This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

- American sugar sales have been slow through the holiday period.

- Unseasonably warm weather in December might affect some beet piles.

- Warmth can lead to beet deterioration.

Sales of bulk refined sugar were slow in the week ended Jan. 5, 2024, and prices were unchanged. Volatility persisted in raw sugar futures prices, which posted modest gains for the week.

US bulk refined cane sugar for 2024 was offered at 62¢ a lb Northeast and West Coast, with prices in the Southeast and Gulf at 59¢ to 60¢, all unchanged. Bulk beet sugar prices for 2024 were unchanged at 57¢ to 59¢ a lb f.o.b. Midwest. Traders indicated both beet and cane sugar in volume could be bought below list prices, especially cane sugar as refiners sought to protect market share from lower-priced beet sugar, and as cane refiners had larger margins to work with after the sharp drop in raw cane sugar futures.

Beet processors offered various volumes of sugar from what for some was a larger-than-expected 2023 sugar beet crop with record-high beet sugar forecast by the US Department of Agriculture for 2023-24. Processors continued to monitor outside beet piles after unseasonably warm weather during much of December. Most expect larger shrink than currently forecast by the USDA due to possible deterioration in piles that will need to stay frozen longer into the spring for some due to the large 2023 crop. That could trim the 2023-24 beet sugar forecast slightly, but at this point a significant drop in sugar production is not expected, and temperatures were turning much colder, especially in the Red River Valley.

Perhaps more worrisome for sellers was slow deliveries of contracted sugar. Some beet processors indicated the fourth quarter was below expectations, especially in the last couple weeks of December. The slowness was attributed to overbooking by some buyers amid concerns about supplies earlier in the year, increased food manufacturer shutdowns compared to prior years over the holiday period, and weaker consumer demand for manufactured food products.

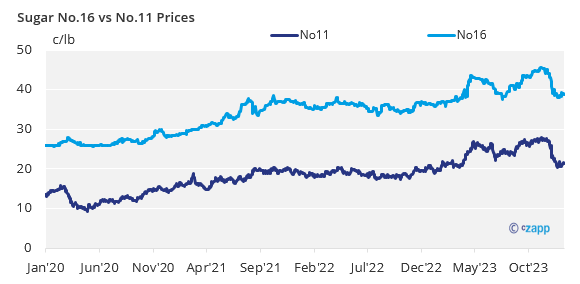

Beet sugar sales for 2024-25 were occurring but at a slow pace after a brief spurt earlier in December. Midwest beet sugar prices appeared to be mostly in the low to mid-50¢ a lb range. Indications of refined cane sugar prices were below 60¢ a lb for the first time since May 2022, based on trade assessments of current raw sugar futures values, but most cane refiners were not yet openly posting 2024-25 prices.

Buyers and sellers were setting up meetings that will take place on the sidelines of the International Sweetener Colloquium Feb. 25-28 in Adventura, Fla., for the contracting of 2024-25 and calendar 2025 business. Last year sales exploded after the Colloquium and were mostly complete for 2023-24 by the end of March. There are mixed views about how negotiations will go this year. Buyers see sharply lower raw sugar futures and a weakening cash sugar market and are expecting to book at considerably lower prices than a year ago. Sellers maintain supply uncertainty persists. Most don’t expect the robust activity seen in March 2023, but they aren’t ruling it out either. Prices are the lowest they have been in a couple years, and buyers, with the opportunity to make budgets look good, may be ready to buy.

Corn sweetener contracting for 2024 was mostly complete.