This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

- Sugar trading picked up among smaller buyers ahead of the International Colloquium.

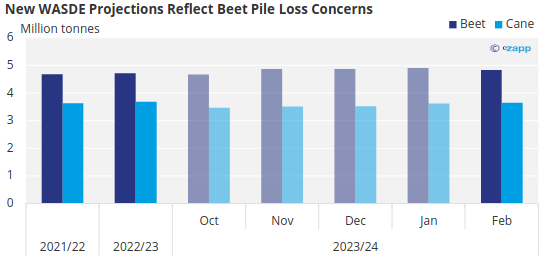

- Concerns over beet pile losses were reflected in the USDA’s latest WASDE projections.

- Beet prices firmed while cane prices held steady.

Sugar Trades Pick Up

There was an increase in trading of bulk refined sugar for 2024-25 during the week ended February 9 as some buyers wanted to “get ahead” of the possible rush that could result from sideline negotiations at the upcoming International Sweetener Colloquium February 25-28 in Aventura, Florida.

Several major sugar users had yet to secure coverage for 2024-25, though some were submitting price requests. Those locking in coverage early were smaller-tier, national companies rather than global conglomerates, but the collective volume currently being booked was significant, trade sources said.

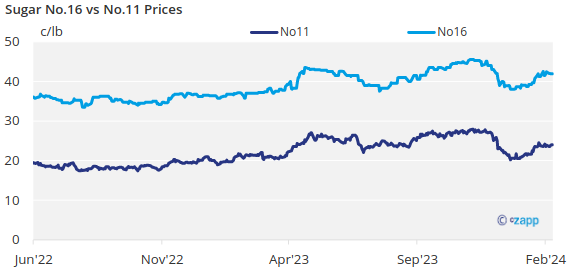

Pricing indications mostly were unchanged. Beet sugar for 2024-25 was offered at 53¢/lb to 55¢/lb FOB Midwest, with some at 56¢/lb (slightly firmer), and for 2024 mostly at 55¢/lb to 58¢/lb Midwest.

Bulk refined cane sugar for 2025 was offered at 60¢/lb FOB Northeast and West Coast and 56¢/lb to 58¢/lb Southeast and Gulf, and for 2024 was offered at 62¢/lb Northeast and West Coast and at 58¢/lb to 60¢/lb Southeast and Gulf.

There is speculation that the jumpstart on adding 2024-25 coverage was a function of some companies trying to take advantage of lower prices, especially if they were outbooked by larger buyers last year and had to book later in the season or subsist hand-to-mouth as sugar prices advanced.

Mexico, Beet Losses Feeds into Concerns

Also potentially influencing the early buyers was the possibility of tightening supplies with imports from Mexico cut sharply due to drought and US outdoor sugar beet piles facing increased shrinkage due to fluctuating and unseasonably warm temperatures.

The situation was arduous in the Red River Valley due to massive 2023 sugar beet production that will require a longer storage duration as processors work through the piles into the early spring. In other areas, processors mostly have been able to manage piles through ventilation and with timely slicing.

The Western Sugar Cooperative has nearly wrapped up slicing beets at its two northern plants and was quickly approaching completion at its other plants. Most processors expected to complete their slicing in early spring, compared with the Red River Valley where some processors anticipated they may be slicing beets into June. The US Department of Agriculture in its February 8 World Agricultural Supply and Demand Estimates report reflected industry concerns of beet pile losses in its forecast 2023-24 US beet sugar production. Its projections reached 5.3 million short tons, raw value, down 79,297 short tons from its January forecast on “adoption of beet sugar processors’ estimates of beet pile shrink.”

Note: Converted from short tons to metric tonnes

Source: USDA

Still, beet sugar production would be record high if realized, as would total sugar production. The USDA’s WASDE report also reduced its forecast of 2023-24 sugar deliveries for food by 75,000 short tons, which was expected based on trade reports of slow deliveries the past few months. Deliveries did show a seasonal uptick in early February.