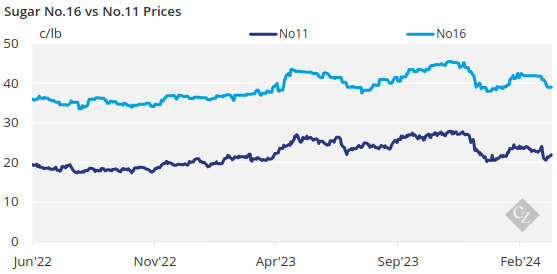

Forward sales of bulk refined sugar took a modest uptick in the week after the International Sweetener Colloquium concluded on February 28, but the activity was well below the rush seen after the industry meeting in 2023. Cash sugar prices were unchanged even as No. 11 and No. 16 raw sugar futures slumped.

Meanwhile, much focus was on news from the US Department of Agriculture.

The USDA announced a 125,000-tonne increase in the raw sugar tariff-rate quota for 2023-24 to ease tight supplies of raw sugar. The move is expected to reduce the record level of high tier imports this year.

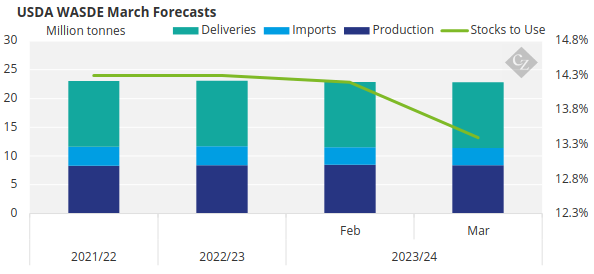

The USDA in its March 8 WASDE report lowered from February its forecasts for US 2023-24 beet sugar production and imports from Mexico but left delivery forecasts unchanged, dropping the ending stocks-to-use ratio to 13.4% from 14.2% in February.

Source: USDA

Sugar Buyers in Holding Pattern

Numerous sideline meetings between buyers and sellers at the Colloquium generated modest sales during and after the event, with a considerable number of pricing requests outstanding. One speaker encouraged attendees to hold off buying sugar until September if they could, which many buyers appeared to be doing.

Forward sales for 2025 were ongoing with only one beet processor indicating active enough sales that could prompt them to exit the market in a few weeks. Most reported measured activity. Prices were steady at pre-Colloquium levels but had a firm tone in some cases.

Bulk refined beet sugar for 2024-25 was offered at 53¢/lb to 55¢/lb FOB Midwest with variations above and below that range depending on volume and other factors. Bulk refined cane sugar for 2025 was offered at 60¢/lb FOB Northeast and West Coast and 56¢/lb to 58¢/lb Southeast and Gulf.

Beet Piles Remain a Concern

Sugar beet piles remain a focus for the current marketing year. Most processors are indicating some level of damage, with most optimistic that losses won’t be as bad as earlier expected. Weather, which has been warmer than ideal to keep piles frozen, is the main factor, but that is tempered by the length of time processors will need to complete slicing of the 2023 crop.

One processor expects to be done in the next couple of weeks, which will limit losses. Another had about five weeks left and was hoping for the best despite some losses. Another will be running through May or into early June, which creates the greatest risk, although piles so far were more resilient than expected.

One processor was out of the 2024 market, another was selling spot only, and at least one other was fully engaged.

Beet sugar was offered for 2024 steady in the range of 55¢/lb to 58¢/lb Midwest. Refined cane sugar for 2024 was offered at 62¢/lb Northeast and West Coast and at 58¢/lb to 60¢/lb Southeast and Gulf.

Corn sweetener markets were quiet with prices expected to be mostly flat into 2025 due to large corn supplies.