This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

- The domestic cash sugar market was mostly quiet during the week ended February 2.

- Spot and forward sales were slow at steady prices.

- Concern about slow deliveries of contracted sugar persisted.

Beet Prices Hold Steady Ahead of Easter

During the week ended February 2, beet processors indicated sales for 2024-25 and calendar 2025 were ongoing at a slow pace. One processor noted new sales at steady prices from a week earlier that were a couple of cents below 2023-24 values. Prices for 2024-25 beet sugar were reported mostly in the 52.50¢/lb to 54.50¢/lb range.

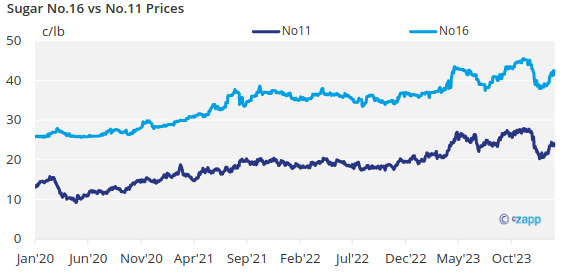

Refined cane sugar for calendar 2025 was offered by one refiner at 60¢/lb FOB in the Northeast and West Coast and at 58¢/lb FOB in the Southeast and Gulf regions.

Most sellers (both beet and cane sugar) and buyers were awaiting sideline negotiations at the International Sweetener Colloquium taking place on February 25-28 before making new commitments. However, some also wanted to “get ahead of the game” after last year when business exploded after the industry meeting. Such fireworks weren’t expected this year due mainly to different market dynamics.

Beet sugar for 2024 was offered mostly at 55¢/lb to 58¢/lb FOB Midwest, unchanged. Processors have spot sugar to sell, and sales are occurring within the quoted range. Bulk refined cane sugar for 2024 was offered at 62¢/lb FOB Northeast and West Coast, and at 58¢/lb to 60¢/lb FOB Southeast and Gulf, all unchanged.

Beet processors reported lower-than-expected deliveries of contracted sugar in the first three weeks of January. There were variations as some indicated shipments of bulk sugar were down sharply, while others noted good bulk movement but slowness in 50lb bags. At the same time, indications were that sugar deliveries improved late in the month, which is typical for the season with Easter demand approaching.

Beet Quality at Risk from Storage

Processors continued to express concerns about how well beets piled outdoors will hold up through the winter. December was unseasonably warm, sharply colder weather ensued in early January and temperatures again moved higher in late January.

Some beet processors will need to slice over a longer period of time this year to realize sugar production potential from the large 2023 sugar beet crop, which will boost the risk of losses in outdoor beet piles. The slicing campaign in the top-producing region of the Red River Valley is expected to run to mid-May, while some other processors may be finished in early February.

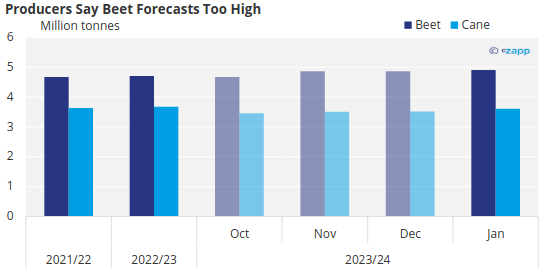

Trade sources still contend the USDA needs to reduce its forecasted record-high 2023-24 beet sugar production by about 100,000 tons due mainly to potential losses in outside beet piles.

Mexico Concerns Continue

Another major concern in the industry is Mexico’s 2023-24 sugar production. Most private forecasts are between 4.7 million and 4.8 million tonnes — well below the USDA’s January forecast of 5.016 million tonnes.

The impact on US cane refiners could be significant if the lower threshold is approached. Although sugar production in Mexico has improved slightly the past couple weeks as the cane harvest moves toward its peak period, output still is well below year-ago levels.

Corn sweetener markets were quiet.