This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

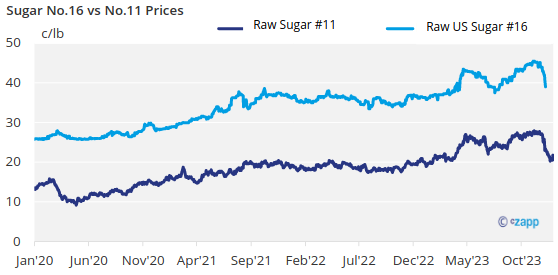

- No.16 domestic raw sugar futures fall sharply.

- Buyers are now also hoping for weakness in cash prices.

- Cash sellers have so far been hesitant to reduce prices.

Sales of bulk refined sugar were slow in the week ended Dec. 22 amid price weakness in refined cane sugar values and a seasonal lull in activity. Raw sugar futures continued to decline with nearby New York No. 11 world futures at a nine-month low.

The market was in a period of uncertainty. Recent sharp declines in No. 11 (world) raw sugar futures mainly due to record-high sugar production in Brazil, spilling over to pressure No. 16 (domestic) raw sugar futures sharply lower have buyers expecting weakness in cash prices, which has been evident to a limited extent on the cane side. But ideas the fund sell-off in No. 11 futures was overdone has made cash sellers hesitant to reduce prices, while buyers wait and see if there will be more weakness.

US bulk refined cane sugar for calendar 2024 was offered at 62¢ a lb Northeast and West Coast, down 1¢ from a week earlier, with prices in the Southeast and Gulf at 59¢ to 60¢, steady to down 1¢. Bulk beet sugar prices for 2024 were unchanged at 57¢ to 59¢ a lb f.o.b. Midwest. Traders indicated both beet and cane sugar in volume could be bought below list prices, especially cane sugar as refiners sought to protect market share from lower-priced beet sugar. Some expect cane sugar could drop a couple more cents if futures prices don’t rebound.

Most sugar from the large 2023 beet crop has been sold with processors assessing prospects for 2024-25. Warmer-than-normal temperatures in most beet growing areas raised concerns about potential damage to outside beet piles as large 2023 beet crops will need to be stored longer into the spring, especially in the key Red River Valley. That could potentially increase shrinkage and reduce sugar production, but it was too early to predict such losses.

Beet sugar sales for 2024-25 were occurring but have slowed from the prior couple weeks, likely a combination of the holidays and the current unsettled feeling in the market. Beet sugar prices appeared mostly in the low to mid-50¢ a lb range. Traders may be waiting to kick off negotiations on the sidelines of the International Sweetener Colloquium in late February, but some were expected to get ahead of the game in January.

Sellers urged buyers not to hold out for a price bottom as current levels were well below recent prices and would reflect well in budgets. They noted potential bullish factors such as the poor crop in Mexico, the end of Brazil’s cane season and a possible upturn in futures prices. On the bearish side was uncertainty about sugar demand.

The pace of deliveries for 2023-24 remained a concern, with most sellers indicating slower or at best as expected shipments. There were reports of some sellers allowing buyers to roll undelivered 2023 sugar contracts into 2024, although that would add to buyers’ 2024 commitments.

Corn sweetener contracting for 2024 was mostly complete at steady to lower prices than 2023 contracted values.